Understanding The Gold Market: Factors Driving The Recent Price Hike

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Gold Market: Factors Driving the Recent Price Hike

Gold, a timeless symbol of wealth and stability, has seen a significant price surge recently, leaving investors and analysts alike scrambling to understand the driving forces behind this upward trend. This article delves into the key factors contributing to the gold market's recent rally, exploring both macroeconomic influences and market-specific dynamics.

The Inflationary Pressure Cooker:

One of the most significant factors fueling gold's price hike is persistent inflation. As the cost of living continues to rise in many parts of the world, investors are increasingly turning to gold as a hedge against inflation. Gold, traditionally viewed as a safe-haven asset, retains its value even during periods of economic uncertainty and rising prices. This "inflation hedge" characteristic is particularly attractive in times of monetary policy uncertainty, where central banks are grappling with controlling inflation without triggering a recession. The weakening US dollar, often a consequence of inflationary pressures, further strengthens gold's appeal, as it's priced in US dollars.

Geopolitical Uncertainty and Safe-Haven Demand:

The global geopolitical landscape remains volatile, with ongoing conflicts and international tensions contributing to increased uncertainty. In times of geopolitical turmoil, investors often flock to safe-haven assets like gold, viewing it as a reliable store of value that can withstand economic shocks. Recent geopolitical events, including the ongoing war in Ukraine and rising tensions in other parts of the world, have undoubtedly played a role in boosting gold demand and driving up its price. This safe-haven demand is a powerful force, often outweighing other market factors in the short term.

Central Bank Buying Spree:

Central banks across the globe have been actively accumulating gold reserves in recent years. This strategic buying, driven by a desire to diversify reserves and strengthen their financial positions, has significantly increased the overall demand for gold. Many central banks view gold as a crucial component of a robust and resilient monetary policy, further solidifying its role as a reliable asset in times of global economic instability. This increased institutional buying adds considerable support to gold's price.

Weakening Dollar and Currency Fluctuations:

The relative strength of the US dollar directly impacts gold's price, as gold is primarily traded in US dollars. A weakening dollar generally makes gold more affordable for investors holding other currencies, increasing demand and driving up prices. Recent fluctuations in major global currencies, alongside the weakening dollar, have contributed to the increase in gold's price.

Supply Chain Disruptions and Physical Gold Demand:

While less impactful than the macroeconomic factors, supply chain disruptions have played a smaller role in influencing the gold price. These disruptions can affect the availability of gold, potentially leading to higher prices. Furthermore, increasing physical demand for gold, driven by both investment and jewelry sectors, further contributes to the upward price pressure.

Looking Ahead:

The factors influencing gold's price are complex and interconnected. While the current price surge is driven by a combination of inflation, geopolitical uncertainty, and central bank buying, predicting future price movements remains challenging. However, understanding these key drivers offers valuable insights for investors navigating the gold market. Continued monitoring of macroeconomic indicators, geopolitical events, and central bank policies will be crucial in assessing future trends in the gold market. Consulting with a financial advisor before making any investment decisions is always recommended.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Gold Market: Factors Driving The Recent Price Hike. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Petrosea Tawarkan Obligasi And Sukuk Rp1 5 Triliun Detail Penawaran And Cara Berinvestasi

Mar 18, 2025

Petrosea Tawarkan Obligasi And Sukuk Rp1 5 Triliun Detail Penawaran And Cara Berinvestasi

Mar 18, 2025 -

New York Court Decision Impact On Live Nation And Ticketmasters Business Practices

Mar 18, 2025

New York Court Decision Impact On Live Nation And Ticketmasters Business Practices

Mar 18, 2025 -

Litia And Grant A Bachelor Relationship Defined By Regret

Mar 18, 2025

Litia And Grant A Bachelor Relationship Defined By Regret

Mar 18, 2025 -

Disney Responds To Backlash Snow White Premiere Downsized

Mar 18, 2025

Disney Responds To Backlash Snow White Premiere Downsized

Mar 18, 2025 -

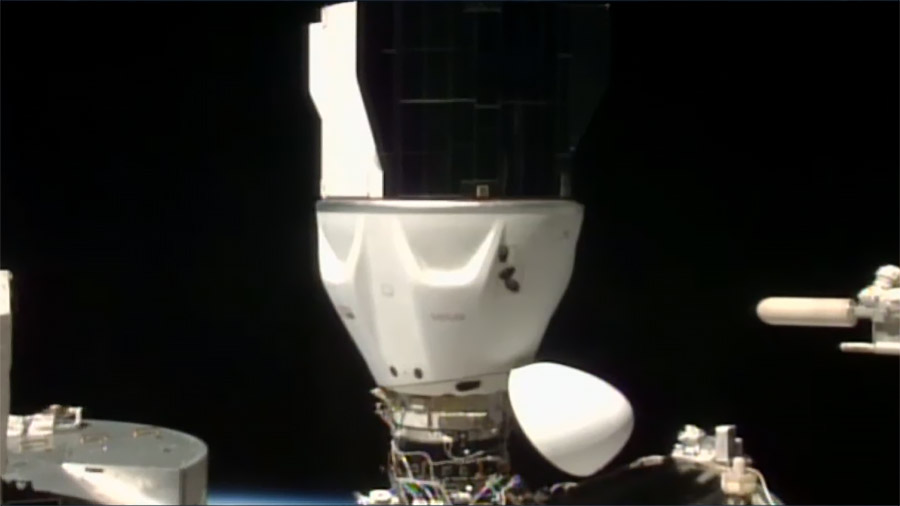

Crew Dragons Hatch Secured Space X Crew 9 Ready For Launch

Mar 18, 2025

Crew Dragons Hatch Secured Space X Crew 9 Ready For Launch

Mar 18, 2025

Latest Posts

-

Delhi Capitals Death Bowling Tactics Under Fire Kumble Bangar Weigh In

Apr 30, 2025

Delhi Capitals Death Bowling Tactics Under Fire Kumble Bangar Weigh In

Apr 30, 2025 -

The Science Of Taste Capturing And Replicating Flavor Profiles

Apr 30, 2025

The Science Of Taste Capturing And Replicating Flavor Profiles

Apr 30, 2025 -

Dtes Proposed 574 Million Rate Increase What It Means For Michigan Electricity Customers

Apr 30, 2025

Dtes Proposed 574 Million Rate Increase What It Means For Michigan Electricity Customers

Apr 30, 2025 -

A Night With Hans Zimmer Live Concert Event In Fishers This Fall

Apr 30, 2025

A Night With Hans Zimmer Live Concert Event In Fishers This Fall

Apr 30, 2025 -

Investigation Closed No Charges In Death Of Adam Johnson Minnesota Hockey Player

Apr 30, 2025

Investigation Closed No Charges In Death Of Adam Johnson Minnesota Hockey Player

Apr 30, 2025