U.S. Crude Oil Prices Plummet: OPEC+ Decision Impacts Global Markets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Crude Oil Prices Plummet: OPEC+ Decision Sends Shockwaves Through Global Markets

October 26, 2023 - The global energy market experienced a significant shakeup today following the OPEC+ decision to slash oil production by two million barrels per day. This unexpected move sent shockwaves across financial markets, leading to a dramatic plummet in U.S. crude oil prices and raising concerns about potential inflationary pressures and global economic growth.

The announcement, made earlier this morning, immediately triggered a sell-off in oil futures contracts. West Texas Intermediate (WTI) crude, the U.S. benchmark, experienced its sharpest one-day decline in months, falling by over [Insert Percentage]% to settle at [Insert Price per Barrel]. Brent crude, the global benchmark, also suffered a significant drop, reflecting the widespread impact of the OPEC+ decision.

<h3>OPEC+'s Surprise Move: Reasons and Ramifications</h3>

The decision by the Organization of the Petroleum Exporting Countries and its allies (OPEC+) to reduce output is largely attributed to concerns about weakening global demand and the potential impact of a slowing global economy. However, analysts are divided on the wisdom of this strategy. Some argue that the move is a calculated attempt to prop up oil prices in the face of increasing economic uncertainty. Others criticize the decision, suggesting it could exacerbate inflationary pressures already impacting consumers worldwide.

Several factors contributed to the market's volatility:

- Unexpected Cut: The magnitude of the production cut surprised many analysts who had anticipated a smaller reduction or even no change.

- Geopolitical Uncertainty: The ongoing war in Ukraine continues to cast a shadow over the energy market, adding to existing supply chain disruptions.

- Inflationary Concerns: The price hike, even if temporary, fuels concerns about rising inflation and its impact on consumer spending and economic growth.

- Dollar Strength: The recent strengthening of the U.S. dollar against other major currencies also played a role in depressing oil prices, as oil is priced in dollars.

<h3>Impact on U.S. Consumers and the Economy</h3>

While lower oil prices generally benefit consumers through reduced gasoline costs, the short-term volatility and uncertainty created by the OPEC+ decision could have negative consequences. The sudden price drop might lead to uncertainty in the energy sector, impacting investment decisions and potentially slowing down economic activity.

Moreover, the long-term implications remain unclear. If oil prices remain depressed for an extended period, it could harm energy producers, leading to job losses and impacting related industries. Conversely, a prolonged period of low prices could stimulate economic activity, particularly in sectors heavily reliant on energy.

<h3>Global Market Reactions and Future Outlook</h3>

The OPEC+ announcement sent ripples across global financial markets. Stock markets reacted negatively, with energy stocks experiencing significant declines. Other commodities also felt the impact, with prices fluctuating in response to the shifting energy landscape.

The future outlook for oil prices remains uncertain. Analysts are closely monitoring global economic data, geopolitical developments, and OPEC+'s future strategies to predict the trajectory of oil prices in the coming months. The situation underscores the delicate balance between global energy supply and demand and highlights the significant influence of OPEC+ on the global economy. Further analysis and market observation are crucial in understanding the full ramifications of this pivotal decision. Stay tuned for updates as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Crude Oil Prices Plummet: OPEC+ Decision Impacts Global Markets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Outdoor Exoskeleton Breakthrough Mass Production Begins For Hip Motion Support

May 06, 2025

Outdoor Exoskeleton Breakthrough Mass Production Begins For Hip Motion Support

May 06, 2025 -

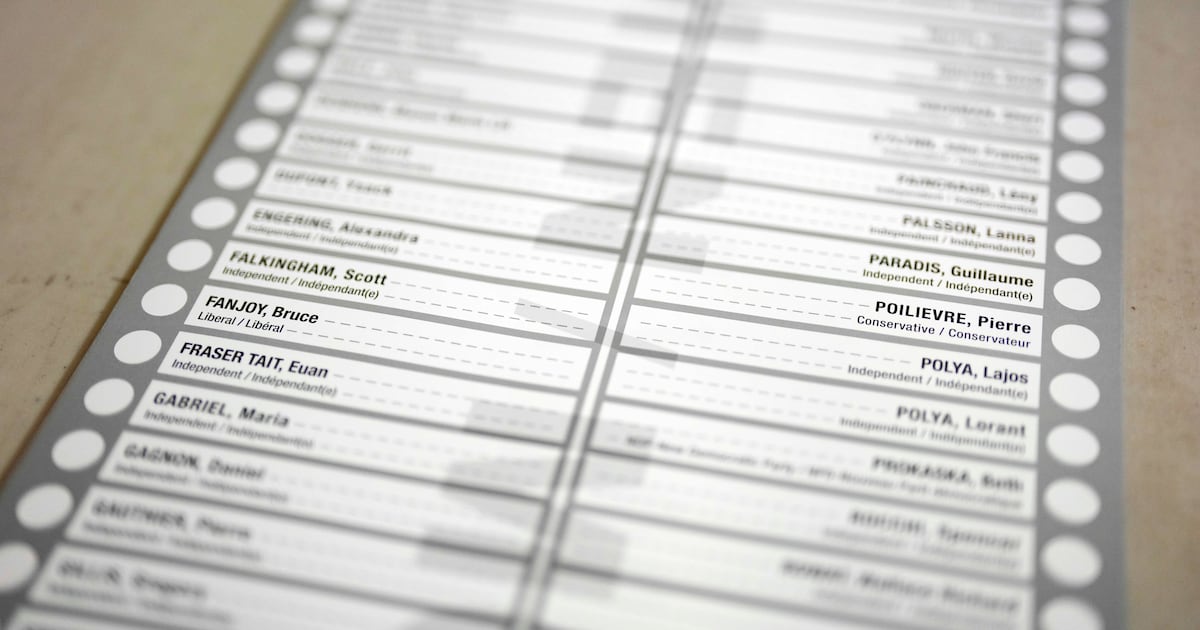

Hundreds Of Names Added To Poilievres Alberta Byelection Ballot By Protest Group

May 06, 2025

Hundreds Of Names Added To Poilievres Alberta Byelection Ballot By Protest Group

May 06, 2025 -

Astros Rout White Sox 8 3 In Mlb Gameday Showdown May 3 2025

May 06, 2025

Astros Rout White Sox 8 3 In Mlb Gameday Showdown May 3 2025

May 06, 2025 -

Shotgun Cop Man Unconventional Platformer Mechanics And Satanic Encounters

May 06, 2025

Shotgun Cop Man Unconventional Platformer Mechanics And Satanic Encounters

May 06, 2025 -

Nba Playoffs What To Watch For In The Thunder Nuggets Series

May 06, 2025

Nba Playoffs What To Watch For In The Thunder Nuggets Series

May 06, 2025

Latest Posts

-

Okc Thunders Defensive Dominance A Historic Nba Feat

May 07, 2025

Okc Thunders Defensive Dominance A Historic Nba Feat

May 07, 2025 -

Nasa And The Government Unpacking Recent Budgetary Shortfalls

May 07, 2025

Nasa And The Government Unpacking Recent Budgetary Shortfalls

May 07, 2025 -

Knicks Win In Ot Josh Hart Teases Jalen Brunson Over Missed Regulation Victory

May 07, 2025

Knicks Win In Ot Josh Hart Teases Jalen Brunson Over Missed Regulation Victory

May 07, 2025 -

Garrisons Death The Sister Wives Emotional Response

May 07, 2025

Garrisons Death The Sister Wives Emotional Response

May 07, 2025 -

What We Know Porzingis Health Following Knicks Celtics Game 1

May 07, 2025

What We Know Porzingis Health Following Knicks Celtics Game 1

May 07, 2025