Undervalued Tech Stocks: Q2 Investment Opportunities According To Analysts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Undervalued Tech Stocks: Q2 2024 Investment Opportunities According to Analysts

The tech sector has experienced significant volatility in recent years, presenting both challenges and opportunities for investors. While some tech giants have seen massive growth, others have been left behind, creating pockets of undervalued stocks ripe for the picking. Q2 2024 presents a compelling window for savvy investors to capitalize on these opportunities, according to leading financial analysts. But which companies are truly undervalued, and what factors should guide your investment decisions?

Identifying Undervalued Tech Gems: Key Metrics and Considerations

Determining whether a tech stock is truly undervalued requires careful analysis beyond simply looking at the current share price. Several key metrics play a crucial role:

-

Price-to-Earnings Ratio (P/E): A low P/E ratio relative to industry peers and historical averages can suggest undervaluation. However, it's crucial to consider the company's growth prospects and future earnings potential. A low P/E might reflect concerns about future growth, not necessarily a bargain.

-

Price-to-Sales Ratio (P/S): This metric compares a company's market capitalization to its revenue. A low P/S ratio, especially for high-growth companies, can indicate undervaluation. However, it's essential to examine the company's profit margins and path to profitability.

-

Discounted Cash Flow (DCF) Analysis: This sophisticated valuation method projects a company's future cash flows and discounts them back to their present value. A DCF analysis can provide a more comprehensive picture of a company's intrinsic value.

-

Growth Potential: Even with a low P/E or P/S, a company lacking significant growth potential may not be a good investment. Analyze the company's market share, product innovation, and competitive landscape.

-

Debt Levels: High debt levels can significantly impact a company's financial health and future performance. Examine the company's debt-to-equity ratio and interest coverage ratio.

Q2 2024 Analyst Picks: Promising Undervalued Tech Stocks

While specific stock recommendations should always be viewed within the context of your own risk tolerance and due diligence, several tech companies are frequently cited by analysts as potentially undervalued in Q2 2024. Note: This is not financial advice, and thorough research is crucial before making any investment decisions.

Potential Candidates (Examples – Replace with actual analyst picks and rationale):

-

Company A: Analysts point to its strong potential in the burgeoning [specific tech sector] market as a reason for its undervaluation despite recent setbacks. Their revised growth projections suggest a significant upside potential.

-

Company B: Despite a recent dip in share price due to [specific event/news], analysts highlight its robust fundamentals and long-term growth trajectory, making it an attractive buy for long-term investors with a higher risk tolerance.

-

Company C: This company's strong cash flow and innovative product pipeline have led analysts to believe its current valuation significantly underestimates its future earning potential.

Navigating the Risks: Due Diligence and Diversification

Investing in undervalued tech stocks carries inherent risks. Market sentiment, technological disruptions, and macroeconomic factors can all impact a company's performance. Therefore, thorough due diligence is essential before making any investment. Diversifying your portfolio across different sectors and asset classes can help mitigate risk.

Conclusion: A Cautiously Optimistic Outlook

Q2 2024 presents a compelling opportunity for investors seeking undervalued tech stocks. However, a thorough understanding of valuation metrics, a careful assessment of individual company fundamentals, and a diversified investment strategy are crucial for navigating the inherent risks and maximizing potential returns. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Undervalued Tech Stocks: Q2 Investment Opportunities According To Analysts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Reeves Tax Increase The 25bn Hit To Uk Businesses And The Economy

Apr 07, 2025

Reeves Tax Increase The 25bn Hit To Uk Businesses And The Economy

Apr 07, 2025 -

Investir Em Cotas De Imoveis Uma Alternativa Para Casas De Veraneio

Apr 07, 2025

Investir Em Cotas De Imoveis Uma Alternativa Para Casas De Veraneio

Apr 07, 2025 -

Review The Minecraft Movie A Surprisingly Engaging Adaptation

Apr 07, 2025

Review The Minecraft Movie A Surprisingly Engaging Adaptation

Apr 07, 2025 -

Can The Canucks Continue Their Winning Streak Against The Rocket

Apr 07, 2025

Can The Canucks Continue Their Winning Streak Against The Rocket

Apr 07, 2025 -

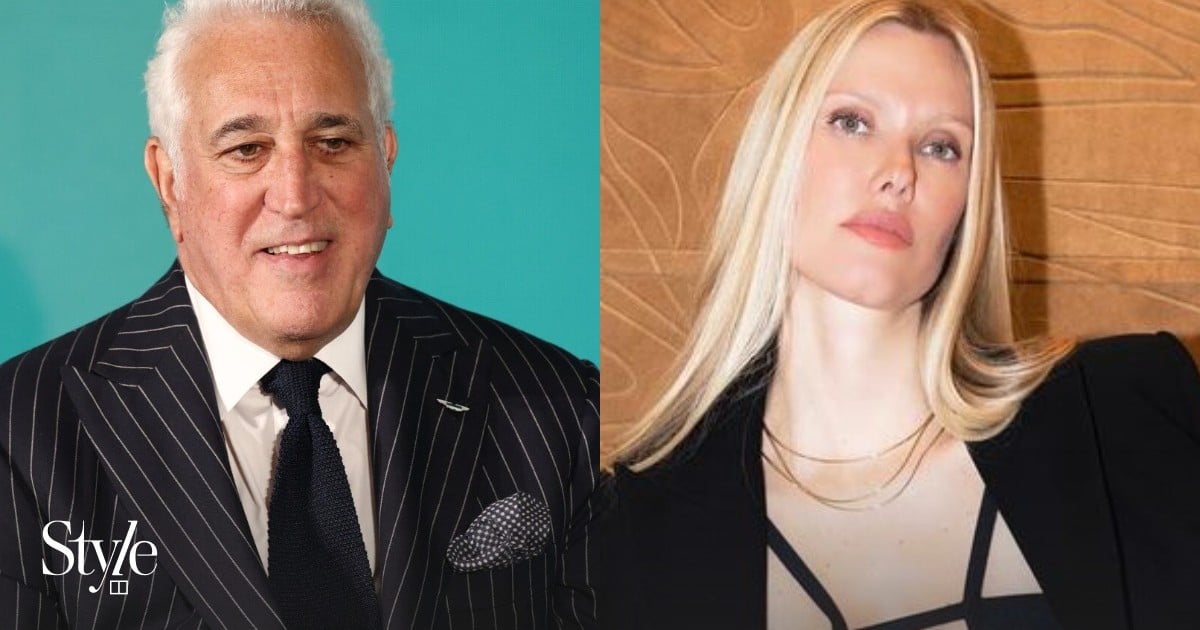

Raquel Stroll Style Icon And Wife Of Aston Martin Ceo Lawrence Stroll

Apr 07, 2025

Raquel Stroll Style Icon And Wife Of Aston Martin Ceo Lawrence Stroll

Apr 07, 2025