US Banks' Quiet Push For A Shared Stablecoin: Implications For The Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Banks' Quiet Push for a Shared Stablecoin: Implications for the Future of Finance

The financial landscape is quietly shifting. While the cryptocurrency world grapples with volatility and regulatory uncertainty, a more subtle, potentially revolutionary change is brewing: a coalition of major US banks is quietly exploring the development of a shared stablecoin. This move, if successful, could dramatically reshape the future of finance, impacting everything from payments and remittances to broader financial inclusion. But what are the implications? And what does this mean for the average American?

A Shared Vision, a Shared Risk?

Several unnamed sources within the banking industry have revealed confidential discussions surrounding the creation of a jointly-backed stablecoin. The idea, proponents argue, is to leverage the established trust and infrastructure of the banking system to create a digital currency pegged to the US dollar, offering stability and security lacking in many cryptocurrencies. This would be a significant departure from the current decentralized model prevalent in the crypto space.

The potential benefits are significant:

- Enhanced Payment Efficiency: A shared stablecoin could drastically reduce transaction fees and processing times compared to traditional methods. This would particularly benefit businesses dealing with high volumes of transactions.

- Improved Cross-Border Payments: Remittances could become faster, cheaper, and more transparent, offering a boon to individuals and businesses engaged in international transactions.

- Increased Financial Inclusion: A stablecoin accessible through established banking channels could bring financial services to underserved populations currently excluded from the traditional banking system.

Navigating the Regulatory Maze:

However, the path to a shared banking stablecoin is fraught with challenges. The most prominent hurdle is navigating the complex regulatory landscape. The involvement of multiple banks necessitates meticulous coordination and adherence to stringent regulations imposed by bodies like the Federal Reserve and the Office of the Comptroller of the Currency (OCC).

Concerns and Considerations:

Despite the potential upsides, several key concerns remain:

- Monopolistic Tendencies: A stablecoin controlled by a consortium of major banks could raise concerns about market dominance and potential anti-competitive practices. Regulators will need to carefully scrutinize the structure and governance of such a system.

- Data Privacy: The handling and protection of user data associated with a shared stablecoin will be paramount. Robust data privacy measures are crucial to maintain user trust and comply with existing regulations like GDPR and CCPA.

- Cybersecurity Risks: As with any digital system, security vulnerabilities represent a significant risk. Robust security protocols and safeguards are essential to prevent breaches and protect user funds.

The Future of Finance – A Decentralized or Centralized Model?

The push for a shared banking stablecoin highlights a fundamental tension in the future of finance: the battle between decentralized and centralized models. While cryptocurrencies champion decentralized control and transparency, this initiative demonstrates a powerful counter-movement by established financial institutions seeking to harness the benefits of digital currency within a controlled framework.

The success or failure of this endeavor will have profound implications for the financial sector and the broader economy. It will undoubtedly shape future discussions around digital currencies, central bank digital currencies (CBDCs), and the role of technology in reshaping financial systems. The coming months and years will be critical in determining the future of this quiet revolution. The implications for consumers, businesses, and the global economy are far-reaching and warrant close observation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Banks' Quiet Push For A Shared Stablecoin: Implications For The Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Can Rantanen Elevate The Dallas Stars To Compete With Mc David And Draisaitl

May 25, 2025

Can Rantanen Elevate The Dallas Stars To Compete With Mc David And Draisaitl

May 25, 2025 -

Compartilhamento De Imoveis Uma Alternativa Economica Para Casas Na Praia E Campo

May 25, 2025

Compartilhamento De Imoveis Uma Alternativa Economica Para Casas Na Praia E Campo

May 25, 2025 -

Watch Fremantle Dockers Vs Port Adelaide Power Free Afl Live Stream Guide

May 25, 2025

Watch Fremantle Dockers Vs Port Adelaide Power Free Afl Live Stream Guide

May 25, 2025 -

An Unfortunate Ending Henrys Journey To The Bin

May 25, 2025

An Unfortunate Ending Henrys Journey To The Bin

May 25, 2025 -

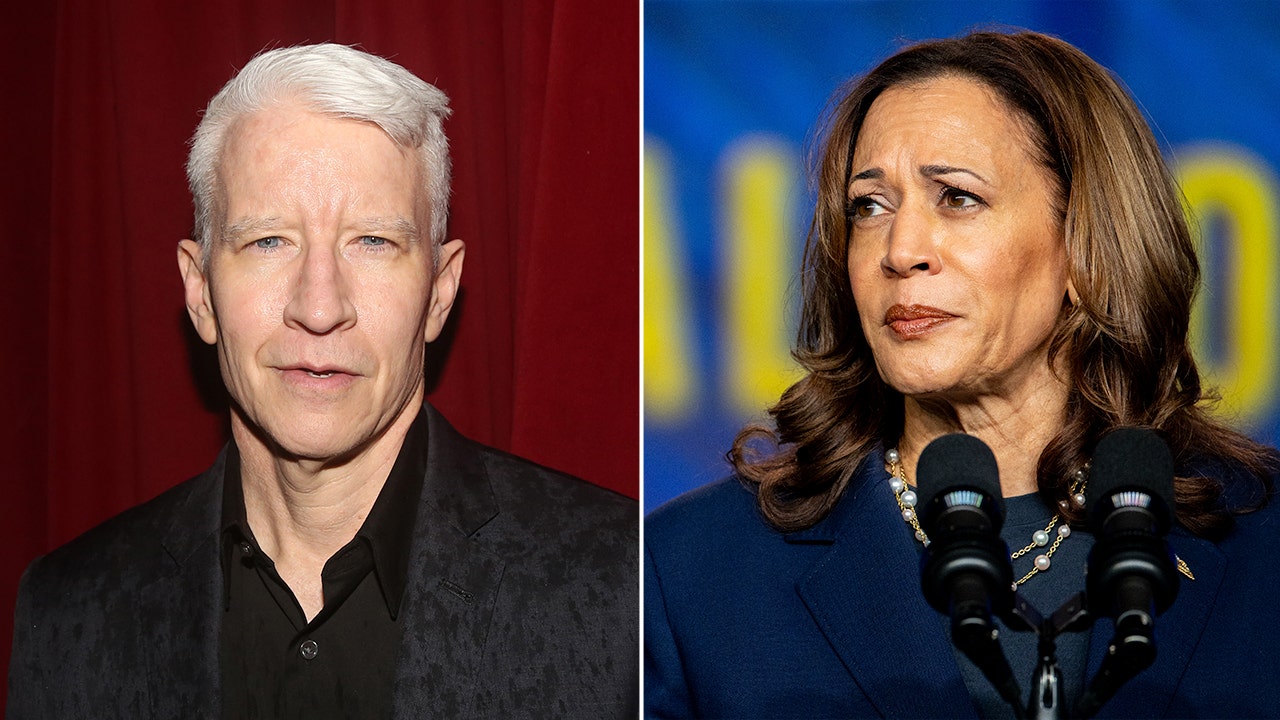

Behind The Scenes Book Reveals Kamala Harriss Reaction To Cooper Interview

May 25, 2025

Behind The Scenes Book Reveals Kamala Harriss Reaction To Cooper Interview

May 25, 2025

Latest Posts

-

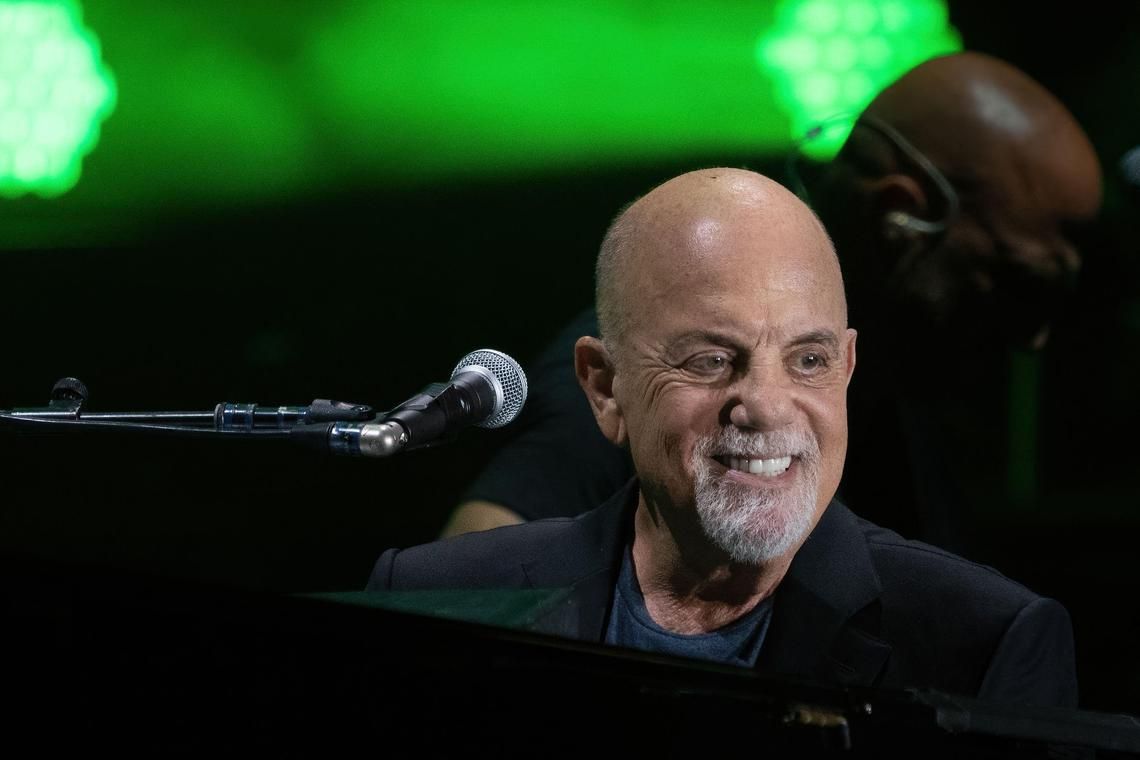

Health Update Billy Joel Postpones Shows Due To Brain Disorder

May 25, 2025

Health Update Billy Joel Postpones Shows Due To Brain Disorder

May 25, 2025 -

Local Politics Explodes Amidst Londons Summer Festivals

May 25, 2025

Local Politics Explodes Amidst Londons Summer Festivals

May 25, 2025 -

Planning Your Trip To Love Saves The Day In Bristol Essential Information

May 25, 2025

Planning Your Trip To Love Saves The Day In Bristol Essential Information

May 25, 2025 -

Oklahoma Tornado Drone Provides Critical Meteorological Data

May 25, 2025

Oklahoma Tornado Drone Provides Critical Meteorological Data

May 25, 2025 -

Official Confirmation Ta Btouch Team Walyalup Remains Unaltered

May 25, 2025

Official Confirmation Ta Btouch Team Walyalup Remains Unaltered

May 25, 2025