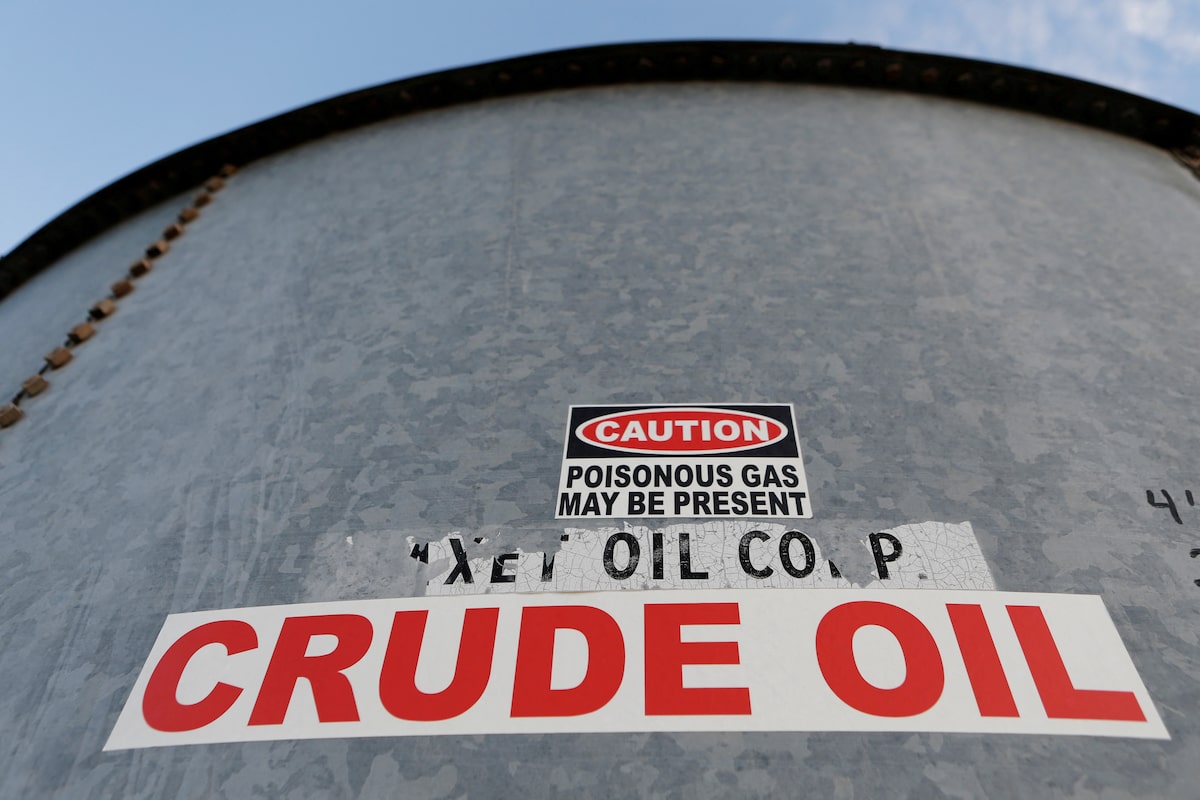

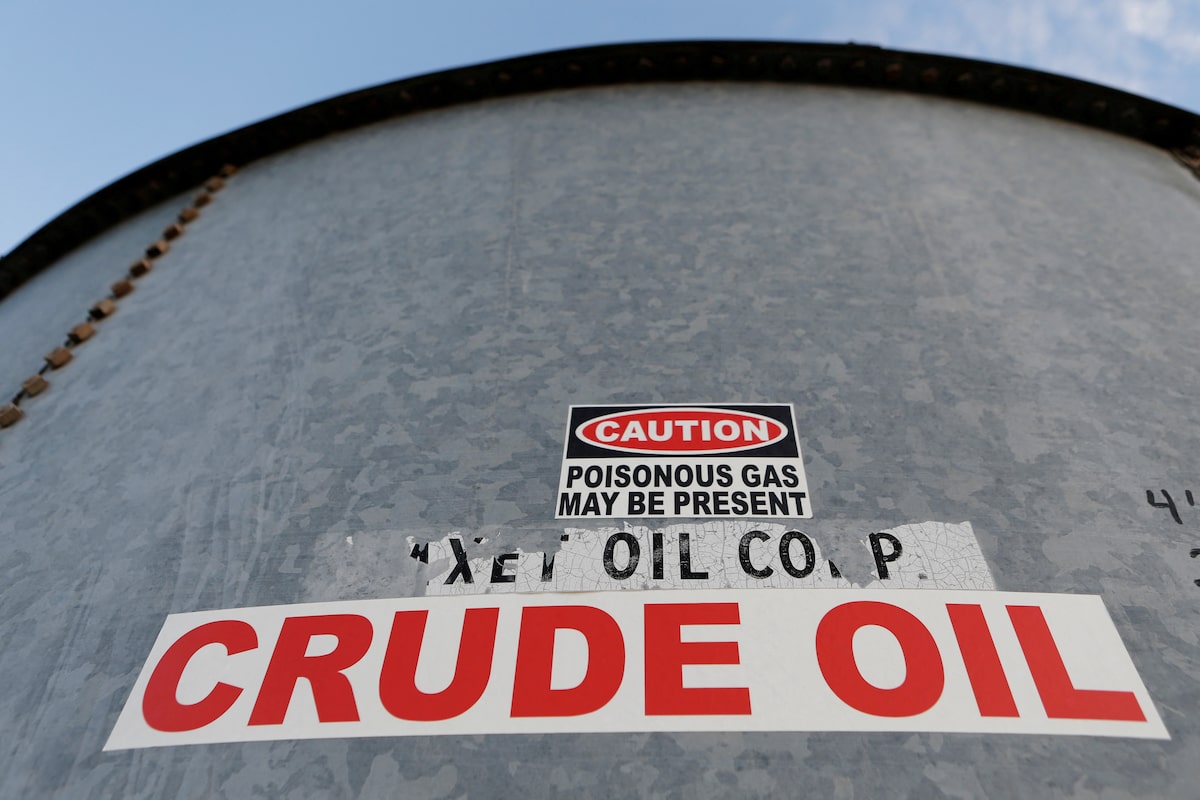

Unexpected Inventory Growth: EIA's Latest Report On U.S. Crude Oil And Fuel Supplies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Unexpected Inventory Growth: EIA Report Reveals Surge in U.S. Crude Oil and Fuel Supplies

The Energy Information Administration (EIA) released its weekly report on Wednesday, sending shockwaves through the energy markets with a surprising revelation: a significant and unexpected increase in U.S. crude oil and fuel inventories. This development contradicts analysts' predictions and raises questions about the future trajectory of oil prices. The report highlights a complex interplay of factors affecting the global energy landscape.

A Deeper Dive into the EIA Report:

The EIA report detailed a substantial build in crude oil stocks, exceeding market expectations by a considerable margin. Analysts had broadly anticipated a modest drawdown, reflecting the ongoing global demand for oil and the impact of OPEC+ production cuts. Instead, the data revealed a build of [Insert Specific Number] barrels, a figure that has triggered significant market volatility.

This unexpected inventory growth wasn't limited to crude oil. The report also showed increases in gasoline and distillate fuel inventories, further adding to the sense of market surprise. This surge in supplies suggests a potential weakening in demand, or perhaps an overestimation of previous supply constraints.

Factors Contributing to the Inventory Build:

Several factors likely contributed to this unexpected inventory expansion. These include:

-

Increased Domestic Production: Recent increases in U.S. oil production may have played a significant role. The ongoing expansion of shale oil production, coupled with improved efficiency in existing fields, has led to a steady rise in domestic output.

-

Reduced Refinery Runs: Lower-than-expected refinery utilization rates could be another contributing factor. This could be due to seasonal factors, maintenance schedules, or perhaps even a softening in demand for refined products.

-

Shifting Global Demand: While global demand remains robust, there are signs of potential slowing in certain key markets. Economic uncertainty in various regions may be impacting fuel consumption, leading to a less aggressive draw on global inventories.

-

Seasonal Factors: The time of year can impact the energy market. Certain seasons might see a natural decrease in demand for certain fuels, leading to a buildup in reserves.

Market Reaction and Implications:

The market's reaction to the EIA report was swift and decisive. Crude oil prices experienced a noticeable drop following the report's release, reflecting the concerns surrounding the unexpected inventory build. This volatility underscores the significant impact of supply and demand dynamics on energy prices.

The long-term implications of this inventory growth remain uncertain. While it could signal a temporary oversupply, it could also reflect underlying shifts in the global energy market. Further analysis and monitoring of key economic indicators will be crucial in assessing the lasting impact of this report.

Looking Ahead: What to Watch For:

Investors and analysts will be closely scrutinizing the coming weeks for further clues on the trajectory of oil prices. Key factors to watch include:

- OPEC+ decisions: Any adjustments to OPEC+ production quotas could significantly impact global oil supplies.

- Global economic growth: The pace of global economic growth will have a direct bearing on energy demand.

- Geopolitical events: Geopolitical instability can significantly influence oil prices and global energy markets.

- Future EIA reports: Subsequent EIA reports will be crucial in confirming or contradicting the trends observed in this week's data.

The unexpected inventory growth highlighted in the latest EIA report serves as a stark reminder of the volatile nature of the energy market. Careful consideration of the factors outlined above will be crucial in navigating the uncertainties ahead. The coming weeks will be pivotal in determining the lasting impact of this surprising development on oil prices and the broader global energy landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Unexpected Inventory Growth: EIA's Latest Report On U.S. Crude Oil And Fuel Supplies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Take It Down Act Understanding The New Laws Provisions And Potential Consequences

May 22, 2025

The Take It Down Act Understanding The New Laws Provisions And Potential Consequences

May 22, 2025 -

Shai Gilgeous Alexanders Stellar Performance Thunder Take Game 1 Of Nba Conference Finals

May 22, 2025

Shai Gilgeous Alexanders Stellar Performance Thunder Take Game 1 Of Nba Conference Finals

May 22, 2025 -

Bbc Zayif Takimlarin Finalini Nasil Yansitti Elestiri Ve Analiz

May 22, 2025

Bbc Zayif Takimlarin Finalini Nasil Yansitti Elestiri Ve Analiz

May 22, 2025 -

Game 1 Thriller Haliburtons Crucial Role In Pacers Win

May 22, 2025

Game 1 Thriller Haliburtons Crucial Role In Pacers Win

May 22, 2025 -

Analyzing Micro Strategys Use Of Strk Preferred Stock For Bitcoin Acquisition

May 22, 2025

Analyzing Micro Strategys Use Of Strk Preferred Stock For Bitcoin Acquisition

May 22, 2025