UK Households Face 25% HMRC Penalty On Cash Withdrawals: What You Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Households Face 25% HMRC Penalty on Cash Withdrawals: What You Need to Know

The UK government's crackdown on cash continues, leaving many households facing significant financial penalties. Recent changes mean that exceeding a certain cash withdrawal threshold could result in a hefty 25% penalty from HMRC. This article breaks down everything you need to know about these new regulations and how to avoid falling foul of the law.

The move towards a cashless society is accelerating, but for many, cash remains a vital part of their financial lives. However, the government's increasing scrutiny of large cash transactions aims to combat tax evasion and money laundering. This means individuals and businesses need to be aware of the implications of handling substantial amounts of cash.

What is the Cash Withdrawal Limit?

While there isn't a single, universally applicable cash withdrawal limit, HMRC focuses on transactions that appear suspicious. They use sophisticated data analysis techniques to identify potentially unlawful activity. Therefore, there's no specific amount you can safely withdraw without raising flags. However, withdrawing consistently large sums of cash, especially without a clear explanation for the source of funds, significantly increases the risk of attracting HMRC attention.

Why is HMRC Imposing Penalties?

The 25% penalty isn't levied arbitrarily. HMRC's primary goal is to prevent tax evasion and money laundering. Large cash transactions are often associated with these illegal activities. By imposing significant penalties, HMRC aims to deter individuals and businesses from using cash to avoid paying their fair share of taxes. The penalty serves as a strong deterrent against illicit financial activities.

What Triggers an HMRC Investigation?

Several factors can trigger an HMRC investigation into your cash transactions:

- Regular large cash withdrawals: Consistently withdrawing significant sums of money over a short period.

- Lack of verifiable income: Unable to provide evidence of legitimate income sources to justify the cash transactions.

- Suspicious patterns of behavior: Unusual or unexplained cash flow patterns.

- Discrepancies in tax returns: A mismatch between declared income and cash transactions.

- Tips and referrals: Information received from other sources.

How to Avoid HMRC Penalties:

- Keep accurate records: Maintain detailed records of all cash transactions, including dates, amounts, and the purpose of each withdrawal.

- Declare all income: Ensure all income is accurately declared on your tax returns.

- Use electronic payments: Opt for electronic payments whenever possible to reduce reliance on cash.

- Understand your reporting obligations: Familiarize yourself with HMRC's guidelines on reporting large cash transactions.

- Seek professional advice: Consult with an accountant or financial advisor if you have concerns about your cash transactions.

Understanding the Implications:

Facing a 25% penalty from HMRC can be devastating. It's not just the financial loss; it also involves the stress of an investigation and potential legal ramifications. Proactive steps to manage your cash transactions are crucial to avoid these problems.

In conclusion, while cash remains a part of many people's lives, it's crucial to be aware of the increasing scrutiny from HMRC. By understanding the potential risks and following the guidelines outlined above, you can significantly reduce the chances of facing substantial penalties. Remember, prevention is always better than cure when it comes to navigating the complexities of UK tax regulations. Don't hesitate to seek professional advice if you are uncertain about any aspect of your financial dealings.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Households Face 25% HMRC Penalty On Cash Withdrawals: What You Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

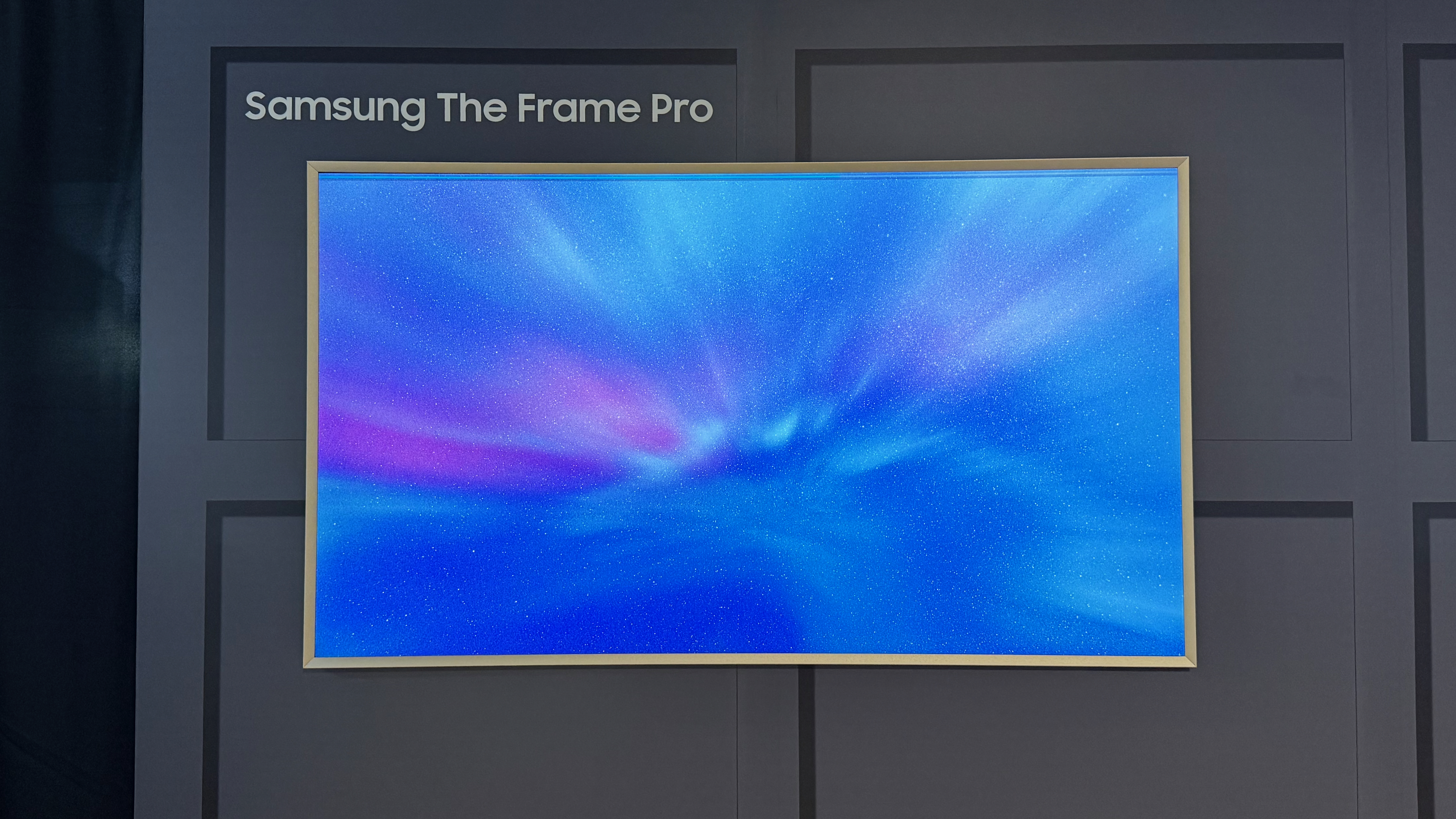

Samsung The Frame Pro A Significant Upgrade After Years With The Frame

May 10, 2025

Samsung The Frame Pro A Significant Upgrade After Years With The Frame

May 10, 2025 -

Refereeing Under Fire Gordon Speaks Out After 40 Point Loss Highlights Jokic Fouling

May 10, 2025

Refereeing Under Fire Gordon Speaks Out After 40 Point Loss Highlights Jokic Fouling

May 10, 2025 -

Conferencia El Impacto De 40 Anos De Espana En La Union Europea

May 10, 2025

Conferencia El Impacto De 40 Anos De Espana En La Union Europea

May 10, 2025 -

Milans Victory Over Bologna Conceicaos Measured Response Ahead Of Final

May 10, 2025

Milans Victory Over Bologna Conceicaos Measured Response Ahead Of Final

May 10, 2025 -

Intense Game 6 Bruins And Brown Head To Decisive Game 7

May 10, 2025

Intense Game 6 Bruins And Brown Head To Decisive Game 7

May 10, 2025

Latest Posts

-

Mayendas Goal Punishes Coventry Blunder Sunderland Lead In Playoff Clash

May 10, 2025

Mayendas Goal Punishes Coventry Blunder Sunderland Lead In Playoff Clash

May 10, 2025 -

Shohei Ohtanis 700 Million Contract Nez Balelos Unwavering Confidence

May 10, 2025

Shohei Ohtanis 700 Million Contract Nez Balelos Unwavering Confidence

May 10, 2025 -

Reeves Demands Welfare System Overhaul A Turning Point For Labour

May 10, 2025

Reeves Demands Welfare System Overhaul A Turning Point For Labour

May 10, 2025 -

Naga Munchettys Bbc Breakfast Interview Was The Labour Mp Exchange A Waste Of Time

May 10, 2025

Naga Munchettys Bbc Breakfast Interview Was The Labour Mp Exchange A Waste Of Time

May 10, 2025 -

Bitcoin Btc Surges Past 100 000 New All Time High In Sight

May 10, 2025

Bitcoin Btc Surges Past 100 000 New All Time High In Sight

May 10, 2025