US Bitcoin Market Share Reaches New Peak: ETFs And Institutional Investment Drive Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Bitcoin Market Share Reaches New Peak: ETFs and Institutional Investment Drive Surge

The US Bitcoin market is experiencing a dramatic surge, hitting an all-time high in market share, driven primarily by the increasing popularity of Bitcoin ETFs (Exchange-Traded Funds) and a significant influx of institutional investment. This unprecedented growth signifies a major shift in the cryptocurrency landscape, solidifying Bitcoin's position as a leading digital asset.

The ETF Effect: Unlocking Accessibility and Investment

The recent approval of several Bitcoin ETFs in the US has played a pivotal role in this market expansion. These ETFs offer investors a regulated and easily accessible way to gain exposure to Bitcoin without the complexities of directly purchasing and managing the cryptocurrency. This streamlined process has attracted a wider range of investors, from individual retail traders to sophisticated institutional players. The lower barrier to entry, combined with the perceived safety and regulatory oversight of ETFs, has fueled significant demand.

Institutional Investors Embrace Bitcoin

Beyond ETFs, institutional investment is another key driver of the surge. Large financial institutions, hedge funds, and pension funds are increasingly allocating a portion of their portfolios to Bitcoin, recognizing its potential as a store of value and a hedge against inflation. This institutional adoption lends credibility and legitimacy to Bitcoin, further boosting confidence among investors. Several prominent financial institutions have publicly declared their Bitcoin holdings, signaling a significant shift in the traditional finance sector's perception of cryptocurrencies.

Market Share Dominance: A New Era for US Bitcoin

This combined effect of ETF accessibility and institutional investment has propelled the US Bitcoin market share to unprecedented heights. Data shows a substantial increase in trading volume and overall market capitalization, clearly illustrating the growing dominance of the US market in the global Bitcoin ecosystem. This surge has outpaced growth in other major cryptocurrency markets, highlighting the unique factors contributing to the US Bitcoin boom.

What Does the Future Hold? Continued Growth and Potential Challenges

While the current trajectory points to continued growth, several factors could influence the future of the US Bitcoin market. Regulatory developments, macroeconomic conditions, and the overall cryptocurrency market sentiment will all play a significant role. However, the current momentum suggests a sustained period of growth, with the US poised to remain a dominant force in the global Bitcoin market.

Key Takeaways:

- ETF Approvals: The catalyst for increased accessibility and investment.

- Institutional Adoption: Lending credibility and driving significant capital inflow.

- Market Share Dominance: The US is now a leading player in the global Bitcoin market.

- Future Outlook: While challenges exist, the overall trend suggests continued growth.

Related Keywords: Bitcoin ETF, Bitcoin investment, institutional Bitcoin investment, US Bitcoin market, cryptocurrency market, Bitcoin price, Bitcoin trading, digital assets, regulatory approval, financial markets.

This surge in the US Bitcoin market share is a significant development with far-reaching implications for the future of both cryptocurrency and traditional finance. The increasing mainstream adoption of Bitcoin, coupled with regulatory clarity, suggests a promising future for this groundbreaking digital asset. It will be fascinating to observe how this trend evolves and shapes the financial landscape in the coming years.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Bitcoin Market Share Reaches New Peak: ETFs And Institutional Investment Drive Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Serie A Showdown Inter Milan Vs Roma Preview Lineups And Betting Odds

Apr 28, 2025

Serie A Showdown Inter Milan Vs Roma Preview Lineups And Betting Odds

Apr 28, 2025 -

Donde Ver Las Semifinales De La Champions League Femenina Horarios Y Tv

Apr 28, 2025

Donde Ver Las Semifinales De La Champions League Femenina Horarios Y Tv

Apr 28, 2025 -

Champions League Qualification Bolognas Prospects And Predictions

Apr 28, 2025

Champions League Qualification Bolognas Prospects And Predictions

Apr 28, 2025 -

Eurovoix Wrap Up A Closer Look At Interval Acts And National Flags

Apr 28, 2025

Eurovoix Wrap Up A Closer Look At Interval Acts And National Flags

Apr 28, 2025 -

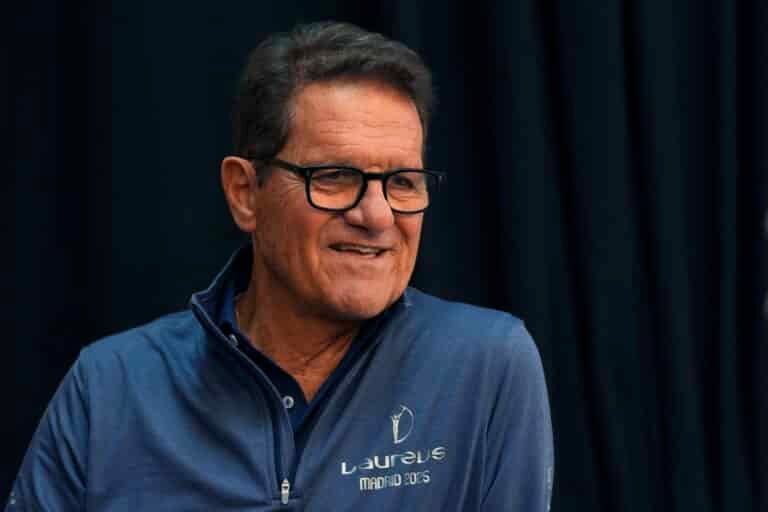

Romas Underdog Status Capello Weighs In On Inter Clash

Apr 28, 2025

Romas Underdog Status Capello Weighs In On Inter Clash

Apr 28, 2025

Latest Posts

-

Enhanced Border Security Armenias Policy To Increase Border Guard Presence

Apr 29, 2025

Enhanced Border Security Armenias Policy To Increase Border Guard Presence

Apr 29, 2025 -

Hands On Review Cmfs Rebranded Nothing Smartphone And Earbuds

Apr 29, 2025

Hands On Review Cmfs Rebranded Nothing Smartphone And Earbuds

Apr 29, 2025 -

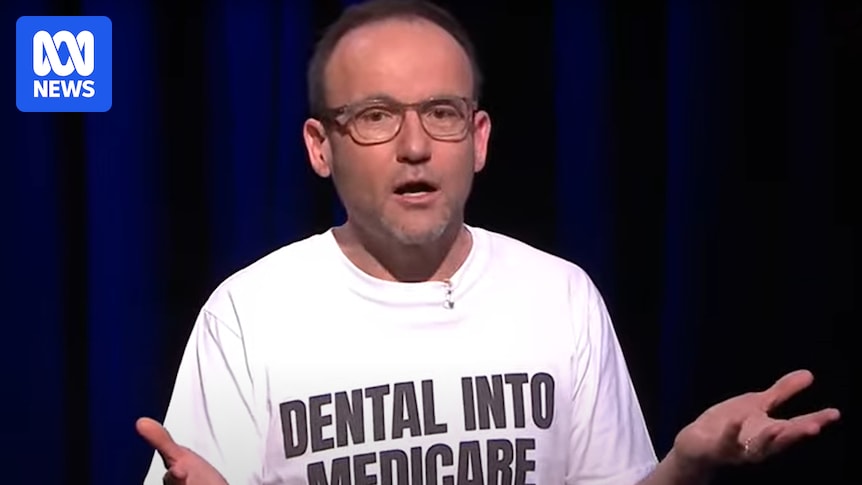

Post Election Standoff Abbotts 2010 Plea And The Rejection Of Horse Trading In Australian Politics

Apr 29, 2025

Post Election Standoff Abbotts 2010 Plea And The Rejection Of Horse Trading In Australian Politics

Apr 29, 2025 -

Virat Kohlis Snippy Reply To Kl Rahul Ex Rcb Coach Reveals Delhi Pavilion Incident

Apr 29, 2025

Virat Kohlis Snippy Reply To Kl Rahul Ex Rcb Coach Reveals Delhi Pavilion Incident

Apr 29, 2025 -

Ge 2025 Wp Urges Punggol Voters To Reject Paps Gan Kim Yong

Apr 29, 2025

Ge 2025 Wp Urges Punggol Voters To Reject Paps Gan Kim Yong

Apr 29, 2025