Understanding The 25% HMRC Penalty On Cash Withdrawals In The UK

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the 25% HMRC Penalty on Cash Withdrawals in the UK: A Guide for Businesses

The UK’s tax authority, HMRC, is cracking down on businesses that fail to properly report cash transactions, introducing a significant penalty for non-compliance. Are you aware of the potential 25% penalty on unreported cash withdrawals? This article will delve into the intricacies of this penalty, helping you understand your obligations and avoid costly mistakes.

What is the 25% HMRC Penalty?

The 25% penalty applies to businesses that fail to accurately report cash withdrawals exceeding £10,000. This isn't just about large, single withdrawals; it encompasses a series of smaller withdrawals that cumulatively exceed this threshold within a 30-day period. This means if your business makes several cash withdrawals totaling more than £10,000 in a month, and these aren't correctly reported, you could face this substantial penalty. The penalty is calculated on the total amount exceeding the £10,000 threshold.

Who is Affected by this Penalty?

This penalty isn't limited to large corporations. Businesses of all sizes, from sole traders to limited companies, are subject to these regulations. If your business regularly handles cash transactions, you must understand and adhere to these reporting requirements. Ignoring these rules can lead to severe financial repercussions.

Why is HMRC Implementing this Penalty?

HMRC's initiative is part of a broader strategy to combat tax evasion and improve the accuracy of tax reporting. Cash transactions, by their nature, are more difficult to track than electronic payments, making them a target for those seeking to avoid paying their fair share of taxes. This penalty serves as a significant deterrent.

How to Avoid the 25% HMRC Penalty:

- Accurate Record Keeping: Meticulous record-keeping is paramount. Maintain detailed records of all cash withdrawals, including dates, amounts, and the purpose of each transaction. Consider using accounting software to automate this process and ensure accuracy.

- Regular Reporting: Submit your cash transaction reports on time. Missing deadlines can lead to additional penalties beyond the 25% penalty for unreported cash.

- Understanding the Threshold: Clearly understand the £10,000 threshold and the cumulative nature of the rule. Small, frequent withdrawals can quickly add up.

- Professional Advice: If you're unsure about your obligations, seek professional advice from a qualified accountant or tax advisor. They can help you navigate the complexities of cash transaction reporting and ensure compliance.

- Employing the Correct Reporting Methods: Familiarize yourself with the specific HMRC reporting methods and ensure you use the correct channels and forms.

Consequences of Non-Compliance:

Failure to comply with these regulations can result in:

- 25% Penalty: As previously stated, this is a substantial financial penalty applied to the unreported amount.

- Further Penalties: Late submission of reports can attract additional penalties.

- Criminal Prosecution: In severe cases, HMRC can pursue criminal prosecution, leading to significant fines and even imprisonment.

- Reputational Damage: A reputation for non-compliance can damage your business's credibility and make it difficult to secure future contracts or funding.

Staying Compliant with HMRC Regulations

Understanding and adhering to HMRC regulations on cash withdrawals is crucial for every UK business. Proactive measures, such as maintaining accurate records and seeking professional advice when needed, can help you avoid the significant financial and reputational risks associated with non-compliance. Don't gamble with your business's financial future; prioritize accurate cash transaction reporting. Contact your accountant or HMRC directly if you have any questions or concerns.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The 25% HMRC Penalty On Cash Withdrawals In The UK. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Oklahoma Lake Recreation Areas Closed Due To Federal Hiring Freeze

May 10, 2025

Oklahoma Lake Recreation Areas Closed Due To Federal Hiring Freeze

May 10, 2025 -

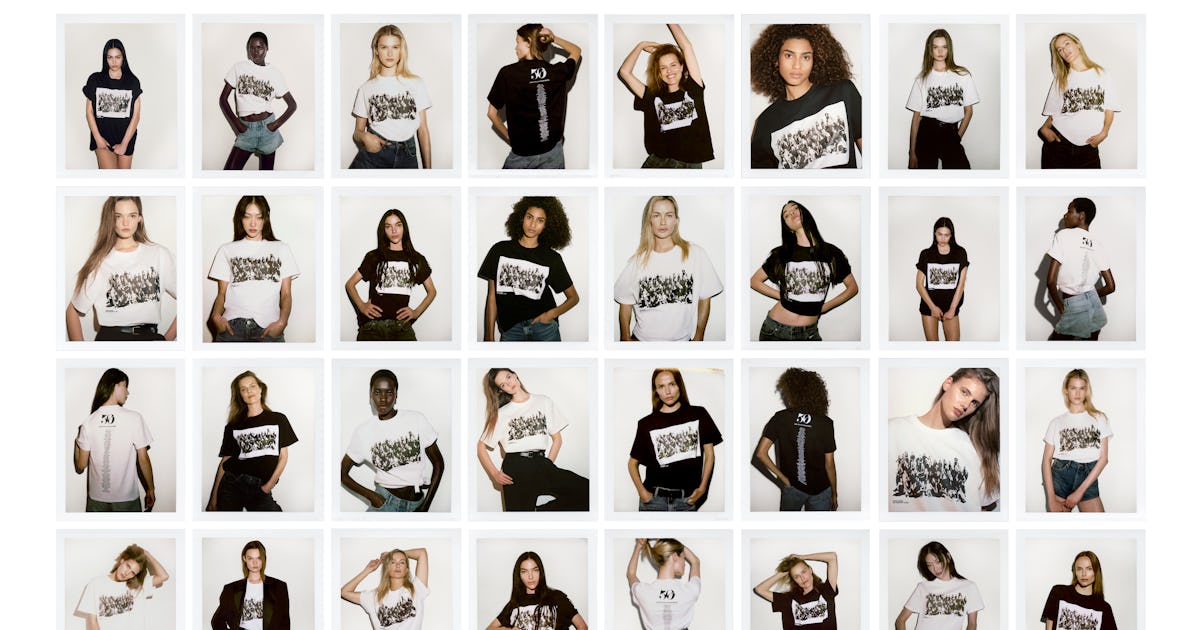

Inclusion Redefined Zaras Groundbreaking Fashion Campaign

May 10, 2025

Inclusion Redefined Zaras Groundbreaking Fashion Campaign

May 10, 2025 -

Agent Confirms Shohei Ohtanis Dodgers Endorsement Deal Earnings Revealed

May 10, 2025

Agent Confirms Shohei Ohtanis Dodgers Endorsement Deal Earnings Revealed

May 10, 2025 -

Mannings Impact Analyzing Bristol Citys Chances Against Sheffield United

May 10, 2025

Mannings Impact Analyzing Bristol Citys Chances Against Sheffield United

May 10, 2025 -

Agent Reveals The Near Miss 15 Year Deal For Shohei Ohtani

May 10, 2025

Agent Reveals The Near Miss 15 Year Deal For Shohei Ohtani

May 10, 2025

Latest Posts

-

Cross Border Airstrikes Pakistans Retaliation Against India

May 10, 2025

Cross Border Airstrikes Pakistans Retaliation Against India

May 10, 2025 -

The Denver Nuggets Upset Wins A Deeper Look At Their Underdog Success

May 10, 2025

The Denver Nuggets Upset Wins A Deeper Look At Their Underdog Success

May 10, 2025 -

Game 3 Celtics Vs Knicks Expert Picks Stats Trends And Betting Preview May 10

May 10, 2025

Game 3 Celtics Vs Knicks Expert Picks Stats Trends And Betting Preview May 10

May 10, 2025 -

Best Of A Bad Bunch Naga Munchetty Questions Labours Us Trade Deal

May 10, 2025

Best Of A Bad Bunch Naga Munchetty Questions Labours Us Trade Deal

May 10, 2025 -

Denver Airport Scandal 165 000 Madrid Trip Sparks Outrage

May 10, 2025

Denver Airport Scandal 165 000 Madrid Trip Sparks Outrage

May 10, 2025