UNH Stock Price Drop: Is It Time To Buy The Dip?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UNH Stock Price Drop: Is it Time to Buy the Dip?

UnitedHealth Group (UNH), a healthcare giant, has recently experienced a dip in its stock price. This has left many investors wondering: is this a buying opportunity, or a sign of further trouble to come? Let's delve into the potential reasons behind the drop and assess whether now is the time to capitalize on this apparent dip.

The recent decline in UNH's stock price isn't entirely unexpected. The healthcare sector, while generally robust, is subject to various cyclical and unforeseen pressures. Several factors likely contributed to this recent downturn.

Potential Factors Contributing to the UNH Stock Price Drop:

-

Regulatory Scrutiny: The healthcare industry is heavily regulated, and changes in policies or increased scrutiny can significantly impact profitability. Any new legislation or stricter enforcement of existing rules could negatively influence UNH's earnings and investor confidence.

-

Inflationary Pressures: Rising inflation affects all sectors, but healthcare is particularly vulnerable. Increased costs for pharmaceuticals, labor, and other operational expenses can squeeze profit margins. UNH, like other companies, is grappling with these inflationary pressures.

-

Market Volatility: The broader market's performance inevitably impacts individual stocks. Overall market corrections or periods of uncertainty can lead to sell-offs, even for fundamentally strong companies like UNH.

-

Competition: The healthcare industry is highly competitive. The emergence of new players or aggressive strategies from existing competitors can put pressure on market share and profitability. UNH constantly faces pressure to maintain its competitive edge.

-

Concerns about Future Growth: While UNH has historically demonstrated strong growth, investor concerns about the sustainability of this growth in the face of the aforementioned challenges could contribute to a price dip. Analysts' forecasts and revised earnings estimates play a significant role in investor sentiment.

Is it Time to Buy the Dip?

The question of whether to buy UNH stock after its recent price drop is complex and depends on individual investment strategies and risk tolerance. There's no easy answer, and conducting thorough research is crucial before making any investment decisions.

Arguments for Buying:

-

Strong Fundamentals: UNH remains a fundamentally strong company with a dominant market position, consistent revenue growth, and a history of delivering shareholder value. The dip could present a valuable entry point for long-term investors.

-

Potential for Recovery: The factors contributing to the price drop may be temporary. Once these pressures ease, UNH's stock price could rebound significantly.

-

Dividend Payments: UNH offers a dividend, which can provide a steady income stream while waiting for the stock price to recover. This can be attractive for investors seeking both capital appreciation and dividend income.

Arguments Against Buying:

-

Uncertain Future: The healthcare landscape is constantly evolving, and future uncertainties remain. The current dip may be a precursor to further declines.

-

Market Sentiment: Negative market sentiment can persist, further impacting the stock price even if the underlying fundamentals remain strong.

-

Alternative Investments: There may be other investment opportunities offering potentially higher returns with less risk.

Conclusion:

The decision of whether to buy UNH stock during this price drop is ultimately a personal one. Investors should carefully consider the potential risks and rewards before investing. Conducting thorough due diligence, consulting with a financial advisor, and diversifying your portfolio are essential steps in making informed investment decisions. Remember, past performance is not indicative of future results. This analysis is for informational purposes only and not financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UNH Stock Price Drop: Is It Time To Buy The Dip?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Exclusive Sofia Carson Hosts Netflixs Tudum Featuring Stranger Things And Wednesday Casts

May 16, 2025

Exclusive Sofia Carson Hosts Netflixs Tudum Featuring Stranger Things And Wednesday Casts

May 16, 2025 -

Sony Wh 1000 Xm 6 Review A Superior Alternative To Bose Noise Cancelling Headphones

May 16, 2025

Sony Wh 1000 Xm 6 Review A Superior Alternative To Bose Noise Cancelling Headphones

May 16, 2025 -

Myrtle Beach Classic Ryan Foxs Pga Championship Win Celebrated By New Zealand

May 16, 2025

Myrtle Beach Classic Ryan Foxs Pga Championship Win Celebrated By New Zealand

May 16, 2025 -

Introducing Androids Modernized Design Key Features And Improvements

May 16, 2025

Introducing Androids Modernized Design Key Features And Improvements

May 16, 2025 -

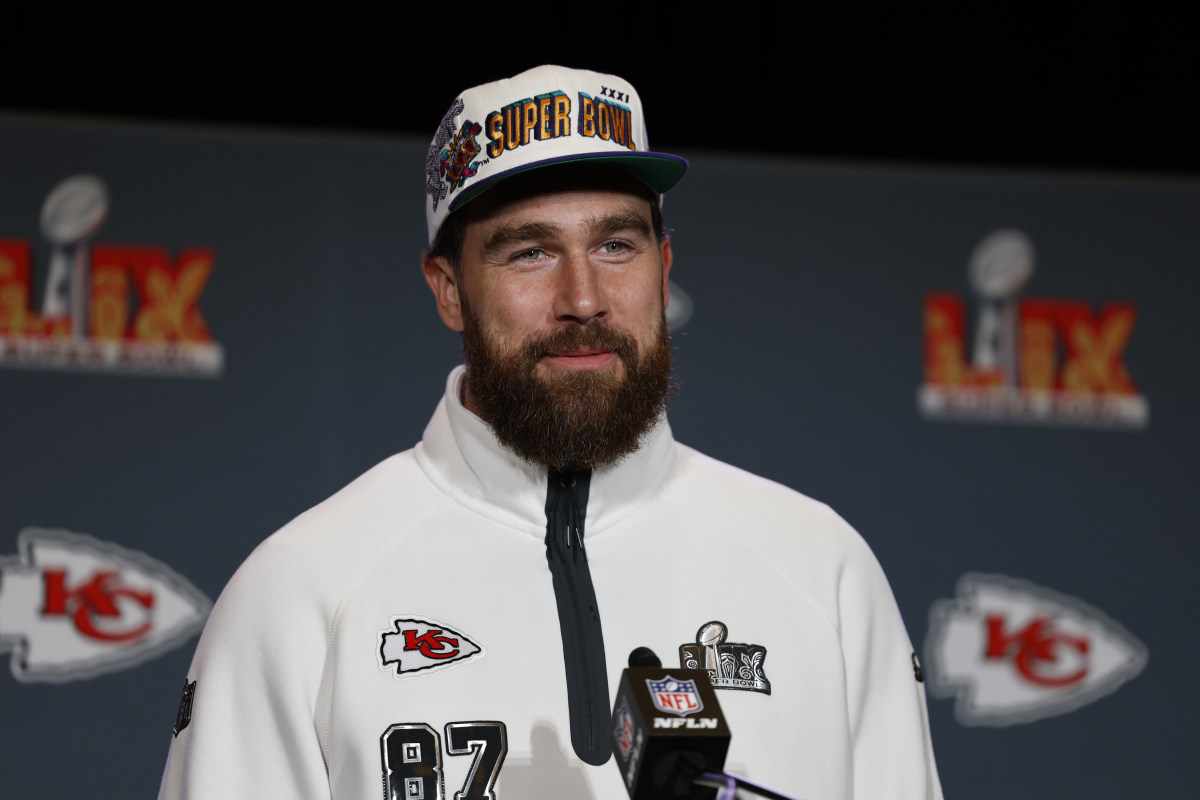

Kelce Gives Andrews Bold Career Decision The Thumbs Up

May 16, 2025

Kelce Gives Andrews Bold Career Decision The Thumbs Up

May 16, 2025