Understanding The Cardano Bearish Divergence: Implications For ADA Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Cardano Bearish Divergence: Implications for ADA Investors

Cardano (ADA), the popular blockchain platform known for its robust security and scalability features, has recently shown signs of a bearish divergence. This technical indicator signals a potential weakening of the bullish momentum, raising concerns among ADA investors. Understanding this divergence is crucial for navigating the current market conditions and making informed investment decisions. This article will delve into the specifics of this bearish divergence, its implications for ADA holders, and potential strategies for mitigating risks.

What is a Bearish Divergence?

A bearish divergence is a technical analysis pattern that occurs when the price of an asset makes higher highs, but a corresponding momentum indicator (like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD)) forms lower highs. This discrepancy suggests a weakening of buying pressure despite price increases, hinting at a potential price reversal. In simpler terms, the price is trying to rally, but the underlying momentum is fading – a classic bearish signal.

Identifying the Bearish Divergence in Cardano (ADA)

Recent price action in ADA shows a classic example. While the price of ADA has climbed to new highs over the past [insert timeframe, e.g., few weeks], indicators like the RSI have failed to reach comparable highs. Instead, the RSI has formed lower peaks, indicating waning buying enthusiasm. This divergence doesn't guarantee a price drop, but it significantly increases the probability of a correction or even a more substantial downturn.

Implications for ADA Investors:

This bearish divergence carries several implications for ADA investors:

- Increased Risk of Price Correction: The most immediate implication is the increased likelihood of a price correction. Investors holding ADA should brace for a potential price decline.

- Reduced Upward Momentum: The weakening momentum suggests that further significant price gains might be difficult to achieve in the short term.

- Potential for Increased Volatility: Bearish divergences often precede periods of increased market volatility. ADA investors should be prepared for price swings.

- Re-evaluation of Investment Strategy: Investors should reassess their investment strategy, considering risk tolerance and potential exit strategies.

Strategies for Mitigating Risk:

While a bearish divergence doesn't automatically signal a catastrophic market crash, proactive strategies can help mitigate risks:

- Trailing Stop-Loss Orders: Implementing trailing stop-loss orders can help protect profits in case of a price reversal.

- Diversification: Diversifying your cryptocurrency portfolio can reduce the impact of a potential ADA price decline.

- Risk Management: Sticking to a well-defined risk management plan is crucial during periods of uncertainty. This includes setting clear entry and exit points and avoiding emotional decision-making.

- Fundamental Analysis: Remember to consider the underlying fundamentals of Cardano. Continued development, partnerships, and adoption could support the price even amidst short-term bearish pressures.

Conclusion:

The recent bearish divergence in Cardano presents a significant consideration for ADA investors. While not a definitive prediction of a price crash, it does suggest a weakening of bullish momentum and warrants careful consideration. By understanding the technical indicators and employing effective risk management strategies, investors can navigate this period of uncertainty and protect their investments. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions. The cryptocurrency market is inherently volatile, and careful planning is key to success.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Cardano Bearish Divergence: Implications For ADA Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dji Mavic 4 Pro Camera Drone Limited Us Market Launch

May 15, 2025

Dji Mavic 4 Pro Camera Drone Limited Us Market Launch

May 15, 2025 -

Decentralized Cloud Infrastructure A Key Strategy For Business Continuity

May 15, 2025

Decentralized Cloud Infrastructure A Key Strategy For Business Continuity

May 15, 2025 -

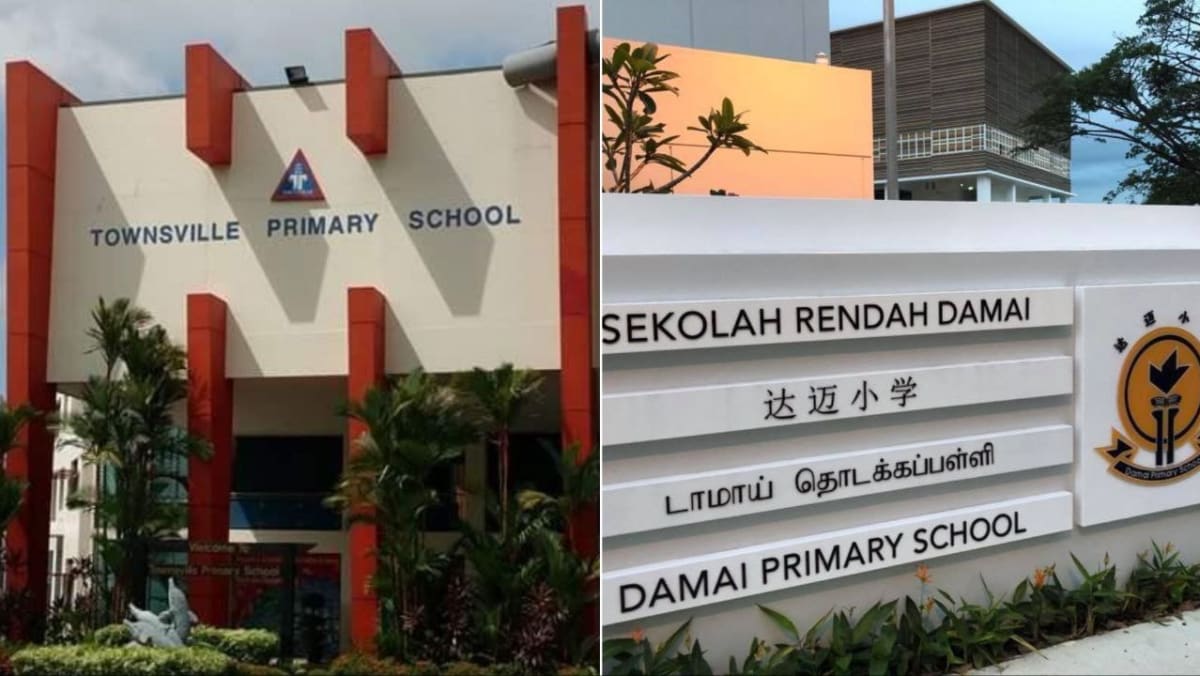

Townsvilles Damai Primary School To Relocate In 2029 Due To Increased Enrollment

May 15, 2025

Townsvilles Damai Primary School To Relocate In 2029 Due To Increased Enrollment

May 15, 2025 -

Ada Price Alert Bearish Divergence Forms After Recent Cardano Surge

May 15, 2025

Ada Price Alert Bearish Divergence Forms After Recent Cardano Surge

May 15, 2025 -

Wordle May 14th 2024 Hints And Solution For Puzzle 1425

May 15, 2025

Wordle May 14th 2024 Hints And Solution For Puzzle 1425

May 15, 2025

Latest Posts

-

Gacs New Concept Ev A Direct Competitor To The Cybertruck

May 15, 2025

Gacs New Concept Ev A Direct Competitor To The Cybertruck

May 15, 2025 -

Martin Brundle Receives Support From Damon Hill After Recent News

May 15, 2025

Martin Brundle Receives Support From Damon Hill After Recent News

May 15, 2025 -

Analysis Pakistans Use Of Chinese J 10 C Fighter Jets And Missiles

May 15, 2025

Analysis Pakistans Use Of Chinese J 10 C Fighter Jets And Missiles

May 15, 2025 -

13 Year Old Among Three Investigated In Hsa Kpod Vape Case

May 15, 2025

13 Year Old Among Three Investigated In Hsa Kpod Vape Case

May 15, 2025 -

Teslas Ambitious Goal Millions Of Robotaxis In 12 Months

May 15, 2025

Teslas Ambitious Goal Millions Of Robotaxis In 12 Months

May 15, 2025