Understanding The Link: China Tariffs And Future MCX Gold Rates

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Link: China Tariffs and Future MCX Gold Rates

The global economy is a complex web, and nowhere is this more apparent than in the intricate relationship between seemingly disparate events. Recent adjustments to China's tariff policies have sent ripples throughout the financial world, impacting everything from consumer goods to the price of precious metals like gold traded on the Multi Commodity Exchange (MCX). Understanding this connection is crucial for investors and anyone watching the global economic landscape.

China's Tariff Policies: A Shifting Sandscape

China's recent tariff decisions, often driven by geopolitical factors and trade negotiations, significantly influence global commodity markets. Any alteration in these policies – whether an increase, decrease, or even a threat of change – can create uncertainty and volatility. This uncertainty acts as a catalyst, often pushing investors towards safe-haven assets.

Gold as a Safe Haven Asset:

Gold has historically served as a safe haven asset during times of economic uncertainty. When investors feel apprehensive about the future – be it due to trade wars, geopolitical instability, or inflation – they often flock to gold, driving up demand and consequently, the price. This is precisely the mechanism through which China's tariff policies can influence MCX gold rates.

How Tariffs Impact MCX Gold Rates:

The impact isn't always direct. Here's a breakdown of the mechanisms:

- Increased Uncertainty: Announcements of new tariffs or changes to existing trade policies inject uncertainty into the market. This uncertainty fuels risk aversion, leading investors to seek the stability of gold. Higher demand on the MCX translates directly to higher gold rates.

- Currency Fluctuations: Tariff disputes often lead to currency fluctuations. A weakening of a major currency like the US dollar (USD) – often a consequence of trade tensions – can make gold, priced in USD, more attractive to international investors, further boosting demand on the MCX.

- Inflationary Pressures: Tariffs can contribute to inflationary pressures, as increased import costs are passed on to consumers. Inflation erodes the purchasing power of fiat currencies, making gold, a hedge against inflation, a more appealing investment.

Analyzing Future Trends:

Predicting future MCX gold rates requires a nuanced understanding of several factors beyond just China's tariff policies. These include:

- Global Economic Growth: A slowdown in global growth often increases demand for gold.

- US Federal Reserve Policy: Interest rate hikes by the Fed can influence the value of the dollar and, subsequently, gold prices.

- Geopolitical Events: Global political instability often triggers a flight to safety, driving up gold prices.

Conclusion: Navigating the Complexity

The relationship between China's tariff policies and MCX gold rates is complex and indirect. While tariffs don't directly dictate gold prices, the uncertainty and economic consequences they trigger significantly influence investor behavior and ultimately affect the price of gold on the MCX. Staying informed about global trade dynamics, macroeconomic indicators, and geopolitical events is crucial for anyone seeking to understand and potentially profit from these market fluctuations. Understanding these intricate connections allows for more informed investment decisions and a better comprehension of the ever-evolving global financial landscape. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Link: China Tariffs And Future MCX Gold Rates. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

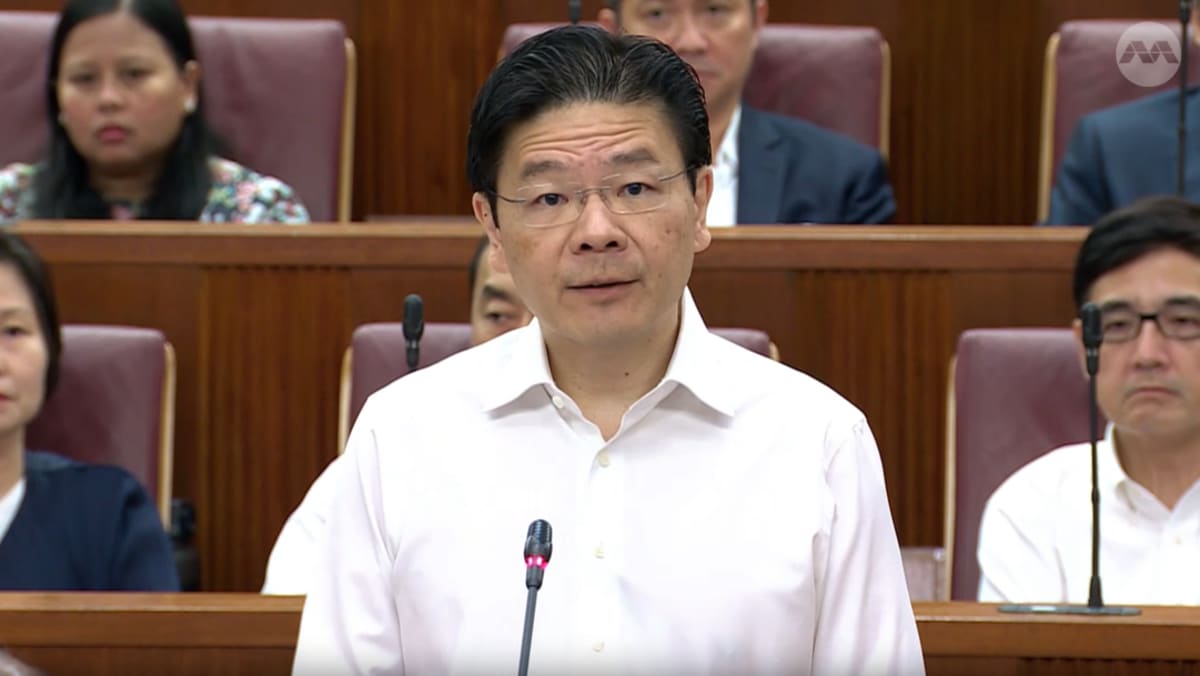

Addressing The Trump Tariff Fallout Singapore Creates Task Force To Support Economy

Apr 08, 2025

Addressing The Trump Tariff Fallout Singapore Creates Task Force To Support Economy

Apr 08, 2025 -

Mary Berry Worthy Cakes My Experience At A Charming Seaside Tearoom

Apr 08, 2025

Mary Berry Worthy Cakes My Experience At A Charming Seaside Tearoom

Apr 08, 2025 -

Foreign Interference Law Targets Singapore Tycoon Robert Ng And His Children

Apr 08, 2025

Foreign Interference Law Targets Singapore Tycoon Robert Ng And His Children

Apr 08, 2025 -

12 Tim Esports Berlaga Di Esl Mobile Masters 2025 Catat Jadwalnya

Apr 08, 2025

12 Tim Esports Berlaga Di Esl Mobile Masters 2025 Catat Jadwalnya

Apr 08, 2025 -

Every Wordle Answer So Far Find Your Past Wordle Solutions

Apr 08, 2025

Every Wordle Answer So Far Find Your Past Wordle Solutions

Apr 08, 2025