Unlocking Growth: Banks And The Strategic Potential Of Stablecoins For Liquidity And Deposits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Unlocking Growth: Banks and the Strategic Potential of Stablecoins for Liquidity and Deposits

The global banking landscape is undergoing a seismic shift, driven by technological innovation and evolving customer expectations. One of the most significant developments is the emergence of stablecoins, cryptocurrencies pegged to a stable asset like the US dollar, and their potential to revolutionize banking liquidity and deposit management. This article explores how forward-thinking banks are leveraging stablecoins to unlock new growth opportunities and enhance their operational efficiency.

H2: The Allure of Stablecoins for Banks

Traditional banking systems often face challenges related to liquidity management and deposit fluctuations. Stablecoins offer a potential solution by providing a readily available, digital form of cash that can be easily integrated into existing banking infrastructure. This presents several key advantages:

-

Enhanced Liquidity: Banks can utilize stablecoins to quickly and efficiently manage short-term liquidity needs, reducing reliance on more expensive and less flexible borrowing options. This increased liquidity translates to better risk management and improved financial stability.

-

Reduced Operational Costs: Transactions using stablecoins can be significantly cheaper and faster than traditional wire transfers, leading to substantial cost savings for banks. The automation potential offered by blockchain technology further streamlines operations.

-

Improved Cross-border Payments: Stablecoins facilitate faster and cheaper international payments, bypassing the complexities and delays associated with traditional correspondent banking networks. This opens up new opportunities for businesses and consumers engaging in global transactions.

-

Attracting New Customers: Banks offering stablecoin-related services can attract tech-savvy customers and businesses seeking innovative financial solutions. This expands the bank's customer base and strengthens its competitive position in the evolving digital economy.

H2: Navigating the Regulatory Landscape

Despite the promising potential, the integration of stablecoins into the banking sector requires careful consideration of regulatory frameworks. Many jurisdictions are still developing comprehensive guidelines for stablecoin usage, creating uncertainty for banks exploring this technology. Key regulatory considerations include:

-

Compliance and Anti-Money Laundering (AML): Banks must ensure robust compliance programs are in place to mitigate risks associated with money laundering and terrorist financing, especially in the context of cryptocurrency transactions.

-

Data Privacy: The handling of customer data related to stablecoin transactions must adhere to relevant data privacy regulations such as GDPR.

-

Financial Stability: Regulators are actively evaluating the systemic risks associated with widespread adoption of stablecoins, focusing on maintaining the stability of the broader financial system.

H3: Strategic Implementation for Banks

Successfully integrating stablecoins requires a strategic approach:

-

Phased Implementation: Banks may consider a phased approach, starting with pilot programs to assess the technology's feasibility and refine their operational processes before wider adoption.

-

Robust Technology Infrastructure: Investing in robust and secure blockchain technology infrastructure is critical to ensure seamless integration and efficient transaction processing.

-

Collaboration and Partnerships: Collaborating with fintech companies specializing in stablecoin technology and blockchain solutions can accelerate implementation and reduce development costs.

-

Customer Education: Educating customers about stablecoins and their benefits is vital for successful adoption. Clear and concise communication about the risks and rewards is crucial.

H2: The Future of Banking with Stablecoins

Stablecoins have the potential to transform the banking industry by enhancing liquidity, reducing costs, and expanding access to financial services. While regulatory uncertainty remains a challenge, forward-thinking banks are actively exploring the opportunities presented by this emerging technology. By strategically navigating the regulatory landscape and implementing robust technological solutions, banks can unlock significant growth potential and solidify their position in the evolving digital financial ecosystem. The future of banking is likely to be one where traditional and digital currencies coexist, creating a more efficient and inclusive financial system for all.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Unlocking Growth: Banks And The Strategic Potential Of Stablecoins For Liquidity And Deposits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Understanding People Are Real A Look At Authenticity Online

May 03, 2025

Understanding People Are Real A Look At Authenticity Online

May 03, 2025 -

Sphere Entertainment Sues Beyonce Over Unauthorized Concert Footage

May 03, 2025

Sphere Entertainment Sues Beyonce Over Unauthorized Concert Footage

May 03, 2025 -

Government Bitcoin Holdings Lazarus Groups April Sale And Its Implications

May 03, 2025

Government Bitcoin Holdings Lazarus Groups April Sale And Its Implications

May 03, 2025 -

Aides Doubts And Marital Friction Report Sheds Light On Fettermans Struggles

May 03, 2025

Aides Doubts And Marital Friction Report Sheds Light On Fettermans Struggles

May 03, 2025 -

Is The Trumpet Of Patriots Candidate A Real Contender Or A Phantom

May 03, 2025

Is The Trumpet Of Patriots Candidate A Real Contender Or A Phantom

May 03, 2025

Latest Posts

-

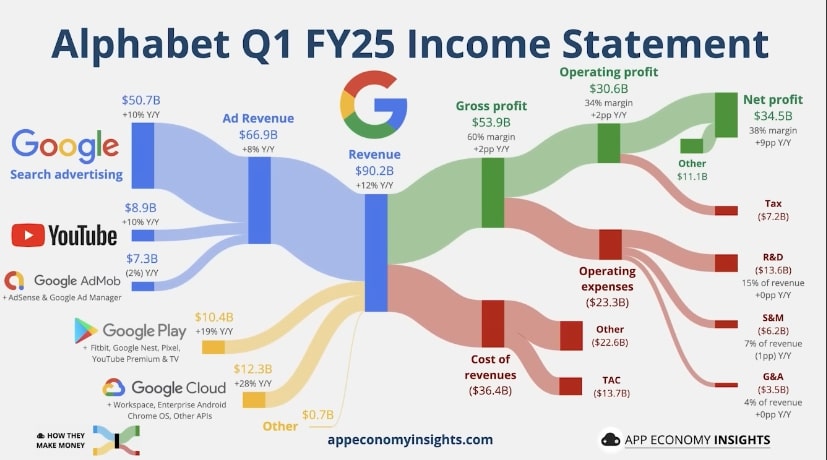

Googles Money Making Machine Analyzing The Sources Of Its Remarkable Profits

May 03, 2025

Googles Money Making Machine Analyzing The Sources Of Its Remarkable Profits

May 03, 2025 -

Stablecoins Unlocking Liquidity And Deposit Growth For Banks

May 03, 2025

Stablecoins Unlocking Liquidity And Deposit Growth For Banks

May 03, 2025 -

Sphere Entertainment Sues Beyonce Over Unauthorized Concert Footage

May 03, 2025

Sphere Entertainment Sues Beyonce Over Unauthorized Concert Footage

May 03, 2025 -

Man Citys De Bruyne A Perfect End To A Glorious Career Says Guardiola

May 03, 2025

Man Citys De Bruyne A Perfect End To A Glorious Career Says Guardiola

May 03, 2025 -

Is Your Uber Account At Risk Understanding The New Rating Policy

May 03, 2025

Is Your Uber Account At Risk Understanding The New Rating Policy

May 03, 2025