Understanding The US Economy: Debt, Deficits, Taxes, And Solutions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>Understanding the US Economy: Debt, Deficits, Taxes, and Potential Solutions</h1>

The United States economy, the world's largest, faces complex challenges intertwined with its national debt, persistent deficits, and the intricate tax system. Understanding these issues is crucial for citizens and policymakers alike. This article delves into the core problems and explores potential solutions to navigate the current economic landscape.

<h2>The Mounting National Debt: A Looming Shadow</h2>

The US national debt, the total amount of money the government owes, has reached astronomical levels. This debt accumulation stems from years of government spending exceeding tax revenue, resulting in budget deficits. While some debt is manageable and even beneficial for economic growth (financing infrastructure projects, for example), excessive debt poses significant risks. These risks include:

- Increased interest payments: A larger debt means higher interest payments, consuming a larger portion of the federal budget that could otherwise be allocated to essential services like education and healthcare.

- Reduced economic flexibility: High debt levels limit the government's ability to respond effectively to economic crises or unexpected events.

- Potential for a debt crisis: In extreme scenarios, uncontrolled debt can lead to a sovereign debt crisis, impacting the value of the US dollar and potentially triggering a global economic downturn.

<h2>Persistent Budget Deficits: A Cycle of Spending and Borrowing</h2>

Budget deficits occur when government spending surpasses revenue collected through taxes and other sources. These deficits contribute directly to the growing national debt. Several factors contribute to persistent deficits:

- Entitlement programs: Programs like Social Security and Medicare, crucial for supporting an aging population, represent significant and growing expenses.

- Defense spending: Military expenditures consistently constitute a substantial portion of the federal budget.

- Tax cuts without corresponding spending cuts: Reducing taxes without simultaneous reductions in government spending exacerbates the deficit problem.

<h2>The US Tax System: Complexity and Inequality</h2>

The US tax system, a complex web of federal, state, and local taxes, is often criticized for its complexity and perceived inequities. Different tax rates apply to various income levels and sources of income, leading to debates about fairness and efficiency. Key aspects include:

- Progressive taxation: The US employs a progressive tax system, meaning higher earners pay a larger percentage of their income in taxes. However, the degree of progressivity is a subject of ongoing debate.

- Tax loopholes and deductions: Numerous tax loopholes and deductions benefit specific groups or industries, potentially reducing the overall tax revenue collected.

- Tax evasion: Tax evasion, the illegal non-payment of taxes, further contributes to revenue shortfalls.

<h2>Potential Solutions: A Multi-pronged Approach</h2>

Addressing the intertwined challenges of debt, deficits, and the tax system requires a multifaceted strategy:

<h3>1. Fiscal Responsibility and Spending Reforms:</h3>

- Targeted spending cuts: Identifying areas for efficient spending reductions without compromising essential services is crucial.

- Entitlement program reform: Addressing the long-term sustainability of entitlement programs is essential, potentially through adjustments to eligibility criteria or benefit levels.

<h3>2. Tax Reform:</h3>

- Closing tax loopholes: Eliminating or reducing tax loopholes and deductions can increase tax revenue.

- Tax simplification: Simplifying the tax system can improve compliance and reduce the administrative burden.

- Revisiting tax rates: Discussions about adjusting tax rates for different income brackets are ongoing.

<h3>3. Economic Growth Strategies:</h3>

- Investing in infrastructure: Investments in infrastructure projects can stimulate economic growth and create jobs.

- Promoting innovation and technological advancements: Encouraging innovation can boost productivity and long-term economic growth.

<h2>Conclusion: Navigating the Path Forward</h2>

The US economy's future depends on addressing the challenges of debt, deficits, and tax policy. Finding sustainable solutions requires a collaborative effort from policymakers, economists, and the public. Open dialogue, evidence-based policymaking, and a commitment to fiscal responsibility are crucial for navigating the path towards a stronger and more stable economy. The choices made today will have profound implications for future generations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The US Economy: Debt, Deficits, Taxes, And Solutions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

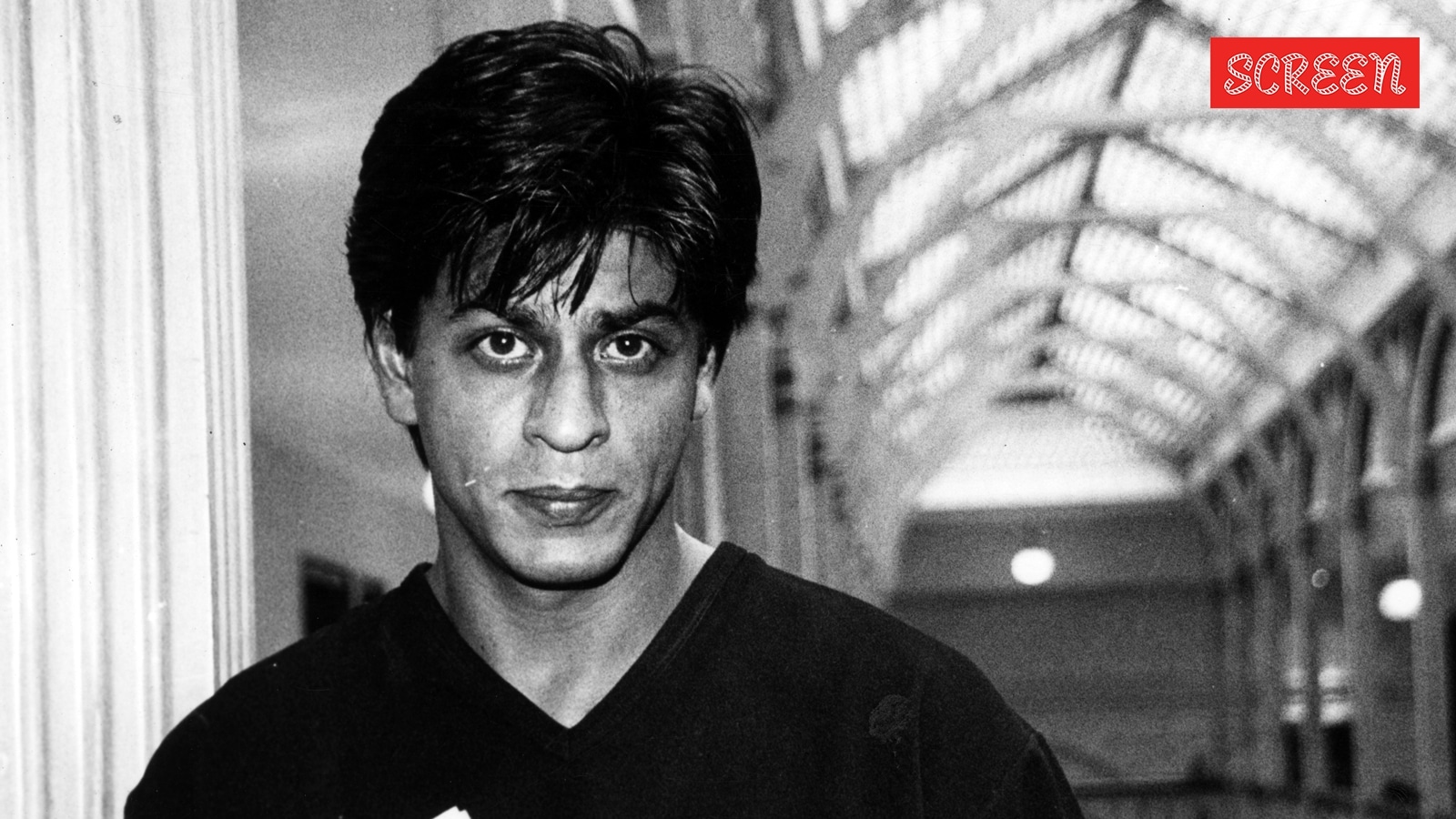

Shah Rukh Khan Devastated By Mumbai Audience Reaction Following Kkr Defeat

Mar 30, 2025

Shah Rukh Khan Devastated By Mumbai Audience Reaction Following Kkr Defeat

Mar 30, 2025 -

Ahmedabads Impact Gujarat Titans Win Loss Ratio And Ipl 2025 Outlook At Narendra Modi Stadium

Mar 30, 2025

Ahmedabads Impact Gujarat Titans Win Loss Ratio And Ipl 2025 Outlook At Narendra Modi Stadium

Mar 30, 2025 -

Vignesh Puthur Omitted Is Hardik Pandyas Judgment In Team Selection Failing Mumbai Indians

Mar 30, 2025

Vignesh Puthur Omitted Is Hardik Pandyas Judgment In Team Selection Failing Mumbai Indians

Mar 30, 2025 -

I Have Seen That John Abraham Comments On Viral Meme With Shah Rukh Khan

Mar 30, 2025

I Have Seen That John Abraham Comments On Viral Meme With Shah Rukh Khan

Mar 30, 2025 -

Analyse Die Veraenderte Fc Bayern Abwehr Staerken Und Schwaechen

Mar 30, 2025

Analyse Die Veraenderte Fc Bayern Abwehr Staerken Und Schwaechen

Mar 30, 2025