Understanding The Rise Of Meta (META) Stock: Investor Insights

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Rise of Meta (META) Stock: Investor Insights

Meta Platforms (META), formerly known as Facebook, has experienced a rollercoaster ride in the stock market. After a significant dip in 2022, the stock has shown signs of recovery, leaving many investors wondering about the future. This article delves into the factors contributing to Meta's recent rise and offers insights for investors navigating this dynamic market.

The Fall and the Rise of the Meta Stock:

Meta's stock price plummeted in 2022, primarily due to concerns about slowing revenue growth, increased competition, and the impact of Apple's privacy changes. The shift towards a metaverse-focused strategy, while ambitious, also contributed to investor uncertainty. However, recent positive developments have fueled a resurgence.

Key Factors Driving Meta's Stock Rebound:

Several key factors have contributed to the recent increase in META stock price:

- Stronger-than-expected earnings reports: Meta has consistently surpassed analysts' expectations in recent quarters, demonstrating resilience and a capacity for adaptation. These positive earnings reports have boosted investor confidence.

- Cost-cutting measures: Meta has implemented significant cost-cutting measures, including layoffs and a freeze on hiring, demonstrating a commitment to improving profitability and efficiency. This fiscal discipline has been well-received by the market.

- Focus on AI and Reels: The company's increased focus on artificial intelligence (AI) across its platforms, particularly in advertising and content recommendation, has shown promising results. The growth of Reels, its short-form video feature, is also a positive indicator, mirroring the success of TikTok and other similar platforms. This adaptation to changing trends is crucial for long-term growth.

- Increased Advertising Revenue: Despite economic headwinds, Meta's advertising revenue has shown signs of stabilization and even growth in certain sectors. This highlights the enduring power of its advertising platforms and their reach to a massive user base.

- Metaverse Investments Yielding Results: While still early days, there are indications that Meta's significant investments in the metaverse are beginning to show some traction, albeit slowly. This long-term vision, though initially met with skepticism, is starting to gain a little more credibility.

Analyzing Investor Sentiment:

Investor sentiment towards Meta has shifted significantly. The initial pessimism surrounding the metaverse pivot and the privacy changes is gradually being replaced by cautious optimism. This shift reflects the company's demonstrable efforts to address past challenges and capitalize on emerging opportunities.

Risks and Considerations for Investors:

While the outlook for Meta is improving, it's crucial to acknowledge existing risks:

- Competition: Intense competition from other tech giants remains a significant challenge. TikTok's popularity, for instance, continues to exert pressure on Meta's platforms.

- Regulatory Scrutiny: Meta continues to face regulatory scrutiny regarding data privacy and antitrust concerns. These ongoing legal and regulatory battles could impact its operations and financial performance.

- Economic Uncertainty: The broader macroeconomic environment remains uncertain, and a potential economic downturn could negatively impact advertising spending, directly affecting Meta's revenue.

Investing in Meta: A Long-Term Perspective?

Investing in Meta requires a long-term perspective. While short-term fluctuations are inevitable, the company's massive user base, strong advertising platform, and evolving strategic focus on AI and the metaverse present significant long-term potential. However, thorough due diligence and risk assessment are essential before making any investment decisions. Consult with a financial advisor to determine if Meta aligns with your individual investment goals and risk tolerance.

Keywords: Meta stock, META, Facebook, stock market, investor insights, investment, metaverse, AI, advertising revenue, stock price, earnings report, competition, regulatory scrutiny, risk assessment, long-term investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Rise Of Meta (META) Stock: Investor Insights. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Emergency Road Closure On South Essex Bypass After Major Crash Drivers Face Heavy Congestion

May 13, 2025

Emergency Road Closure On South Essex Bypass After Major Crash Drivers Face Heavy Congestion

May 13, 2025 -

The Office Spinoff The Paper September Premiere Date Confirmed On Peacock

May 13, 2025

The Office Spinoff The Paper September Premiere Date Confirmed On Peacock

May 13, 2025 -

Us Cattle Import Ban Mexico Faces Maggot Infestation Crisis

May 13, 2025

Us Cattle Import Ban Mexico Faces Maggot Infestation Crisis

May 13, 2025 -

Is Taylan May Ready Nrl Comeback Imminent For Panthers Star

May 13, 2025

Is Taylan May Ready Nrl Comeback Imminent For Panthers Star

May 13, 2025 -

Claudia Karvans Emotional Breakdown The Sad News Revealed

May 13, 2025

Claudia Karvans Emotional Breakdown The Sad News Revealed

May 13, 2025

Latest Posts

-

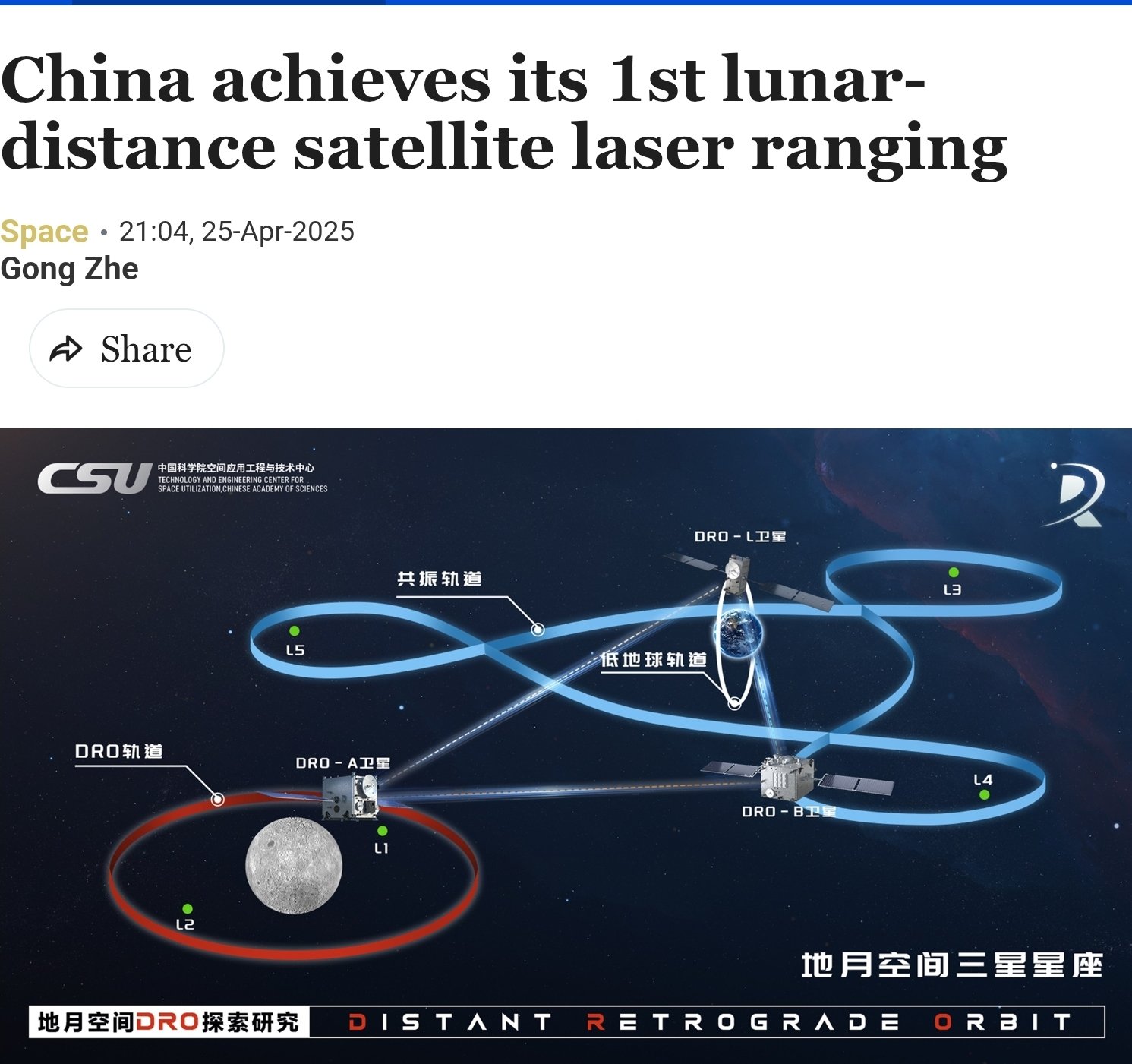

Lunar Laser Ranging A Chinese Satellites Technological Feat

May 13, 2025

Lunar Laser Ranging A Chinese Satellites Technological Feat

May 13, 2025 -

Follow The Action Draper Vs Moutet Italian Open Last 16 Live Score

May 13, 2025

Follow The Action Draper Vs Moutet Italian Open Last 16 Live Score

May 13, 2025 -

Uptick In Singapore Covid 19 Infections Authorities Expect Recurring Waves

May 13, 2025

Uptick In Singapore Covid 19 Infections Authorities Expect Recurring Waves

May 13, 2025 -

Hondas Financial Woes Deepen The Lasting Impact Of Trumps Trade Policies On Japan

May 13, 2025

Hondas Financial Woes Deepen The Lasting Impact Of Trumps Trade Policies On Japan

May 13, 2025 -

Beyond The Propaganda Unmasking Russias False Sense Of Victory

May 13, 2025

Beyond The Propaganda Unmasking Russias False Sense Of Victory

May 13, 2025