US Bitcoin Market Cap Dominance: The Rise Of ETFs And Institutional Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Bitcoin Market Cap Dominance: The Rise of ETFs and Institutional Investors

The United States is rapidly solidifying its position as the global leader in Bitcoin market capitalization, a trend fueled by the surge in Bitcoin exchange-traded funds (ETFs) and the increasing involvement of institutional investors. This shift represents a significant development in the cryptocurrency landscape, impacting global markets and signaling a growing acceptance of Bitcoin as a legitimate asset class.

The ETF Effect: Opening the Doors to Mainstream Investors

The approval of Bitcoin ETFs in the US has been a game-changer. Previously, individual investors faced significant barriers to entry, including navigating complex exchanges and understanding the intricacies of cryptocurrency wallets. ETFs offer a simpler, more regulated pathway for participation, making Bitcoin accessible to a broader range of investors, from seasoned professionals to retail traders. This increased accessibility has directly contributed to the swelling US Bitcoin market cap. The ease of buying and selling Bitcoin through brokerage accounts, familiar to millions, dramatically lowered the barrier to entry.

Institutional Adoption: Beyond the Hype

While retail investors have played a role, the real engine behind the US Bitcoin market cap dominance is the growing interest from institutional investors. Large corporations, hedge funds, and pension funds are increasingly allocating a portion of their portfolios to Bitcoin, viewing it as a hedge against inflation and a potential long-term store of value. This institutional adoption lends credibility to Bitcoin, legitimizing it within traditional finance and further driving its price upward. The shift is palpable; what was once considered a fringe asset is now appearing in sophisticated investment strategies.

Factors Contributing to US Dominance:

- Regulatory Clarity (Relative to other jurisdictions): While still evolving, the US regulatory landscape for cryptocurrencies is becoming clearer, offering a degree of stability that attracts institutional investment. This contrasts with the uncertainty seen in some other countries.

- Established Financial Infrastructure: The US boasts a well-developed financial infrastructure, making it easier for institutional investors to integrate Bitcoin into their existing systems.

- Technological Innovation: The US remains a hub for technological innovation, fostering the development of cryptocurrency infrastructure and supporting services.

Challenges and Future Outlook:

Despite the current dominance, challenges remain. Regulatory uncertainty continues to be a factor, and potential future regulations could impact the market. Furthermore, competition from other cryptocurrencies and potential market corrections are ongoing considerations.

However, the long-term outlook appears bullish. The ongoing adoption by institutional investors, coupled with the increasing accessibility via ETFs, suggests that the US will continue to hold a significant share of the Bitcoin market capitalization. This will likely influence global Bitcoin pricing and solidify the US's role as a key player in the evolving cryptocurrency ecosystem.

Keywords: Bitcoin, ETF, Institutional Investors, US Bitcoin Market Cap, Cryptocurrency, Market Dominance, Regulatory Clarity, Bitcoin Investment, Bitcoin Price, Cryptocurrency Market, Bitcoin ETF Approval.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Bitcoin Market Cap Dominance: The Rise Of ETFs And Institutional Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Juneteenth In Seattle Traditions Events And Community Engagement

Apr 29, 2025

Juneteenth In Seattle Traditions Events And Community Engagement

Apr 29, 2025 -

Why Is Ex Mi Pacer Akash Madhwal Missing Todays Game

Apr 29, 2025

Why Is Ex Mi Pacer Akash Madhwal Missing Todays Game

Apr 29, 2025 -

Ceasefire Announced Analyzing Putins Latest Move And The Kremlins Unwavering Position On Ukraine

Apr 29, 2025

Ceasefire Announced Analyzing Putins Latest Move And The Kremlins Unwavering Position On Ukraine

Apr 29, 2025 -

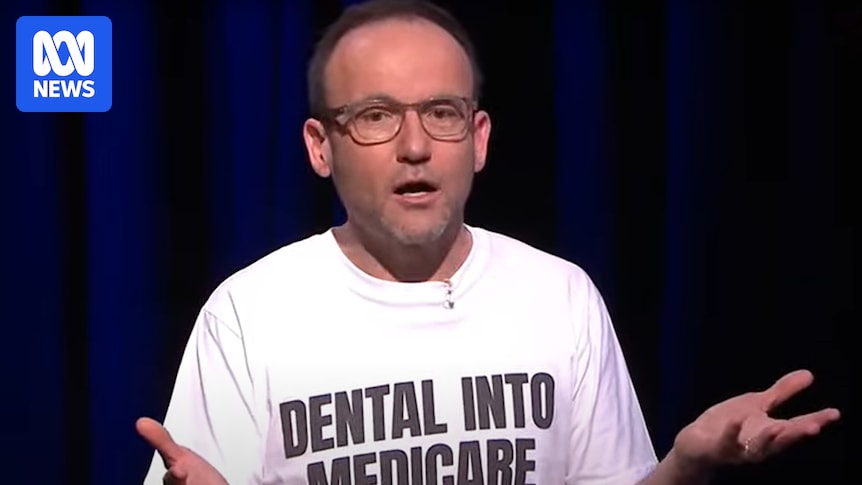

Australian Election 2024 Parties Deny Backroom Deals Following Greens Disclosure

Apr 29, 2025

Australian Election 2024 Parties Deny Backroom Deals Following Greens Disclosure

Apr 29, 2025 -

Ge 2025 How To Watch The Paps Fullerton Rally At Uob Plaza

Apr 29, 2025

Ge 2025 How To Watch The Paps Fullerton Rally At Uob Plaza

Apr 29, 2025

Latest Posts

-

Get Flappy Bird On Android Exclusive Epic Games Store Launch

Apr 29, 2025

Get Flappy Bird On Android Exclusive Epic Games Store Launch

Apr 29, 2025 -

Martinellis High Stakes Arsenals Young Gun Faces Psg In Life Changing Match

Apr 29, 2025

Martinellis High Stakes Arsenals Young Gun Faces Psg In Life Changing Match

Apr 29, 2025 -

Mertens Falls To Sabalenka In Three Set Battle Ninth Straight Win For Sabalenka

Apr 29, 2025

Mertens Falls To Sabalenka In Three Set Battle Ninth Straight Win For Sabalenka

Apr 29, 2025 -

Emirates Stadium Brace For Impact Arsenals Psg Threat Assessment

Apr 29, 2025

Emirates Stadium Brace For Impact Arsenals Psg Threat Assessment

Apr 29, 2025 -

Qantas International Flight Sale 499 Fares To Popular Destinations

Apr 29, 2025

Qantas International Flight Sale 499 Fares To Popular Destinations

Apr 29, 2025