U.S. Energy Reserves Rise: EIA Data Shows Unexpected Build In Crude And Fuel Inventories

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Energy Reserves Rise: EIA Data Reveals Unexpected Surge in Crude and Fuel Inventories

Surprise Inventory Build Challenges Market Expectations

The U.S. energy market experienced an unexpected shake-up this week, as the Energy Information Administration (EIA) released data revealing a significant increase in crude oil and fuel inventories. This unexpected build challenges analysts' predictions and is sending ripples through the energy sector. The report, published [Insert Date of EIA Report Release], indicates a larger-than-anticipated stockpile of both crude oil and refined petroleum products, impacting prices and raising questions about future demand.

Key Findings from the EIA Report:

-

Crude Oil: The EIA reported a build of [Insert Amount] barrels of crude oil for the week ending [Insert Date], significantly exceeding the [Insert Amount] barrel increase anticipated by analysts. This surge in crude oil inventories can be attributed to [Insert Reasons provided by EIA - e.g., reduced refinery demand, increased imports, etc.]. The increase pushed total U.S. crude oil inventories to [Insert Current Inventory Level], a level [higher/lower] than the five-year average.

-

Gasoline: Gasoline inventories also saw a substantial increase of [Insert Amount] barrels, contrasting with the expected [Insert Amount] barrel decrease. This unexpected build could indicate softening gasoline demand, potentially reflecting factors such as [Insert Possible Factors - e.g., seasonal changes, higher prices, etc.].

-

Distillate Fuels: Distillate fuel inventories, including diesel and heating oil, showed a [Increase/Decrease] of [Insert Amount] barrels, compared to the anticipated [Insert Amount] barrel [Increase/Decrease]. This data point provides insight into the heating oil market's performance heading into [Winter/Summer], and the potential implications for prices.

Market Reaction and Analyst Commentary:

The unexpected inventory build has sent shockwaves through the energy markets. Crude oil prices experienced a [Insert Percentage]% [Increase/Decrease] following the release of the EIA report, while gasoline futures also saw a [Insert Percentage]% [Increase/Decrease].

Analysts are offering varied interpretations of the data. Some attribute the increase to temporary factors, predicting a return to more balanced inventory levels in the coming weeks. Others express concerns that the build signifies weakening demand, potentially foreshadowing a more significant market correction. [Insert quote from an energy analyst here].

Looking Ahead: Implications for Energy Prices and Policy:

The implications of this substantial inventory build remain uncertain. While it could lead to short-term price pressure, the long-term effects will depend on several factors, including global economic growth, geopolitical developments, and future demand. The EIA's forecast for [Insert Future Period - e.g., the next quarter] will be crucial in shaping market expectations. This unexpected data could also influence government energy policies, potentially prompting discussions around [Insert Potential Policy Implications - e.g., strategic petroleum reserve releases, production adjustments].

Keywords: EIA, Energy Information Administration, Crude Oil, Gasoline, Distillate Fuels, Energy Reserves, U.S. Energy, Oil Inventories, Fuel Inventories, Energy Market, Oil Prices, Gasoline Prices, Energy Report, Inventory Build, Market Analysis, Energy Demand, Energy Policy

This article provides a comprehensive overview of the latest EIA report and its potential impact on the U.S. energy market. Remember to replace the bracketed information with the actual data from the EIA report.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Energy Reserves Rise: EIA Data Shows Unexpected Build In Crude And Fuel Inventories. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New York Knicks All Time Greatest Revisiting The Top 11 Players

May 23, 2025

New York Knicks All Time Greatest Revisiting The Top 11 Players

May 23, 2025 -

Controversy Surrounds Qatars Gift Of New Air Force One Jet To Trump Administration

May 23, 2025

Controversy Surrounds Qatars Gift Of New Air Force One Jet To Trump Administration

May 23, 2025 -

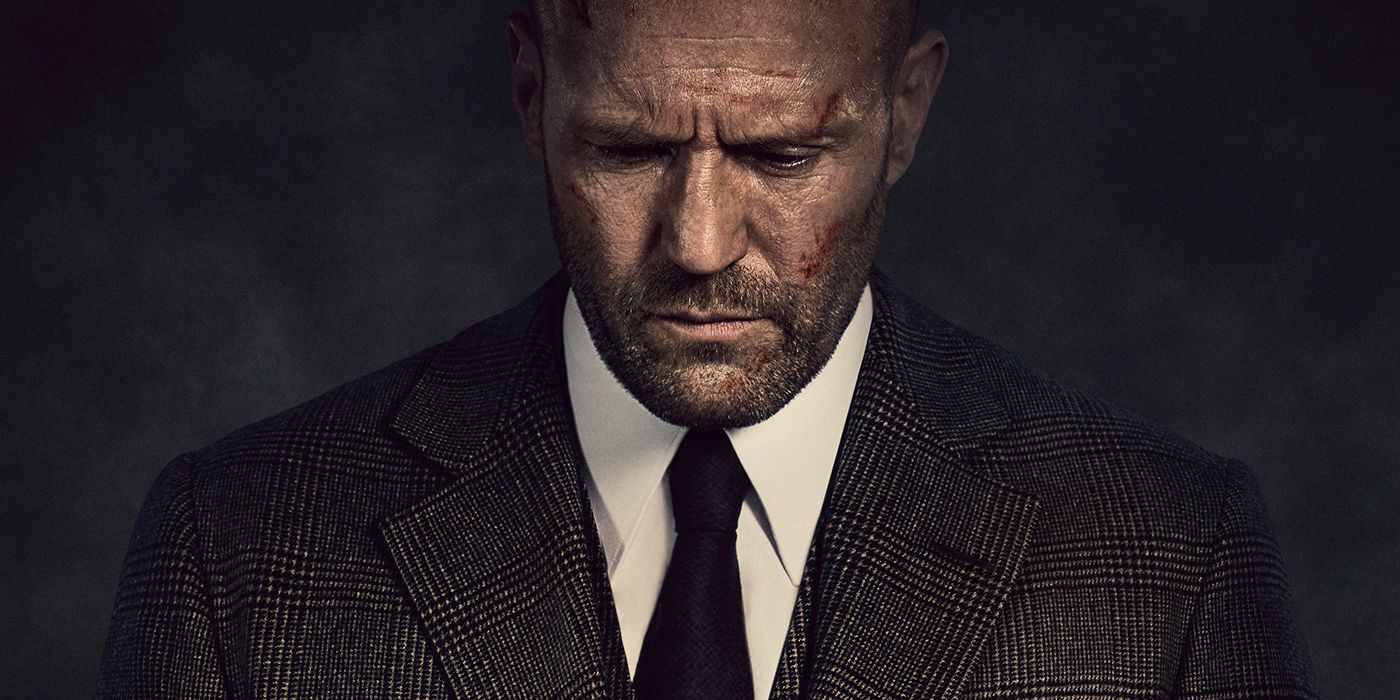

Streaming Charts Conquered Jason Statham Movies 90 Rotten Tomatoes Score

May 23, 2025

Streaming Charts Conquered Jason Statham Movies 90 Rotten Tomatoes Score

May 23, 2025 -

Say Goodbye To Lost Prescriptions Nhs Implements New Tracking System

May 23, 2025

Say Goodbye To Lost Prescriptions Nhs Implements New Tracking System

May 23, 2025 -

15 Year Old Girl Missing Amber Alert Activation In Harris County

May 23, 2025

15 Year Old Girl Missing Amber Alert Activation In Harris County

May 23, 2025

Latest Posts

-

Eiza Gonzalez And The Unsolved Mystery Of The Fountain Of Youth

May 23, 2025

Eiza Gonzalez And The Unsolved Mystery Of The Fountain Of Youth

May 23, 2025 -

28 Years On Movie Show Name Returns With A Powerful No Rescues Message In New Tv Spot

May 23, 2025

28 Years On Movie Show Name Returns With A Powerful No Rescues Message In New Tv Spot

May 23, 2025 -

Watch Global Stars Celebrate Shai Gilgeous Alexanders Mvp Award

May 23, 2025

Watch Global Stars Celebrate Shai Gilgeous Alexanders Mvp Award

May 23, 2025 -

Tournee P A Dates Et Details De Son Grand Retour Sur Scene

May 23, 2025

Tournee P A Dates Et Details De Son Grand Retour Sur Scene

May 23, 2025 -

Game Stops Financial Turnaround Profits 6 Billion Balance Sheet And Bitcoin Strategy

May 23, 2025

Game Stops Financial Turnaround Profits 6 Billion Balance Sheet And Bitcoin Strategy

May 23, 2025