US Bitcoin Market Dominance Soars: ETF Approvals And Institutional Investment Fuel Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Bitcoin Market Dominance Soars: ETF Approvals and Institutional Investment Fuel Growth

The United States is rapidly solidifying its position as the global epicenter for Bitcoin trading, experiencing a surge in market dominance fueled by a confluence of factors. Recent approvals of Bitcoin exchange-traded funds (ETFs) and a continued influx of institutional investment are key drivers behind this remarkable growth, pushing the US ahead of other major Bitcoin markets.

The ETF Effect: Unlocking Untapped Potential

The approval of several Bitcoin ETFs by the Securities and Exchange Commission (SEC) marks a pivotal moment for the cryptocurrency market. This regulatory green light has legitimized Bitcoin in the eyes of many mainstream investors, significantly lowering the barrier to entry. Previously, institutional investors and individual investors alike faced hurdles accessing Bitcoin directly, limiting participation. ETFs offer a more regulated and accessible avenue, attracting a wider range of investors and bolstering trading volume within the US. This increased liquidity directly translates to higher market dominance for the US.

Institutional Adoption: A Game Changer

Beyond ETF approvals, the sustained interest from institutional investors continues to propel US Bitcoin market dominance. Large corporations, pension funds, and hedge funds are increasingly incorporating Bitcoin into their investment portfolios, viewing it as a hedge against inflation and a potential diversification tool. This institutional adoption brings significant capital into the US market, further strengthening its position on the global stage. The influx of large-scale investment contributes to price stability and increased market depth, attracting even more participants.

Increased Trading Volume and Liquidity: A Self-Reinforcing Cycle

The combined effects of ETF approvals and institutional investment have created a self-reinforcing cycle of increased trading volume and liquidity within the US Bitcoin market. Higher trading volume attracts more market makers, increasing liquidity and making it easier for investors to buy and sell Bitcoin quickly and efficiently. This improved liquidity, in turn, attracts even more investors, further driving up trading volume.

Global Implications of US Bitcoin Dominance:

The rise of US Bitcoin market dominance has significant global implications. It suggests a shift towards a more regulated and institutionalized cryptocurrency market, potentially influencing regulatory frameworks in other countries. The increased trading volume in the US could also impact global Bitcoin pricing, setting the tone for international markets.

Looking Ahead: Continued Growth and Potential Challenges:

While the future looks bright for US Bitcoin dominance, certain challenges remain. Regulatory uncertainty, potential volatility in the cryptocurrency market, and competition from other jurisdictions could impact future growth. However, the current trajectory suggests that the US will continue to play a leading role in shaping the future of Bitcoin and the broader cryptocurrency landscape.

Key takeaways:

- ETF Approvals: A major catalyst for increased investor participation.

- Institutional Investment: Significant capital inflow bolstering market stability.

- Increased Liquidity: Attracting more investors and market makers.

- Global Impact: Influencing regulatory frameworks and global pricing.

- Future Outlook: Continued growth, but challenges remain.

This surge in US Bitcoin market dominance signifies a significant milestone for the cryptocurrency industry, highlighting the growing acceptance and integration of Bitcoin into the mainstream financial system. The coming months will be crucial in observing how this trend evolves and what further impact it will have on the global cryptocurrency landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Bitcoin Market Dominance Soars: ETF Approvals And Institutional Investment Fuel Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ipl 2025 Rr Vs Gt Jaiswal Drop And Gills Absence Impact Live Score

Apr 29, 2025

Ipl 2025 Rr Vs Gt Jaiswal Drop And Gills Absence Impact Live Score

Apr 29, 2025 -

White House Confirmation Pending Trumps Call To Bezos Regarding Amazon

Apr 29, 2025

White House Confirmation Pending Trumps Call To Bezos Regarding Amazon

Apr 29, 2025 -

Australian Election 2024 Parties Pledge No Deals Greens Reveal Abbotts 2010 Approach

Apr 29, 2025

Australian Election 2024 Parties Pledge No Deals Greens Reveal Abbotts 2010 Approach

Apr 29, 2025 -

Eurovision Song Contest 2024 Switzerlands Host City And Preparations

Apr 29, 2025

Eurovision Song Contest 2024 Switzerlands Host City And Preparations

Apr 29, 2025 -

Billy Joels Infidelity Christie Brinkley Speaks Out On The Other Woman

Apr 29, 2025

Billy Joels Infidelity Christie Brinkley Speaks Out On The Other Woman

Apr 29, 2025

Latest Posts

-

Ipl 2024 Narines Front Foot Leadership Secures Kolkata Knight Riders Win Against Delhi Capitals

Apr 30, 2025

Ipl 2024 Narines Front Foot Leadership Secures Kolkata Knight Riders Win Against Delhi Capitals

Apr 30, 2025 -

Workers Party Holds Significant Ge 2025 Rally In Bedok

Apr 30, 2025

Workers Party Holds Significant Ge 2025 Rally In Bedok

Apr 30, 2025 -

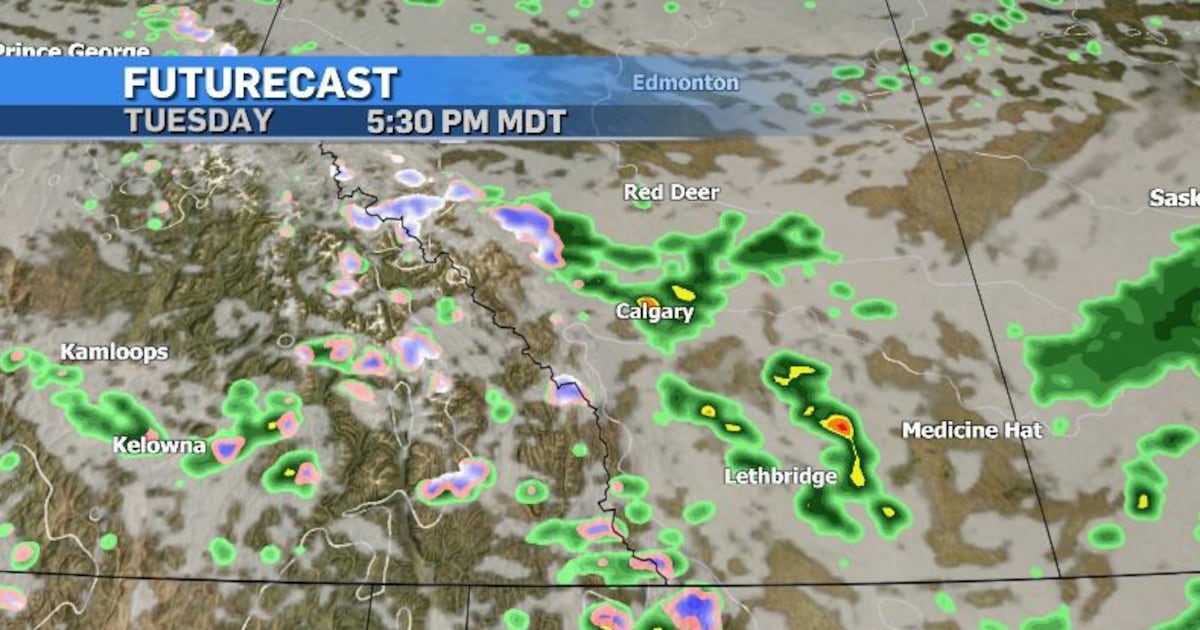

Calgary Weather Alert Cloudy Windy And Thunderstorm Potential Tuesday

Apr 30, 2025

Calgary Weather Alert Cloudy Windy And Thunderstorm Potential Tuesday

Apr 30, 2025 -

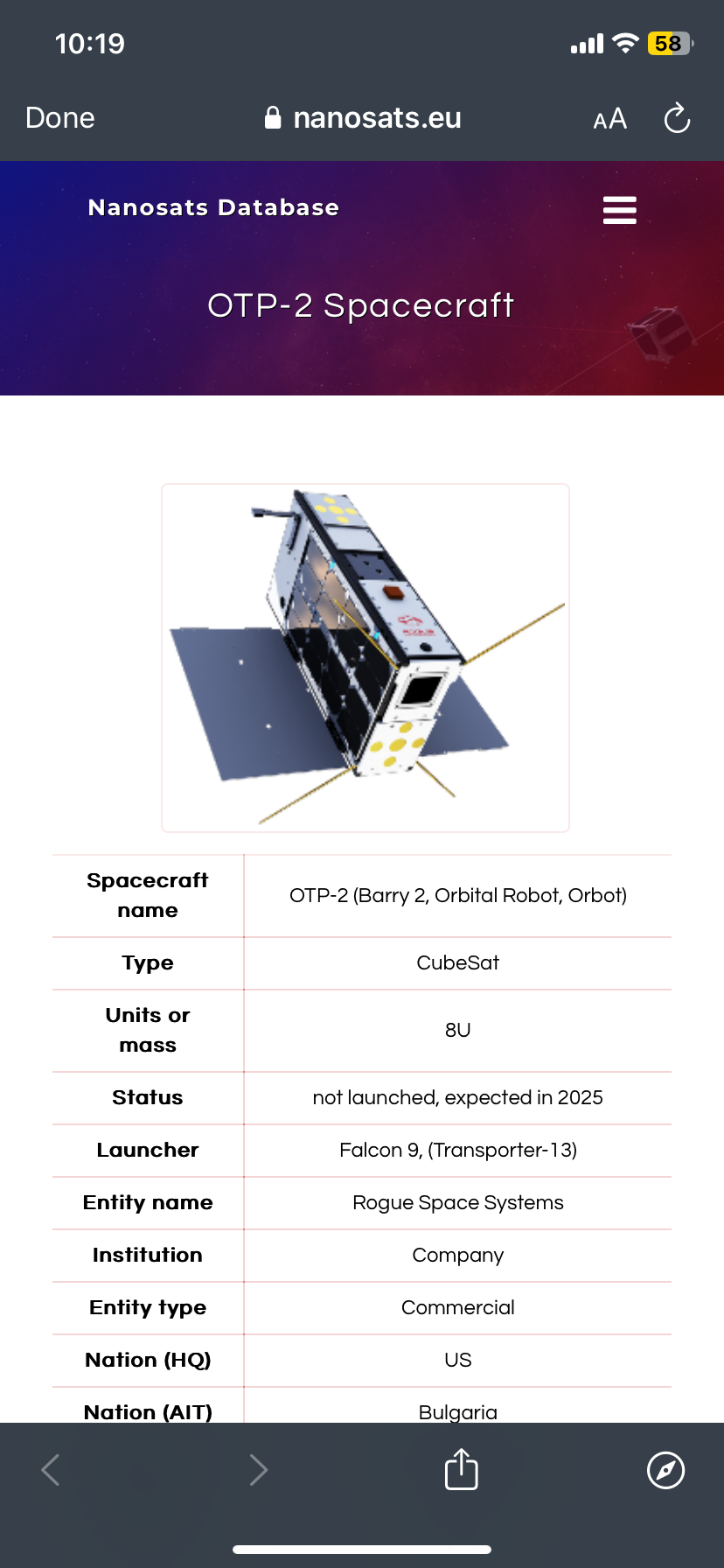

Otp 2 Progress Report On Two Recent Propulsion Experiments

Apr 30, 2025

Otp 2 Progress Report On Two Recent Propulsion Experiments

Apr 30, 2025 -

New Thunderbolts Footage Leaks Post Credits Scene And Critic Reviews Analyzed

Apr 30, 2025

New Thunderbolts Footage Leaks Post Credits Scene And Critic Reviews Analyzed

Apr 30, 2025