Unwavering: OCBC Retains 2025 Guidance For Singapore Operations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Unwavering: OCBC Retains 2025 Guidance for Singapore Operations Despite Economic Headwinds

Singapore, [Date of Publication] – Amidst growing global economic uncertainty and a softening Singaporean market, Oversea-Chinese Banking Corporation (OCBC Bank), one of Singapore's leading financial institutions, has reaffirmed its ambitious 2025 guidance for its domestic operations. This unwavering commitment signals a confident outlook despite persistent headwinds affecting the broader financial sector.

The announcement, made [mention source of announcement, e.g., during a press conference, in a financial report], underscores OCBC's resilience and its belief in the long-term potential of the Singaporean economy. While acknowledging the challenges presented by inflation, rising interest rates, and potential global recessionary pressures, the bank emphasized its robust business model and strategic initiatives designed to navigate these complexities.

Maintaining Momentum in a Challenging Landscape

OCBC's 2025 guidance, which [briefly summarize the key targets, e.g., includes specific targets for loan growth, net interest margin, and cost efficiency], remains unchanged. This steadfast approach contrasts with some of its competitors who have adjusted their forecasts in light of recent economic developments. The bank's confidence is rooted in several key factors:

- Strong Capital Position: OCBC boasts a strong capital base and healthy liquidity ratios, providing a buffer against potential economic downturns. This financial strength allows the bank to continue investing in growth opportunities and supporting its customers.

- Diversified Revenue Streams: The bank's diversified business model, spanning retail banking, corporate banking, and wealth management, mitigates risks associated with reliance on a single sector. This diversification proves crucial in navigating economic uncertainty.

- Strategic Investments in Digitalization: OCBC's significant investments in digital banking technologies are expected to drive efficiency and enhance customer experience, contributing to long-term growth. These digital initiatives are positioned to capitalize on evolving customer preferences.

- Robust Risk Management Framework: The bank's robust risk management framework enables proactive identification and mitigation of potential threats, ensuring stability and operational resilience in challenging markets. This commitment to responsible lending practices strengthens investor confidence.

Challenges and Opportunities for OCBC in Singapore

While OCBC remains optimistic, it acknowledges the challenges ahead. The slowdown in the Singaporean property market and potential impact of global economic slowdowns are key areas requiring ongoing monitoring and strategic adaptation. However, the bank also sees opportunities in several key sectors, such as:

- Sustainable Finance: OCBC is actively pursuing growth in the sustainable finance sector, aligning with Singapore's commitment to environmental, social, and governance (ESG) principles.

- Wealth Management: The bank's wealth management division is well-positioned to capitalize on the growing affluence of the Singaporean population and the region's burgeoning wealth management market.

Analyst Reactions and Market Outlook

[Include quotes from relevant financial analysts and their perspectives on OCBC's decision to maintain its 2025 guidance. Mention any changes in stock price following the announcement.] The market's reaction to OCBC's announcement will be a key indicator of investor sentiment towards the bank's strategy and its ability to navigate the current economic climate.

Conclusion: A Testament to Resilience

OCBC's unwavering commitment to its 2025 guidance for its Singapore operations demonstrates a strong belief in the long-term resilience of the Singaporean economy and the bank's own capabilities. While challenges remain, the bank's strategic positioning, robust financial health, and proactive risk management suggest a confident outlook for the future. This decision underscores the bank's commitment to delivering sustainable value to its shareholders and customers amidst fluctuating global economic conditions. The coming months will be crucial in observing how OCBC navigates these challenges and whether its optimistic projection proves accurate.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Unwavering: OCBC Retains 2025 Guidance For Singapore Operations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Empresas Pagam Dividendos Veja Quais Acoes Distribuem Lucros Esta Semana

May 09, 2025

Empresas Pagam Dividendos Veja Quais Acoes Distribuem Lucros Esta Semana

May 09, 2025 -

Wolves Series Clinching Victory Relive The Best Moments

May 09, 2025

Wolves Series Clinching Victory Relive The Best Moments

May 09, 2025 -

75 Anos De La Declaracion Schuman Un Legado Vigente En Europa

May 09, 2025

75 Anos De La Declaracion Schuman Un Legado Vigente En Europa

May 09, 2025 -

Unveiling Mars How Comprehensive Mapping Reshaped Our View

May 09, 2025

Unveiling Mars How Comprehensive Mapping Reshaped Our View

May 09, 2025 -

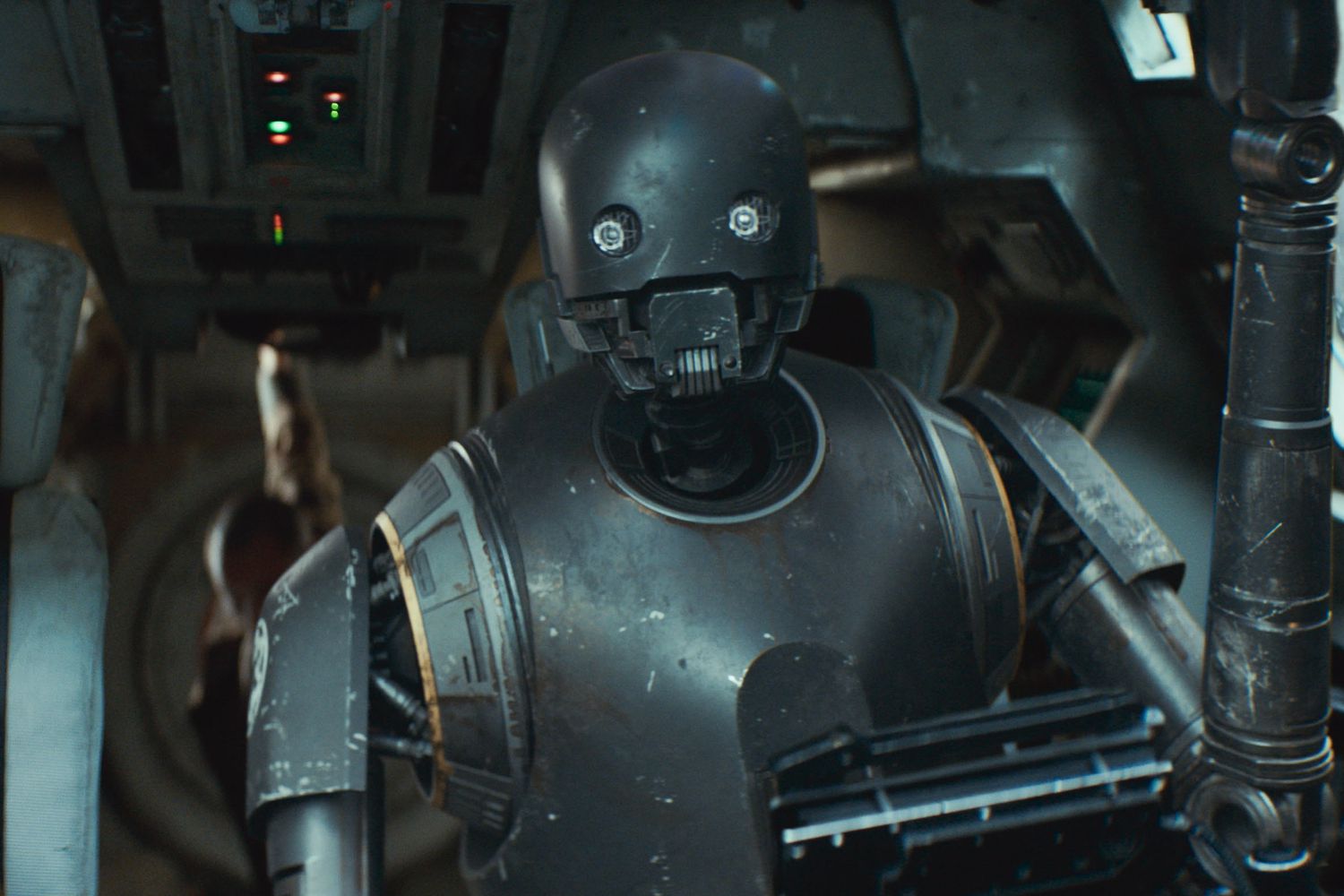

Tony Gilroy On Andor The K 2 So Horror Episode That Didnt Make The Cut

May 09, 2025

Tony Gilroy On Andor The K 2 So Horror Episode That Didnt Make The Cut

May 09, 2025