UK Banking Chaos: Lloyds, Halifax, And Nationwide Suffer Outages Due To System Failures

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Banking Chaos: Lloyds, Halifax, and Nationwide Suffer Widespread Outages

Major UK banks Lloyds, Halifax, and Nationwide experienced significant system failures on [Date of Outages], leaving millions of customers unable to access their accounts online or through mobile banking apps. The widespread outages caused significant disruption, sparking widespread frustration and concerns about the security and reliability of the nation's banking infrastructure. This incident highlights the vulnerability of even the largest financial institutions to technological failures and underscores the critical need for robust contingency planning.

The outages, which began around [Time of Outages], affected a wide range of banking services. Customers reported being unable to access their accounts, make payments, or transfer funds. ATM services were also reportedly affected in some areas, further exacerbating the problems faced by affected customers. The sheer scale of the disruption quickly became apparent, with social media platforms flooded with complaints from frustrated customers. The hashtag #bankingoutage trended nationally, showcasing the widespread nature of the problem.

What Caused the Outages?

While the exact causes of the outages remain unclear, initial reports suggest a combination of factors may be at play. [Insert confirmed information from official bank statements, press releases, or reputable news sources regarding the cause, e.g., "Lloyds Banking Group attributed the issue to a 'major technical problem' affecting its core systems," or "Nationwide cited an unexpected surge in online traffic as a contributing factor."]. The lack of immediate transparency from the banks fueled speculation and increased public anxiety.

- Technical Glitches: System failures within the banks' internal infrastructure are a likely suspect. This could involve anything from software bugs to hardware malfunctions.

- Cybersecurity Concerns: While no evidence suggests a cyberattack, the timing and scale of the outages have led some to question potential security vulnerabilities. Further investigation will be necessary to rule this out conclusively.

- Overwhelmed Systems: A sudden surge in online activity could have overloaded the banks' systems, causing them to fail. This is particularly plausible given the increasing reliance on digital banking.

Impact on Customers and the Economy

The widespread outages had a significant impact on millions of customers, causing inconvenience and, in some cases, financial hardship. Many were unable to pay bills, access funds for essential purchases, or manage their finances effectively. The broader economic impact, while difficult to quantify immediately, could involve delays in business transactions and potential disruptions to the flow of money within the UK economy.

- Financial Inconvenience: Customers faced significant delays in accessing their money, disrupting daily life and financial planning.

- Reputational Damage: The outages damaged the reputation of the affected banks, potentially leading to customer churn.

- Regulatory Scrutiny: The incident is likely to trigger further regulatory scrutiny of the banks' IT infrastructure and resilience planning.

The Road to Recovery and Future Prevention

The affected banks have pledged to investigate the root causes of the outages and implement measures to prevent similar incidents in the future. [Include specific measures announced by banks, if any]. The incident serves as a stark reminder of the critical importance of investing in robust IT infrastructure, comprehensive cybersecurity measures, and effective disaster recovery planning. Independent audits and rigorous testing are essential to ensuring the reliability and resilience of UK banking systems. Consumers should expect greater transparency from banks regarding the steps taken to prevent future failures.

This ongoing situation warrants close monitoring. We will continue to update this article as more information becomes available. Check back for the latest developments and advice on navigating these disruptions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Banking Chaos: Lloyds, Halifax, And Nationwide Suffer Outages Due To System Failures. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Google Ai Overly Protective Co Founder Calls For A Change Of Course

Mar 04, 2025

Google Ai Overly Protective Co Founder Calls For A Change Of Course

Mar 04, 2025 -

Eth Price Rallies 10 Is A 3 000 Ethereum Price Realistic

Mar 04, 2025

Eth Price Rallies 10 Is A 3 000 Ethereum Price Realistic

Mar 04, 2025 -

Ethereum Price Rally 10 Jump But Will Eth Break The Descending Channel

Mar 04, 2025

Ethereum Price Rally 10 Jump But Will Eth Break The Descending Channel

Mar 04, 2025 -

Is Donald Trumps Crypto Strategy A Winning Bet Experts Weigh In

Mar 04, 2025

Is Donald Trumps Crypto Strategy A Winning Bet Experts Weigh In

Mar 04, 2025 -

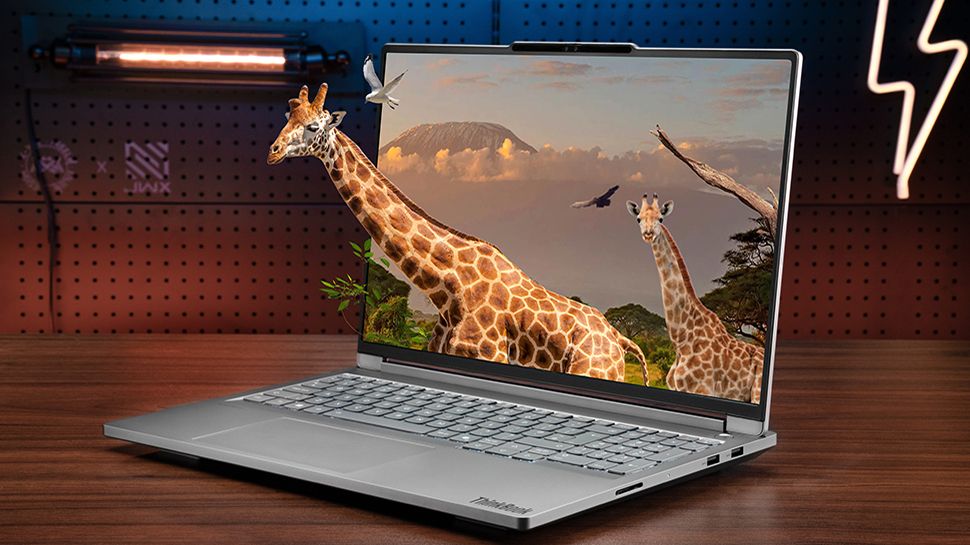

Glasses Free 3 Ds Last Stand A Look At Lenovos Think Book 3 D Laptop

Mar 04, 2025

Glasses Free 3 Ds Last Stand A Look At Lenovos Think Book 3 D Laptop

Mar 04, 2025