UK Rejects Bitcoin Reserve: Concerns Over Market Suitability And Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>UK Rejects Bitcoin Reserve: Concerns Over Market Volatility and Regulatory Risks</h1>

The UK Treasury has officially rejected the proposal to include Bitcoin as part of the country's foreign currency reserves, citing significant concerns about market volatility and regulatory uncertainties surrounding the cryptocurrency. This decision, announced yesterday, marks a cautious approach by the UK government towards Bitcoin's integration into its financial infrastructure. While some nations explore digital assets as a potential diversification strategy, the UK's stance highlights the prevailing apprehension surrounding Bitcoin's long-term stability and potential risks.

<h2>Volatility Remains a Major Concern</h2>

The primary reason behind the rejection, according to a Treasury spokesperson, is the inherent volatility of the Bitcoin market. Bitcoin's price has historically experienced dramatic swings, making it an unsuitable asset for a reserve intended to maintain stability and value. Unlike traditional fiat currencies, Bitcoin lacks the backing of a central bank or government, making it susceptible to significant price fluctuations influenced by market sentiment, regulatory changes, and technological developments. This unpredictability poses a considerable risk to the stability of the UK's financial reserves.

<h3>Price Swings and Market Manipulation</h3>

The spokesperson emphasized the vulnerability of Bitcoin to manipulation, pointing to instances of significant price drops triggered by market events or influential players. The lack of robust regulatory oversight in the cryptocurrency market further exacerbates these risks, making it difficult to predict or mitigate potential losses. The Treasury's assessment concluded that the inherent volatility of Bitcoin outweighs any potential benefits of its inclusion in the UK's reserve portfolio.

<h2>Regulatory Uncertainty and Legal Frameworks</h2>

Beyond volatility, the absence of a comprehensive and internationally harmonized regulatory framework for cryptocurrencies adds to the UK's concerns. The Treasury highlighted the lack of clear legal definitions, taxation policies, and consumer protection measures surrounding Bitcoin. This regulatory uncertainty creates significant legal and operational risks, making it difficult to integrate Bitcoin into existing financial systems and manage potential legal liabilities.

<h3>International Regulatory Harmonization Needed</h3>

The UK government indicated that a more stable and regulated global cryptocurrency landscape would be necessary before considering the inclusion of Bitcoin or other cryptocurrencies in its reserves. The Treasury is advocating for enhanced international collaboration on cryptocurrency regulation, emphasizing the need for clear standards and consistent enforcement across jurisdictions to mitigate the inherent risks.

<h2>Exploring Alternative Digital Asset Strategies</h2>

While rejecting Bitcoin for its reserves, the UK Treasury expressed openness to exploring other potential uses of digital assets in the future. This could include investigating Central Bank Digital Currencies (CBDCs) or exploring the potential of blockchain technology for improving financial infrastructure efficiency and security. However, any future engagement with digital assets would be contingent on robust regulatory frameworks and a demonstrably reduced level of market risk.

<h3>Focus on CBDCs and Blockchain Technology</h3>

The government's statement suggests a preference for regulated digital assets with a strong backing, unlike the decentralized nature of Bitcoin. The focus on CBDCs and blockchain technology reflects a more cautious, controlled approach to the integration of digital assets into the UK's financial ecosystem.

<h2>Conclusion: A Cautious but Not Dismissive Stance</h2>

The UK's rejection of Bitcoin as a reserve asset highlights a pragmatic approach to the integration of cryptocurrencies into mainstream finance. The government's concerns about volatility, regulatory uncertainty, and potential risks are widely shared among central banks globally. While the door isn't entirely closed to future consideration of digital assets, the UK's current focus remains on stable, regulated systems and the mitigation of significant financial risks associated with volatile cryptocurrencies like Bitcoin.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Rejects Bitcoin Reserve: Concerns Over Market Suitability And Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dwps Final Ruling On Cost Of Living Support Payments

May 08, 2025

Dwps Final Ruling On Cost Of Living Support Payments

May 08, 2025 -

Exploring Neurological Conditions The Power Of Pen And Paper For Broken Brains

May 08, 2025

Exploring Neurological Conditions The Power Of Pen And Paper For Broken Brains

May 08, 2025 -

Urgent Travel Warning Uk Foreign Office Advises Against Travel To Popular Holiday Destination

May 08, 2025

Urgent Travel Warning Uk Foreign Office Advises Against Travel To Popular Holiday Destination

May 08, 2025 -

The Masked Singer A Mad Scientists Journey To Liberation

May 08, 2025

The Masked Singer A Mad Scientists Journey To Liberation

May 08, 2025 -

Nuggets Vs Thunder Live Score May 7 2025 Play By Play And Box Score

May 08, 2025

Nuggets Vs Thunder Live Score May 7 2025 Play By Play And Box Score

May 08, 2025

Latest Posts

-

Enhanced Productivity In App Image Editing With Gemini

May 08, 2025

Enhanced Productivity In App Image Editing With Gemini

May 08, 2025 -

Leaked Details Hint At Unannounced Amd Epyc 4005 Mini Pc In Large Scale Us Deployment

May 08, 2025

Leaked Details Hint At Unannounced Amd Epyc 4005 Mini Pc In Large Scale Us Deployment

May 08, 2025 -

Will The Genius Act Boost Or Stifle Stablecoin Adoption In The Us

May 08, 2025

Will The Genius Act Boost Or Stifle Stablecoin Adoption In The Us

May 08, 2025 -

Fatal Police Encounter Ends Life Of Courtroom Double Murderer

May 08, 2025

Fatal Police Encounter Ends Life Of Courtroom Double Murderer

May 08, 2025 -

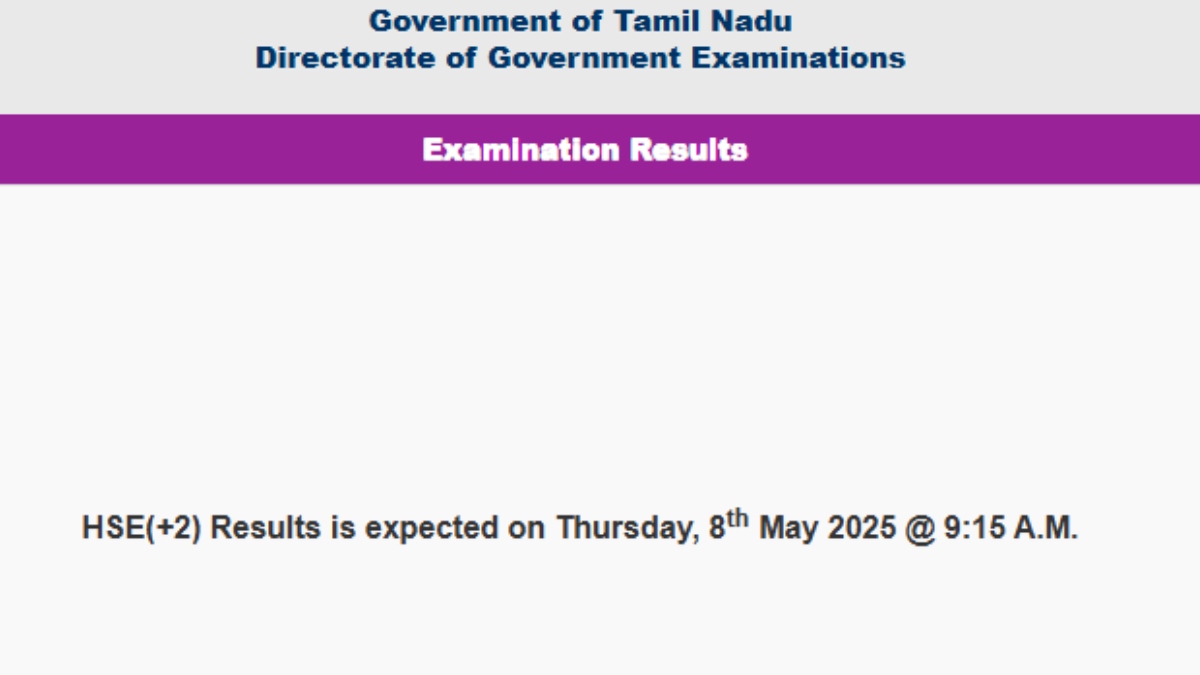

Tngde Tamil Nadu 12th Results 2025 Direct Link To Check Plus Two Scores And Pass Percentage

May 08, 2025

Tngde Tamil Nadu 12th Results 2025 Direct Link To Check Plus Two Scores And Pass Percentage

May 08, 2025