U.S. Crude Oil Tanks: 2021 Low Reached Post-OPEC+ Production Boost

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Crude Oil Tanks: 2021 Low Reached Post-OPEC+ Production Boost

U.S. crude oil inventories plummeted to their lowest level of 2021, a dramatic fall directly linked to the recent OPEC+ production increase. This significant drop has sent shockwaves through the energy market, sparking debate about future price volatility and the reliability of global oil supplies. Experts warn that while this might temporarily benefit consumers, the long-term implications remain uncertain.

The Energy Information Administration (EIA) reported a startling decline in crude oil stocks last week, marking a substantial reversal from earlier trends. This unexpected shift underscores the intricate interplay between global supply chains, geopolitical tensions, and fluctuating consumer demand. The drop follows the decision by the Organization of the Petroleum Exporting Countries and its allies (OPEC+) to significantly increase their oil production. This move, while intended to ease global supply constraints, has instead highlighted the fragility of the current energy market.

OPEC+'s Impact: A Double-Edged Sword?

The OPEC+ decision to boost oil production was largely seen as a positive step towards stabilizing global energy prices and easing inflationary pressures. However, the resulting rapid depletion of U.S. crude oil tanks suggests a potential downside. While increased production aimed to address a global shortage, the speed of the drawdown raises concerns about the adequacy of the response.

- Increased Demand: The rapid depletion indicates a surge in global demand, potentially outpacing the increase in supply. This suggests that the world's appetite for oil remains robust, despite the ongoing economic uncertainty.

- Supply Chain Bottlenecks: While OPEC+ increased production, logistical challenges and existing supply chain bottlenecks could be hindering the efficient distribution of crude oil. This could be contributing to the low inventory levels in the U.S.

- Geopolitical Factors: The ongoing conflict in Ukraine and other geopolitical factors continue to exert pressure on global energy markets, adding to the uncertainty surrounding oil prices and supply.

What This Means for Consumers and the Future of Oil

The current situation presents a complex picture for consumers. While lower inventories could lead to higher prices at the pump in the short term, the long-term impact is less clear. The increased production from OPEC+ aims to alleviate these price pressures, but the unexpected depletion of U.S. reserves raises questions about the efficacy of this strategy.

Looking ahead, several key factors will determine the future trajectory of crude oil prices:

- OPEC+ Production Levels: The consistency and reliability of OPEC+ production increases will play a crucial role in stabilizing the market.

- Global Demand: Future fluctuations in global demand, driven by economic growth and other factors, will significantly influence oil prices.

- Geopolitical Stability: Continued geopolitical instability will likely maintain upward pressure on oil prices.

The dramatic drop in U.S. crude oil inventories serves as a stark reminder of the delicate balance in the global energy market. While the OPEC+ production boost aimed to address supply concerns, the resulting low inventory levels highlight the challenges in accurately predicting and managing global energy demand. The coming months will be crucial in determining whether this situation represents a temporary blip or a more significant shift in the energy landscape. Close monitoring of OPEC+ production, global demand, and geopolitical events will be essential for understanding the evolving dynamics of the crude oil market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Crude Oil Tanks: 2021 Low Reached Post-OPEC+ Production Boost. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Important Notice Queensland Public Holiday Office Closings

May 06, 2025

Important Notice Queensland Public Holiday Office Closings

May 06, 2025 -

How The Panthers Free Agent Departures Benefited The Maple Leafs

May 06, 2025

How The Panthers Free Agent Departures Benefited The Maple Leafs

May 06, 2025 -

Dicas Para Acessar Casas Na Praia E No Campo Sem Compra Compartilhamento E Aluguel

May 06, 2025

Dicas Para Acessar Casas Na Praia E No Campo Sem Compra Compartilhamento E Aluguel

May 06, 2025 -

Reopening Alcatraz Examining The Economic And Security Implications Under Trump

May 06, 2025

Reopening Alcatraz Examining The Economic And Security Implications Under Trump

May 06, 2025 -

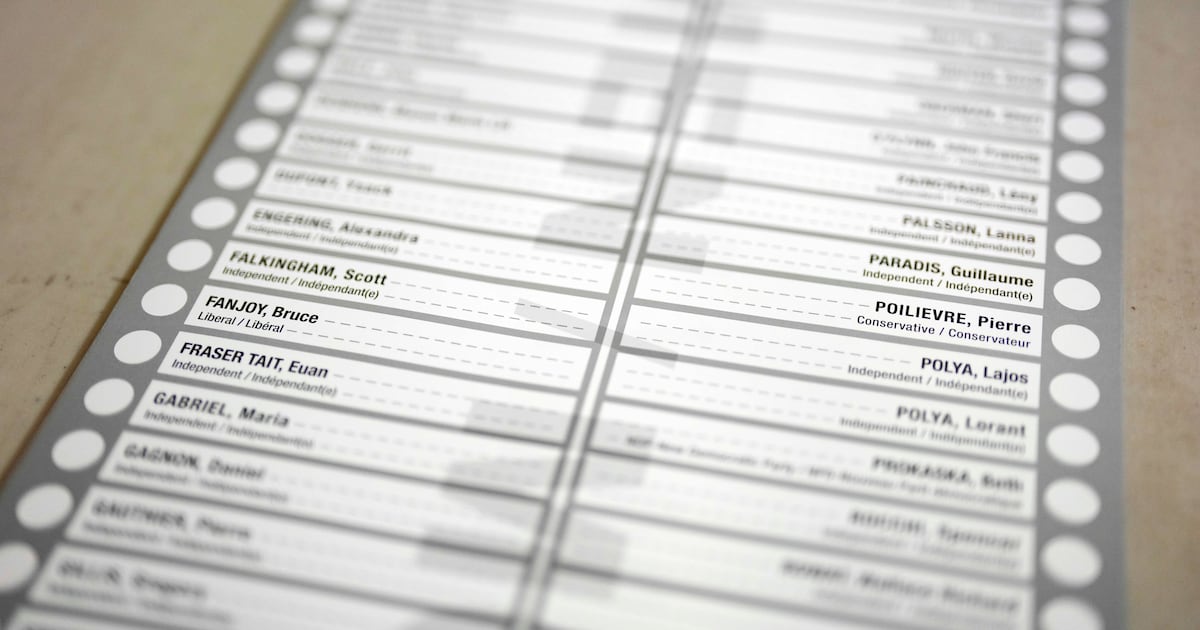

Pierre Poilievre Faces Ballot Challenge 200 Names From Protest Group

May 06, 2025

Pierre Poilievre Faces Ballot Challenge 200 Names From Protest Group

May 06, 2025

Latest Posts

-

108 105 Victory For Knicks Over Celtics Highlights And Analysis May 5 2025

May 06, 2025

108 105 Victory For Knicks Over Celtics Highlights And Analysis May 5 2025

May 06, 2025 -

Japan Nexts Budget Friendly 5 K Monitor High Pixel Density And Unique Aspect Ratio

May 06, 2025

Japan Nexts Budget Friendly 5 K Monitor High Pixel Density And Unique Aspect Ratio

May 06, 2025 -

Over 200 Names Added To Poilievres Ballot Alberta Byelection Protest Escalates

May 06, 2025

Over 200 Names Added To Poilievres Ballot Alberta Byelection Protest Escalates

May 06, 2025 -

Falling From Space Predicting The Impact Zone Of The 1972 Soviet Satellite

May 06, 2025

Falling From Space Predicting The Impact Zone Of The 1972 Soviet Satellite

May 06, 2025 -

New Report Hints At Significant Changes For The I Phone 17 Air

May 06, 2025

New Report Hints At Significant Changes For The I Phone 17 Air

May 06, 2025