U.S. Energy Markets React: EIA Data Shows Significant Build In Crude And Fuel Inventories

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Energy Markets React: EIA Data Reveals Significant Crude and Fuel Inventory Build

U.S. energy markets experienced a noticeable shift this week following the release of the Energy Information Administration's (EIA) latest weekly petroleum status report. The report revealed a substantial increase in both crude oil and gasoline inventories, triggering a wave of reactions across the sector. This unexpected build-up has sent ripples through prices and sparked debate among analysts about the implications for the coming months.

Key Findings from the EIA Report:

The EIA data unveiled a significant jump in crude oil inventories, exceeding market expectations by a considerable margin. Specifically, the report indicated a build of [Insert Actual Number] million barrels, compared to analyst predictions of a [Insert Analyst Prediction] million barrel increase or even a draw. This unexpected surplus points to a potential weakening in demand or a surge in supply, prompting concerns about market oversaturation.

Furthermore, the report highlighted a notable increase in gasoline inventories, adding to the overall picture of a less-than-robust energy market. This build of [Insert Actual Number] million barrels contrasts with anticipated levels and adds pressure to already softening gasoline prices. Distillate fuel oil inventories also showed a build, although less dramatic than crude oil and gasoline.

Market Reactions and Analyst Commentary:

The release of the EIA data immediately impacted energy futures prices. Crude oil prices experienced a [Insert Percentage]% drop following the announcement, reflecting the market's response to the unexpected inventory build. Gasoline futures also saw a decline, albeit less pronounced.

- Several analysts attribute the inventory build to several factors: Increased domestic production, a slowdown in refinery activity due to planned maintenance, and weaker-than-expected demand are all cited as potential contributing elements.

- Concerns about a global economic slowdown are also playing a significant role, impacting the outlook for energy consumption and consequently, prices.

- The impact on consumer prices remains uncertain. While the inventory build generally suggests downward pressure on gasoline prices at the pump, several factors, including geopolitical events and refining margins, could influence the final cost to consumers.

Looking Ahead: Implications for the Energy Sector:

The EIA's report raises several key questions about the future trajectory of the U.S. energy market. The sustained build in crude and fuel inventories poses challenges for producers, refiners, and investors alike. The coming weeks will be crucial in observing how these markets adjust to the new reality. Further analysis is needed to determine whether the current inventory situation represents a temporary blip or a more significant shift in the supply-demand balance.

Keywords: EIA, Energy Information Administration, Crude Oil Inventories, Gasoline Inventories, Petroleum Status Report, U.S. Energy Markets, Oil Prices, Gasoline Prices, Energy Futures, Market Reaction, Supply and Demand, Economic Slowdown, Energy Sector, Inventory Build.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Energy Markets React: EIA Data Shows Significant Build In Crude And Fuel Inventories. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

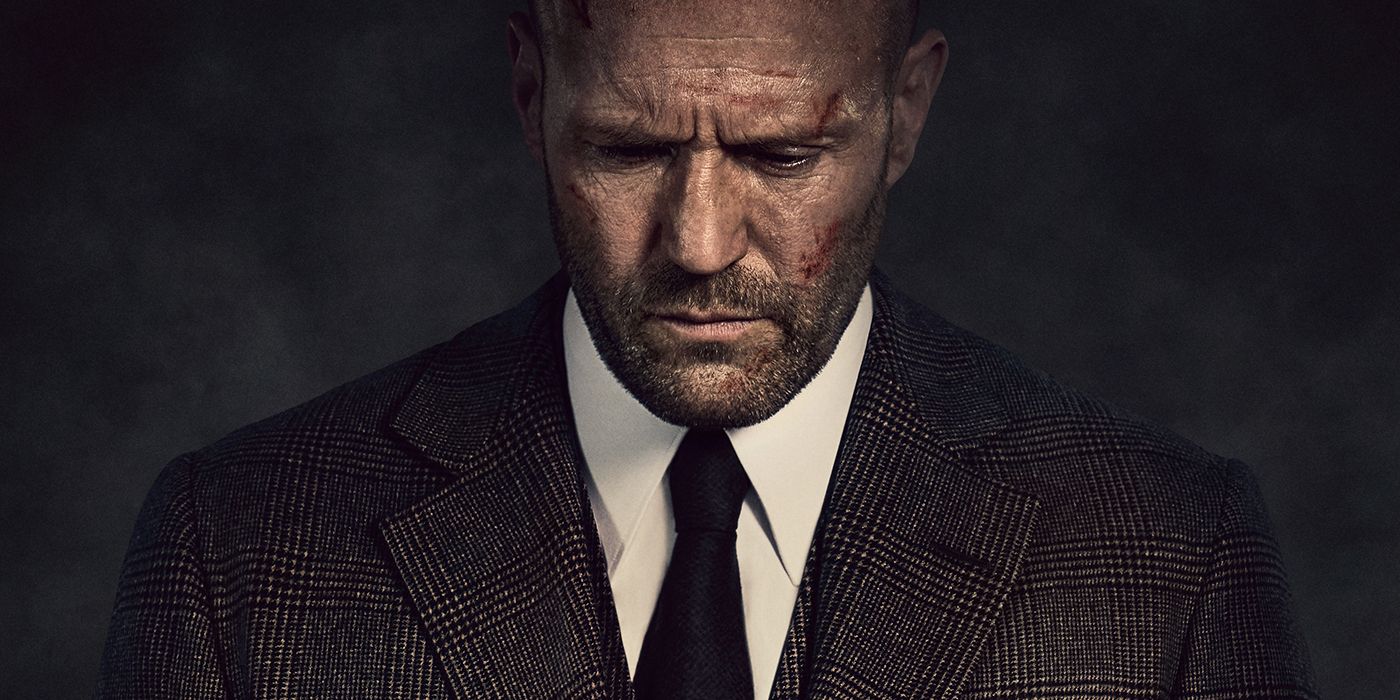

Jason Statham Movie Scores 90 On Rotten Tomatoes Breaks Streaming Charts

May 22, 2025

Jason Statham Movie Scores 90 On Rotten Tomatoes Breaks Streaming Charts

May 22, 2025 -

Scientists Achieve Petahertz Phototransistor Operation At Room Temperature

May 22, 2025

Scientists Achieve Petahertz Phototransistor Operation At Room Temperature

May 22, 2025 -

Analyzing The Knicks Pacers Series The Impact Of The Towns Turner Center Duel

May 22, 2025

Analyzing The Knicks Pacers Series The Impact Of The Towns Turner Center Duel

May 22, 2025 -

Teknik Direktoer Postecoglou Dan Oyuncularina Tebrik Basariyi Kutladi

May 22, 2025

Teknik Direktoer Postecoglou Dan Oyuncularina Tebrik Basariyi Kutladi

May 22, 2025 -

Marina Fogles Candid Confession The Lies Behind The Perfect Family Image

May 22, 2025

Marina Fogles Candid Confession The Lies Behind The Perfect Family Image

May 22, 2025