UK Finance Officials Rule Out Bitcoin As A Reserve Asset

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Finance Officials Rule Out Bitcoin as a Reserve Asset: Sterling Remains King

The UK Treasury and the Bank of England have definitively ruled out Bitcoin and other cryptocurrencies as potential reserve assets, solidifying the pound sterling's position as the nation's primary store of value. This decisive stance, announced [Insert Date of Announcement] in a joint statement, comes amidst increasing global uncertainty surrounding the volatile cryptocurrency market and growing concerns about its regulatory landscape.

The statement emphasized the inherent risks associated with Bitcoin and other digital assets, citing their extreme price volatility, susceptibility to hacking and fraud, and lack of intrinsic value. These factors, the officials argued, render them unsuitable for inclusion in a responsible and stable reserve portfolio.

Why the Rejection of Bitcoin as a Reserve Asset?

The decision underscores the UK government's cautious approach towards cryptocurrencies. Several key reasons underpin this rejection:

- Volatility: Bitcoin's price has historically been extremely volatile, experiencing dramatic swings that could significantly impact the value of a nation's reserves. This unpredictability poses a substantial risk to financial stability.

- Regulatory Uncertainty: The lack of a clear and consistent global regulatory framework for cryptocurrencies adds to the uncertainty. This makes it difficult to accurately assess and manage the risks associated with holding Bitcoin as a reserve asset.

- Security Concerns: The cryptocurrency market is susceptible to hacking and fraud, with numerous instances of exchanges and wallets being compromised. This poses a significant security risk for any entity holding large amounts of Bitcoin.

- Environmental Concerns: The energy consumption associated with Bitcoin mining is a growing concern for environmentally conscious nations. The UK's commitment to net-zero emissions makes the energy-intensive nature of Bitcoin a significant deterrent.

- Lack of Intrinsic Value: Unlike fiat currencies backed by a government, Bitcoin lacks inherent value. Its worth is solely determined by supply and demand, making it a highly speculative asset.

Focus on Sterling and Stablecoins:

The statement reaffirms the UK's commitment to the pound sterling as its primary reserve currency. While acknowledging the potential of blockchain technology, officials suggested a focus on exploring stablecoins – cryptocurrencies pegged to the value of a stable asset like the US dollar – as a possible avenue for future exploration within a carefully regulated environment.

Implications for the Cryptocurrency Market:

The UK's clear stance on Bitcoin's unsuitability as a reserve asset is likely to have wider implications for the cryptocurrency market. It could further discourage institutional adoption of Bitcoin and potentially influence the regulatory policies of other nations. The statement highlights the growing divide between established financial institutions and the cryptocurrency world, emphasizing the need for greater regulatory clarity and risk management within the crypto space.

Looking Ahead:

While the UK has firmly closed the door on Bitcoin as a reserve asset for now, the ongoing evolution of blockchain technology and cryptocurrencies suggests that the landscape could shift in the future. However, for the foreseeable future, the pound sterling remains the cornerstone of the UK's financial system. The government's emphasis on stablecoins signals a potential path towards incorporating blockchain technology into the financial system in a more controlled and regulated manner. This focus on responsible innovation within the digital asset space is likely to continue shaping the UK's approach to cryptocurrency in the coming years.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Finance Officials Rule Out Bitcoin As A Reserve Asset. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How Your Uber Rating Affects Your Ability To Use The App

May 08, 2025

How Your Uber Rating Affects Your Ability To Use The App

May 08, 2025 -

Jackie Chan Revisits The Karate Kid New Adventures And Unexpected Wisdom

May 08, 2025

Jackie Chan Revisits The Karate Kid New Adventures And Unexpected Wisdom

May 08, 2025 -

Nuggets Beat Thunder In Game 1 Thriller Gordons Game Winner Seals Victory

May 08, 2025

Nuggets Beat Thunder In Game 1 Thriller Gordons Game Winner Seals Victory

May 08, 2025 -

Hockey News Live Playoff Chat Stars Clinch Series Victory Round 1 Analysis

May 08, 2025

Hockey News Live Playoff Chat Stars Clinch Series Victory Round 1 Analysis

May 08, 2025 -

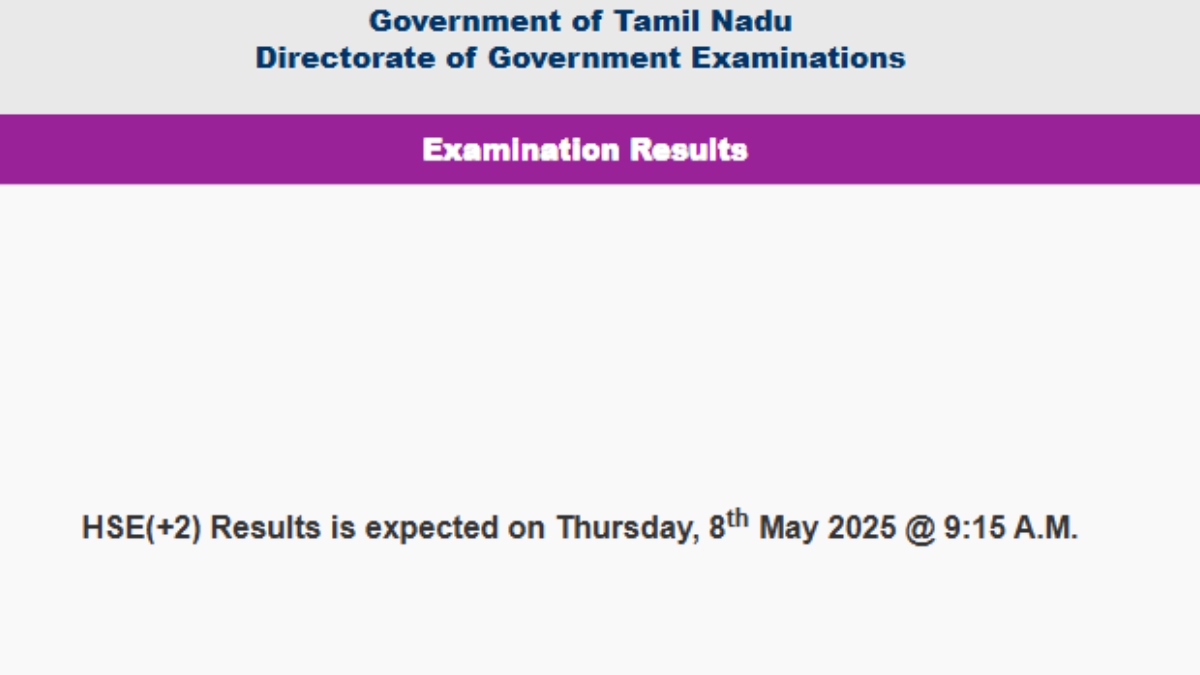

Tngde Tamil Nadu 2 Results 2025 Direct Link To Check Your Hsc Scores On Tnresults Nic In

May 08, 2025

Tngde Tamil Nadu 2 Results 2025 Direct Link To Check Your Hsc Scores On Tnresults Nic In

May 08, 2025

Latest Posts

-

Oldest Person Set On Fire Final Destination Bloodlines Directors Record Under Scrutiny

May 08, 2025

Oldest Person Set On Fire Final Destination Bloodlines Directors Record Under Scrutiny

May 08, 2025 -

Shai Gilgeous Alexander And Jamal Murray The Future Of Canadian Basketball

May 08, 2025

Shai Gilgeous Alexander And Jamal Murray The Future Of Canadian Basketball

May 08, 2025 -

Urgent 1 400 Refund For U S Expats Act Within Six Weeks

May 08, 2025

Urgent 1 400 Refund For U S Expats Act Within Six Weeks

May 08, 2025 -

Unmasked The Masked Singers Mad Scientist Reveals His Transformative Experience

May 08, 2025

Unmasked The Masked Singers Mad Scientist Reveals His Transformative Experience

May 08, 2025 -

Eastern Conference Finals Awaits Knicks Stage Impressive Comeback Against Celtics

May 08, 2025

Eastern Conference Finals Awaits Knicks Stage Impressive Comeback Against Celtics

May 08, 2025