Understanding Early Trader Behavior In The R9 Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Decoding the Dawn: Understanding Early Trader Behavior in the R9 Market

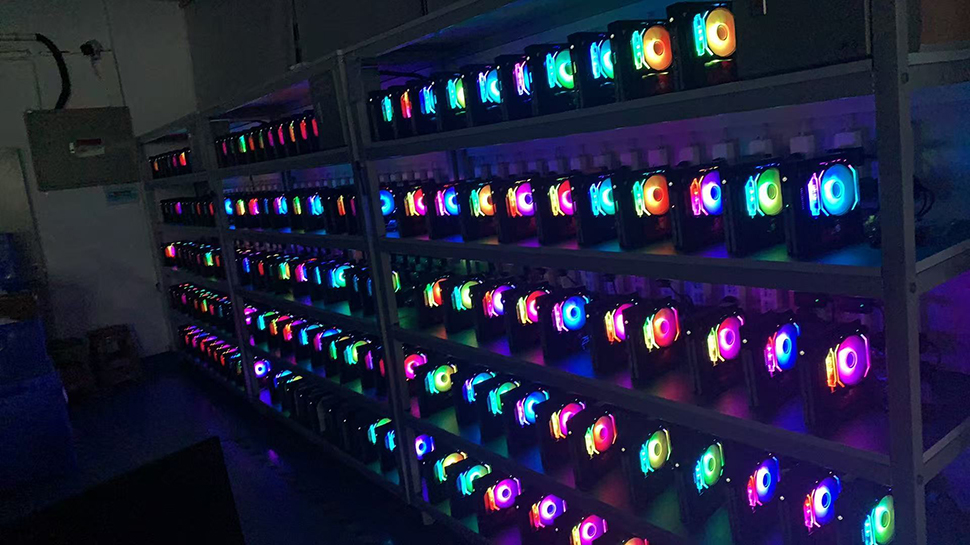

The R9 market, a relatively new player in the [specify market sector, e.g., cryptocurrency, commodities, etc.] landscape, has seen explosive growth, attracting a diverse range of traders. Understanding the behavior of early adopters in this volatile market is crucial for both seasoned investors and newcomers alike. This analysis delves into the key characteristics and strategies employed by these pioneering traders, offering insights into potential future trends.

Early Trader Profiles: A Diverse Landscape

The R9 market's early adopters weren't a monolithic group. Instead, they comprised several distinct profiles:

-

The Tech-Savvy Speculator: This group, often familiar with blockchain technology (if applicable) or complex trading platforms, jumped in early, driven by potential for high returns and a willingness to accept high risk. They often utilized advanced technical analysis and leveraged trading strategies.

-

The Long-Term Visionary: Less focused on short-term gains, this segment saw the inherent value in R9 and adopted a "buy-and-hold" strategy, believing in its long-term potential. They were less reactive to market fluctuations.

-

The Trend Follower: These traders entered the market after seeing initial price increases, hoping to capitalize on the upward trend. They relied heavily on market sentiment and news cycles.

-

The Arbitrageur: Seeking to exploit price discrepancies across different exchanges, this group focused on quick profits through simultaneous buying and selling of R9 on various platforms.

Key Behavioral Patterns Observed:

Early R9 trading revealed several interesting behavioral patterns:

-

High Risk Tolerance: The early market was characterized by significant volatility. Successful early traders demonstrated a higher-than-average risk tolerance.

-

Information Sensitivity: News, updates, and social media sentiment significantly impacted trading decisions. Early traders actively sought out information and reacted swiftly.

-

Emotional Involvement: The nascent nature of the R9 market often led to heightened emotional responses, potentially impacting rational decision-making. Fear and greed played significant roles.

-

Community Influence: Early traders often relied on online forums and communities for information sharing and support. This created a strong network effect.

Strategic Implications for Future Traders:

Understanding these early behaviors provides valuable insights for future participants in the R9 market:

-

Thorough Due Diligence: Before investing, conduct comprehensive research, understanding both the potential rewards and significant risks.

-

Risk Management: Implement robust risk management strategies, including stop-loss orders and diversification.

-

Emotional Discipline: Maintain emotional discipline, avoiding impulsive decisions based on fear or greed.

-

Stay Informed: Keep abreast of market developments, utilizing reputable news sources and analytical tools.

The Future of the R9 Market:

The R9 market remains dynamic and unpredictable. While early trader behavior provides valuable insights, future trends will depend on a multitude of factors, including technological advancements, regulatory changes, and overall market sentiment. Continued monitoring and adaptation are crucial for success. The early adopters paved the way, offering lessons both valuable and cautionary for those entering this exciting, yet volatile, space. Further research into specific trading algorithms and the impact of social media on R9 price fluctuations is warranted.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding Early Trader Behavior In The R9 Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

What The New Godzilla X Kong Sequel Title Reveals About The Plot

May 11, 2025

What The New Godzilla X Kong Sequel Title Reveals About The Plot

May 11, 2025 -

Chinese Firm Showcases Production Ready Amd Ryzen Ai Max 395 Mini Workstations

May 11, 2025

Chinese Firm Showcases Production Ready Amd Ryzen Ai Max 395 Mini Workstations

May 11, 2025 -

Della Maddalena Vs Opponent Craig Jones Bold Prediction For Ufc 315 Main Event

May 11, 2025

Della Maddalena Vs Opponent Craig Jones Bold Prediction For Ufc 315 Main Event

May 11, 2025 -

Compromised Employee Monitoring Software The New Vector For Ransomware

May 11, 2025

Compromised Employee Monitoring Software The New Vector For Ransomware

May 11, 2025 -

Secs Crypto Regulatory Ambiguity Insights From Coinbases Foia Documents

May 11, 2025

Secs Crypto Regulatory Ambiguity Insights From Coinbases Foia Documents

May 11, 2025

Latest Posts

-

Virat Kohli Retires From Test Cricket The End Of An Era

May 12, 2025

Virat Kohli Retires From Test Cricket The End Of An Era

May 12, 2025 -

South Essex Bypass Long Delays Expected Following Major Collision

May 12, 2025

South Essex Bypass Long Delays Expected Following Major Collision

May 12, 2025 -

Atp Rome Open R3 In Depth Preview And Predictions For Sinner De Jong Mensik And Marozsan

May 12, 2025

Atp Rome Open R3 In Depth Preview And Predictions For Sinner De Jong Mensik And Marozsan

May 12, 2025 -

Serie A Showdown Conte Calls For Calm As Napoli Fight For The Championship

May 12, 2025

Serie A Showdown Conte Calls For Calm As Napoli Fight For The Championship

May 12, 2025 -

Post Game 4 Analysis Thunders Hard Earned Victory Against Denver Nuggets

May 12, 2025

Post Game 4 Analysis Thunders Hard Earned Victory Against Denver Nuggets

May 12, 2025