Urgent Action Needed: Addressing The UK's Equity Outflows

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Urgent Action Needed: Addressing the UK's Equity Outflows

The UK is facing a significant challenge: a worrying outflow of equity investments. This isn't just a minor economic blip; it's a potential crisis demanding immediate and decisive action from the government and financial institutions. The sustained exodus of capital threatens economic stability, job security, and the UK's standing on the global stage. Understanding the causes and implementing effective solutions are paramount to averting a deeper economic downturn.

Understanding the Exodus: Why is Money Leaving the UK?

Several factors contribute to this concerning trend of equity outflows. The post-Brexit economic landscape plays a significant role. Uncertainty surrounding trade deals, regulatory changes, and the overall economic impact of leaving the European Union have created a climate of apprehension for investors. This uncertainty is a major deterrent, making the UK a less attractive investment destination compared to more stable economies.

Furthermore, global economic headwinds, including high inflation and rising interest rates, are exacerbating the situation. Investors are seeking safer havens for their capital, often prioritizing countries perceived as more stable and less vulnerable to economic shocks. The UK's relatively weak economic performance compared to its global peers further contributes to this capital flight.

The Consequences of Inaction: A Looming Economic Crisis?

The continued outflow of equity investment has serious implications for the UK economy. It could lead to:

- Reduced economic growth: Less investment translates directly to slower economic expansion and fewer job creation opportunities.

- Weakening of the pound: Capital flight puts downward pressure on the British pound, impacting import costs and potentially fueling inflation further.

- Increased borrowing costs: The government may need to borrow more to fund public services, potentially leading to higher interest rates for businesses and consumers.

- Loss of international competitiveness: A weaker economy makes the UK less attractive for foreign direct investment, potentially hindering long-term growth.

What Needs to be Done: A Multi-pronged Approach

Addressing this crisis requires a comprehensive strategy focusing on several key areas:

- Boosting investor confidence: The government needs to provide clear, consistent, and predictable economic policies to reassure investors about the UK's long-term prospects. This includes addressing Brexit-related uncertainties and creating a stable and attractive regulatory environment.

- Improving economic performance: Focusing on sustainable economic growth through investments in infrastructure, education, and innovation is crucial. Targeted support for key industries can stimulate job creation and attract investment.

- Strengthening international partnerships: Strengthening trade relationships with key global partners can help to diversify the UK's economy and reduce reliance on a single market.

- Addressing inflation: Tackling inflation effectively is paramount to restoring investor confidence and improving the UK's economic competitiveness.

The Road Ahead: A Call for Urgent Action

The UK's equity outflows represent a serious threat to its economic stability. Ignoring this issue will only exacerbate the problem. Swift and decisive action from the government, in conjunction with proactive measures from the Bank of England and the private sector, is essential to stem the outflow, restore investor confidence, and safeguard the UK's economic future. Failure to act decisively could have profound and lasting consequences for the nation. The time for decisive action is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Urgent Action Needed: Addressing The UK's Equity Outflows. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Elsbeth Ep Impact Of Kayas Departure On Female Friendship Dynamic Explored

May 12, 2025

Elsbeth Ep Impact Of Kayas Departure On Female Friendship Dynamic Explored

May 12, 2025 -

Dados Economicos Da Semana Copom Ipca China E Perspectivas Para O Brasil

May 12, 2025

Dados Economicos Da Semana Copom Ipca China E Perspectivas Para O Brasil

May 12, 2025 -

Jeremie Frimpong Analyzing The Potential 30m Transfer To Liverpool

May 12, 2025

Jeremie Frimpong Analyzing The Potential 30m Transfer To Liverpool

May 12, 2025 -

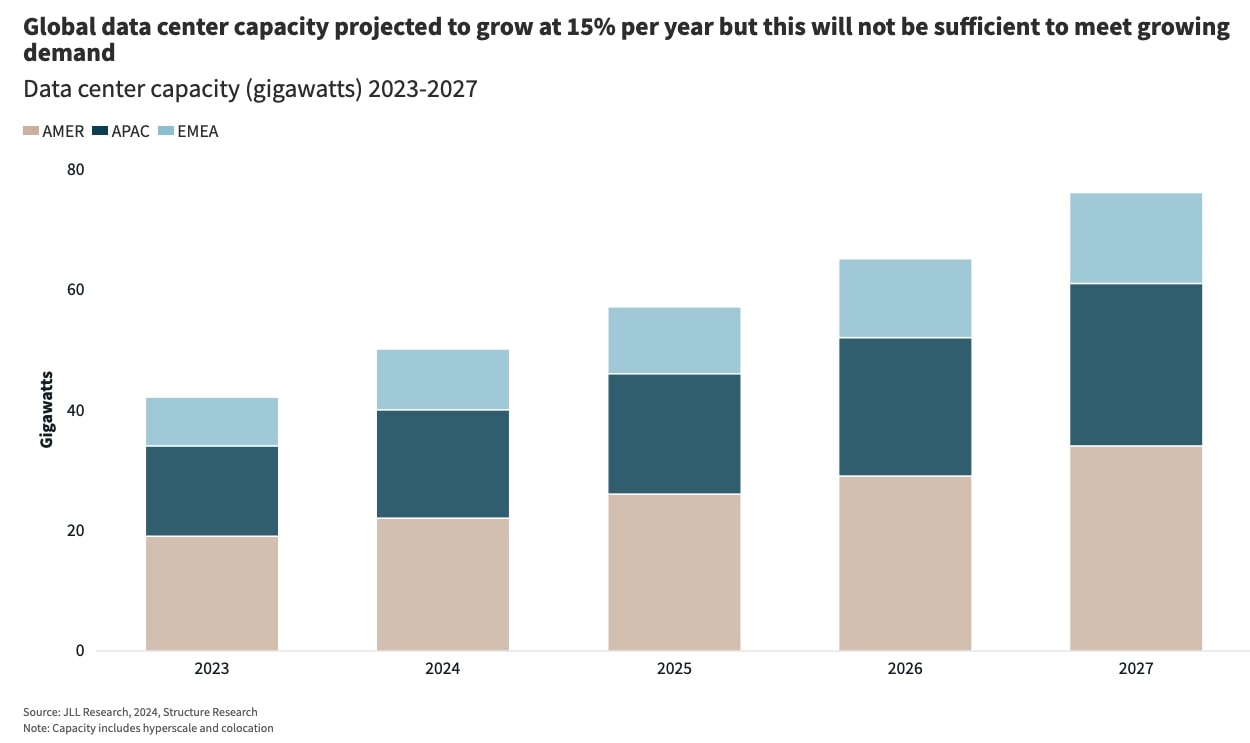

Amazon And Microsofts Impact Navigating The Shifting Landscape Of Global Ai Data Centers

May 12, 2025

Amazon And Microsofts Impact Navigating The Shifting Landscape Of Global Ai Data Centers

May 12, 2025 -

Upcoming Sony Xperia 1 Vii Leaked Images Hint At Design And Specifications

May 12, 2025

Upcoming Sony Xperia 1 Vii Leaked Images Hint At Design And Specifications

May 12, 2025

Latest Posts

-

Dedicated Mom And Teacher Receives Special Gma Breakfast Surprise

May 12, 2025

Dedicated Mom And Teacher Receives Special Gma Breakfast Surprise

May 12, 2025 -

Increased Caa Activity Anticipated During Vesak Festival

May 12, 2025

Increased Caa Activity Anticipated During Vesak Festival

May 12, 2025 -

A12 Collision Traffic Disruption Ends After Two Vehicle Crash

May 12, 2025

A12 Collision Traffic Disruption Ends After Two Vehicle Crash

May 12, 2025 -

The Future Of Design Figma Ceo On Ais Transformative Power

May 12, 2025

The Future Of Design Figma Ceo On Ais Transformative Power

May 12, 2025 -

The Sonos Leadership Transition An Interview With Tom Conrad

May 12, 2025

The Sonos Leadership Transition An Interview With Tom Conrad

May 12, 2025