U.S. Crude Oil And Fuel Inventories Surge: EIA Data Reveals Surprise Build

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Crude Oil and Fuel Inventories Surge: EIA Data Reveals Surprise Build

U.S. energy markets experienced a significant shake-up this week as the Energy Information Administration (EIA) reported a surprising build in crude oil and fuel inventories. The unexpected increase, significantly higher than analysts' predictions, sent ripples through the oil market, impacting prices and raising questions about future demand. This unexpected surge challenges the prevailing narrative of tightening energy supplies and highlights the volatility inherent in the global energy landscape.

The EIA's weekly report, released on [Date of Release], revealed a substantial increase in crude oil stocks. The data showed a build of [Specific number] million barrels, far exceeding the anticipated [Specific number] million-barrel draw predicted by analysts. This unexpected surplus adds to the already substantial Strategic Petroleum Reserve (SPR), impacting the overall supply-demand balance.

Unexpected Inventory Build Across the Board

The inventory build wasn't limited to crude oil. The report also highlighted significant increases in gasoline and distillate fuel inventories. Gasoline stocks rose by [Specific number] million barrels, while distillate fuels saw an increase of [Specific number] million barrels. These figures contrast sharply with the anticipated draws, further fueling market uncertainty.

- Crude Oil: [Specific number] million barrels increase (vs. predicted [Specific number] million-barrel draw)

- Gasoline: [Specific number] million barrels increase (vs. predicted [Specific number] million-barrel draw)

- Distillate Fuels: [Specific number] million barrels increase (vs. predicted [Specific number] million-barrel draw)

This unexpected inventory glut raises several crucial questions for market analysts and energy traders:

- Is demand weakening? The substantial build suggests a potential softening of demand, potentially influenced by economic slowdown concerns or seasonal factors.

- Are refinery operations impacted? Unexpected refinery maintenance or operational issues could contribute to the inventory surplus.

- What is the impact on oil prices? The increase in inventories is likely to exert downward pressure on oil prices in the short term.

Market Reaction and Future Outlook

The market reacted swiftly to the EIA's report. Crude oil prices experienced a [Percentage]% drop following the release, indicating immediate market sensitivity to the unexpected inventory surge. Trading activity increased significantly as investors and traders reassessed their positions in light of the new data.

The long-term implications of this inventory build remain uncertain. Several factors, including global economic growth, geopolitical events, and OPEC+ production decisions, will play a significant role in shaping future supply and demand dynamics. Analysts are closely monitoring these factors to predict the trajectory of oil prices and inventory levels in the coming weeks and months. The coming weeks will be crucial in determining whether this is a temporary blip or a signal of a more sustained shift in the market.

Keywords: EIA, crude oil, oil inventories, fuel inventories, gasoline, distillate fuel, oil prices, energy market, supply and demand, Strategic Petroleum Reserve (SPR), OPEC+, economic slowdown, refinery operations, market reaction, energy news.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Crude Oil And Fuel Inventories Surge: EIA Data Reveals Surprise Build. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stephen A Smiths Outrage Cnn Anchor Faces Public Criticism

May 23, 2025

Stephen A Smiths Outrage Cnn Anchor Faces Public Criticism

May 23, 2025 -

Fewer Than 1 500 Pharmacies Use Nhs App Prescription Feature

May 23, 2025

Fewer Than 1 500 Pharmacies Use Nhs App Prescription Feature

May 23, 2025 -

Galvin Facing Huge Decision 2 Million Offers From Nrl Rivals

May 23, 2025

Galvin Facing Huge Decision 2 Million Offers From Nrl Rivals

May 23, 2025 -

Nyt Wordle May 22nd Solution And Helpful Hints For Game 1433

May 23, 2025

Nyt Wordle May 22nd Solution And Helpful Hints For Game 1433

May 23, 2025 -

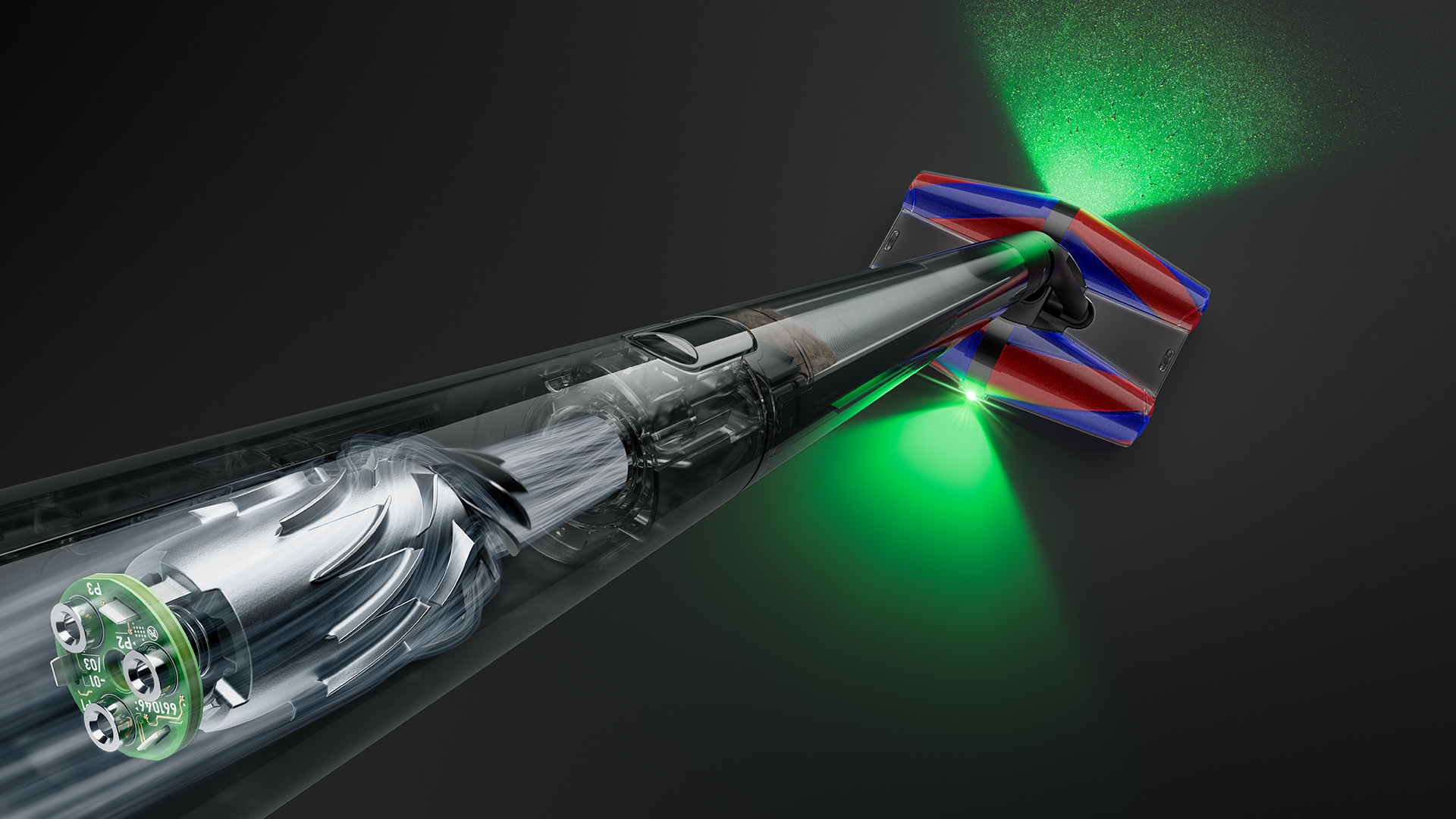

Revolutionary Dyson Vacuum Floats Across Floors Redefines Cleaning

May 23, 2025

Revolutionary Dyson Vacuum Floats Across Floors Redefines Cleaning

May 23, 2025

Latest Posts

-

Garlicks Return A Key Piece In South Sydneys Nrl Reconstruction

May 23, 2025

Garlicks Return A Key Piece In South Sydneys Nrl Reconstruction

May 23, 2025 -

Laos Economic Crisis Debt Relief Needed To Avoid A Lost Decade

May 23, 2025

Laos Economic Crisis Debt Relief Needed To Avoid A Lost Decade

May 23, 2025 -

Enhanced Patient Experience Nhs Unveils Trackable Prescriptions

May 23, 2025

Enhanced Patient Experience Nhs Unveils Trackable Prescriptions

May 23, 2025 -

Amy Schumers Strategic 45 Million Investment In Real Estate

May 23, 2025

Amy Schumers Strategic 45 Million Investment In Real Estate

May 23, 2025 -

Top Asian Intellectual Properties Enter Web3 Via Animoca Brands And Astar Network Partnership

May 23, 2025

Top Asian Intellectual Properties Enter Web3 Via Animoca Brands And Astar Network Partnership

May 23, 2025