Understanding The New FHA Residency Requirements For Mortgage Loans

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the New FHA Residency Requirements for Mortgage Loans

The Federal Housing Administration (FHA) recently updated its residency requirements for mortgage loans, impacting borrowers seeking government-backed financing. These changes, while seemingly minor, could significantly affect eligibility for many prospective homeowners. This article clarifies the updated rules and guides you through understanding their implications.

What's Changed?

The most significant shift in FHA residency requirements centers on the definition of "principal residence." Previously, a more lenient interpretation allowed for flexibility. Now, the FHA is enforcing a stricter definition, demanding more demonstrable proof of intent to occupy the property as a primary residence. This means borrowers can no longer simply claim the property as their primary residence; they must provide concrete evidence.

Key Changes in Evidence Requirements:

-

Stronger Documentation: Expect a more rigorous review of supporting documentation. This includes utility bills, driver's licenses, tax returns, and employment records reflecting the borrower's address. Ambiguous or insufficient documentation will lead to loan rejection.

-

Increased Scrutiny: FHA lenders are now under increased pressure to verify residency claims. This means more thorough background checks and a more detailed examination of the borrower's financial situation and living arrangements.

-

Reduced Flexibility: The previous allowances for temporary absences or dual residences are significantly reduced. While short-term absences might be acceptable, extended stays elsewhere could jeopardize the loan approval.

How to Meet the New Requirements:

Successfully navigating the new FHA residency requirements demands proactive preparation. Here's how:

-

Gather Comprehensive Documentation: Begin assembling all relevant documentation well in advance of applying for a loan. Don't underestimate the importance of thoroughness.

-

Establish Residency: Ensure all your official documentation reflects your intention to reside in the property. This includes updating your driver's license, voter registration, and any other official records.

-

Transparency is Key: Be completely transparent with your lender about any potential complexities related to your residency. Open communication from the start minimizes the risk of delays or rejections.

-

Work with a Knowledgeable Lender: Choosing an FHA-approved lender experienced with the updated requirements is crucial. They can guide you through the process and help you avoid common pitfalls.

Implications for Borrowers:

The stricter residency requirements might impact several groups of borrowers:

-

Military Personnel: Frequent relocations could pose challenges. Thorough documentation and clear communication with the lender are vital.

-

Individuals with Dual Residences: Those maintaining residences in multiple locations should carefully consider the implications and prepare compelling evidence of primary residency.

-

First-Time Homebuyers: The increased scrutiny may present a higher hurdle for first-time homebuyers who might be less familiar with the documentation requirements.

Conclusion:

The updated FHA residency requirements necessitate a more meticulous approach to the mortgage application process. By understanding these changes and preparing accordingly, borrowers can significantly improve their chances of securing an FHA-backed mortgage. Remember, proactive planning and a focus on transparent communication are key to success. Consult with an FHA-approved lender to ensure you meet all the requirements and avoid any potential complications.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The New FHA Residency Requirements For Mortgage Loans. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Strengthening Venue Security In Australia Lessons From The Mcg Gun Scare And The Martyns Law Debate

Apr 08, 2025

Strengthening Venue Security In Australia Lessons From The Mcg Gun Scare And The Martyns Law Debate

Apr 08, 2025 -

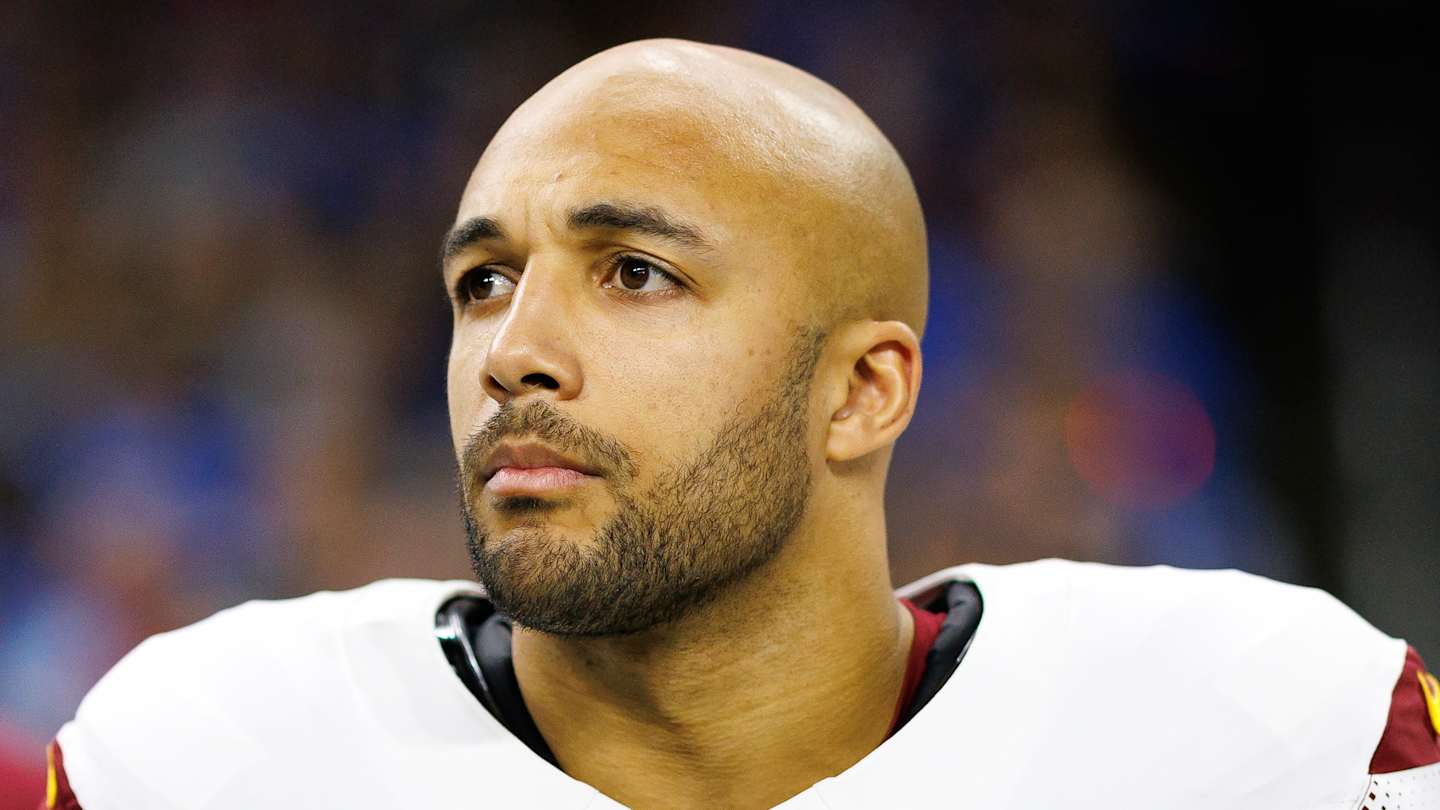

Washington Commanders 7 Veterans Possibly In Their Final Year

Apr 08, 2025

Washington Commanders 7 Veterans Possibly In Their Final Year

Apr 08, 2025 -

Ice Storm Forces Closure Of Two Schools Updates And Reopening Plans

Apr 08, 2025

Ice Storm Forces Closure Of Two Schools Updates And Reopening Plans

Apr 08, 2025 -

Election 2025 Live Updates Aussie Dollar Tanks Stock Market Recovers Ground

Apr 08, 2025

Election 2025 Live Updates Aussie Dollar Tanks Stock Market Recovers Ground

Apr 08, 2025 -

Update Klasemen Liga 1 And Jadwal Pertandingan Pekan 28

Apr 08, 2025

Update Klasemen Liga 1 And Jadwal Pertandingan Pekan 28

Apr 08, 2025