U.S. Crude Oil At 2021 Low: OPEC+ June Production Increase Impacts Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Crude Oil Prices Plunge to 2021 Lows: OPEC+ Production Hike Shakes Market

U.S. crude oil prices have plummeted to their lowest levels since early 2021, triggered by a significant increase in oil production from OPEC+ nations in June. The market is reeling from the unexpected surge, raising concerns about oversupply and dampening the prospects for a sustained price recovery. This dramatic shift underscores the delicate balance between global supply and demand, and highlights the significant influence of OPEC+ decisions on the energy market.

The price drop is a stark contrast to the soaring prices seen earlier this year, driven primarily by geopolitical instability and strong post-pandemic demand. However, the recent OPEC+ decision to boost production has effectively flooded the market, leading to a substantial price correction. This move, while intended to stabilize the market, has instead caused significant volatility and uncertainty for energy producers and consumers alike.

OPEC+ Production Increase: A Double-Edged Sword?

OPEC+ – the alliance of the Organization of the Petroleum Exporting Countries (OPEC) and other major oil producers, including Russia – announced a sizable production increase for June. While the intention was likely to address concerns about potential supply shortages, the actual increase surpassed market expectations. This unexpected surplus has sent ripples throughout the global oil market, contributing significantly to the current price decline. The decision reflects a complex interplay of factors, including geopolitical considerations, internal disagreements within OPEC+, and evolving global demand forecasts.

- Oversupply Fears: The market is now grappling with concerns about an impending oversupply of crude oil. This is particularly significant given the recent economic slowdown in several key regions, hinting at a potential decrease in future demand.

- Demand Uncertainty: The global economic outlook remains uncertain, with inflation and potential recessionary pressures casting shadows over future energy consumption. This uncertainty is further amplifying the impact of increased OPEC+ production.

- Strategic Implications: The OPEC+ decision also carries significant geopolitical ramifications. The move could be interpreted as a strategy to influence market prices, potentially undermining the influence of other energy producers and impacting global energy security.

Impact on U.S. Energy Sector: A Challenging Landscape

The dramatic drop in U.S. crude oil prices presents a formidable challenge for the American energy sector. Producers are facing lower revenues, potentially leading to reduced investment in new projects and impacting employment within the industry. This situation is particularly concerning given the recent focus on energy independence and the ongoing transition to cleaner energy sources.

- Reduced Investment: Lower oil prices may discourage investment in exploration and production, hindering long-term growth within the U.S. energy sector.

- Job Security Concerns: The price decline could lead to job losses within the oil and gas industry, impacting communities heavily reliant on energy production.

- Inflationary Pressures: While lower oil prices generally benefit consumers, the current situation is complicated by persistent inflationary pressures. The interplay of these factors may limit the extent of consumer relief.

What Lies Ahead for Crude Oil Prices?

Predicting the future trajectory of crude oil prices remains challenging. Analysts are divided on whether the current price drop represents a temporary correction or the start of a longer-term downward trend. Several key factors will shape the market’s future:

- Global Economic Growth: The pace of global economic recovery will be a crucial determinant of future oil demand.

- Geopolitical Stability: Ongoing geopolitical tensions and potential disruptions to supply chains could significantly impact prices.

- OPEC+ Policy: Future decisions by OPEC+ will continue to exert considerable influence over the global oil market.

The recent plunge in U.S. crude oil prices to 2021 lows highlights the inherent volatility of the energy market and the profound impact of OPEC+ production decisions. The coming months will be critical in determining whether this represents a temporary setback or a more significant shift in the global energy landscape. The situation demands close monitoring by energy producers, consumers, and policymakers alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Crude Oil At 2021 Low: OPEC+ June Production Increase Impacts Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Worlds Largest Bank Sounds Alarm Critical Security Flaw Impacts Billions

May 06, 2025

Worlds Largest Bank Sounds Alarm Critical Security Flaw Impacts Billions

May 06, 2025 -

May 3rd 2025 Mlb Game Recap Astros Defeat White Sox 8 3

May 06, 2025

May 3rd 2025 Mlb Game Recap Astros Defeat White Sox 8 3

May 06, 2025 -

Ong Ye Kung And Chee Hong Tat Deny Links To Fujian Gang Member Su Haijin

May 06, 2025

Ong Ye Kung And Chee Hong Tat Deny Links To Fujian Gang Member Su Haijin

May 06, 2025 -

Gigabyte Aorus Master 16 A Detailed Review Of Its Strengths And Weaknesses

May 06, 2025

Gigabyte Aorus Master 16 A Detailed Review Of Its Strengths And Weaknesses

May 06, 2025 -

Unseen Footage Jack O Connells Irish Dancing Past

May 06, 2025

Unseen Footage Jack O Connells Irish Dancing Past

May 06, 2025

Latest Posts

-

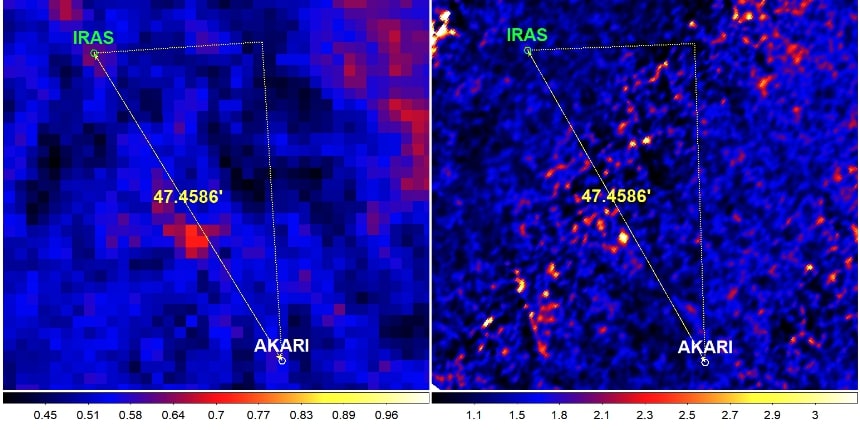

Reanalyzing Iras And Akari Data Fresh Clues In The Planet Nine Hunt

May 06, 2025

Reanalyzing Iras And Akari Data Fresh Clues In The Planet Nine Hunt

May 06, 2025 -

23 Thoughtful Mothers Day Gifts Under 50 Jewelry Lego And More

May 06, 2025

23 Thoughtful Mothers Day Gifts Under 50 Jewelry Lego And More

May 06, 2025 -

Space X Starbase New Flame Trench Completed Next Big Future Com

May 06, 2025

Space X Starbase New Flame Trench Completed Next Big Future Com

May 06, 2025 -

Met Gala 2025 Witness The Iconic Fashion Moments Unfold Live

May 06, 2025

Met Gala 2025 Witness The Iconic Fashion Moments Unfold Live

May 06, 2025 -

Kristaps Porzingis Injury Update Will He Play Game 2 Against Boston

May 06, 2025

Kristaps Porzingis Injury Update Will He Play Game 2 Against Boston

May 06, 2025