US-China Trade War And Rising Bond Yields Shake Up Stock Market: Dow, S&P 500, And Nasdaq Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US-China Trade War and Rising Bond Yields Shake Up Stock Market: Dow, S&P 500, and Nasdaq Suffer

The global stock market is experiencing significant turbulence, with major US indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all feeling the pressure from escalating US-China trade tensions and a surge in bond yields. This volatile environment has investors on edge, prompting concerns about a potential economic slowdown.

The Perfect Storm: Trade Wars and Rising Yields

The renewed trade war rhetoric between the US and China is injecting considerable uncertainty into the market. Recent tariffs and threats of further escalation have sparked fears of disrupted supply chains, reduced global trade, and slower economic growth. This uncertainty is driving investors towards safer assets, leading to a sell-off in equities.

Simultaneously, rising bond yields are adding fuel to the fire. Higher yields indicate increased borrowing costs for businesses and consumers, potentially dampening economic activity. This makes stocks, which are considered riskier assets compared to bonds, less attractive to investors. The interplay between these two factors is creating a perfect storm for market volatility.

Impact on Major Indices:

-

Dow Jones Industrial Average: The Dow has experienced significant daily fluctuations, reflecting the overall market anxiety. The index is particularly sensitive to the performance of large, multinational corporations, many of which are directly impacted by the trade war.

-

S&P 500: As a broader measure of the US stock market, the S&P 500 mirrors the Dow's volatility, with many of its constituent companies facing similar challenges related to trade and rising interest rates. The index's performance provides a comprehensive overview of the market's overall health.

-

Nasdaq Composite: The tech-heavy Nasdaq has also been affected, though perhaps less dramatically than the Dow in some periods. While some tech companies benefit from global growth, others are vulnerable to supply chain disruptions and reduced consumer spending resulting from economic uncertainty.

What's Next for Investors?

The current market environment demands a cautious approach. Investors are advised to carefully review their portfolios and consider diversifying their holdings to mitigate risk. Monitoring developments in the US-China trade negotiations and keeping a close eye on interest rate movements will be crucial in navigating this period of uncertainty. Experts suggest that a long-term perspective and a well-defined investment strategy are paramount during times of market volatility.

Key Takeaways:

- The ongoing US-China trade war is a major driver of market instability.

- Rising bond yields are exacerbating the situation, increasing borrowing costs and impacting investor sentiment.

- The Dow, S&P 500, and Nasdaq are all experiencing significant volatility.

- Investors should adopt a cautious approach, diversify their portfolios, and monitor economic indicators closely.

- Long-term investment strategies are crucial for navigating market uncertainty.

Looking Ahead: The future trajectory of the stock market depends heavily on the resolution (or lack thereof) of the US-China trade dispute and the Federal Reserve's monetary policy decisions. Any escalation in trade tensions or further increases in interest rates could trigger further market corrections. Conversely, a de-escalation of tensions and a more dovish stance from the Fed could potentially stabilize the market and lead to a rebound. Only time will tell how this complex situation will unfold.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US-China Trade War And Rising Bond Yields Shake Up Stock Market: Dow, S&P 500, And Nasdaq Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sinetron Asmara Gen Z Chemistry Harry Dan Aqeela Tuai Pujian Ship Har Qeel Makin Kuat

Apr 12, 2025

Sinetron Asmara Gen Z Chemistry Harry Dan Aqeela Tuai Pujian Ship Har Qeel Makin Kuat

Apr 12, 2025 -

Video 14 Year Old Vaibhav Suryavanshis Net Session With Jofra Archer

Apr 12, 2025

Video 14 Year Old Vaibhav Suryavanshis Net Session With Jofra Archer

Apr 12, 2025 -

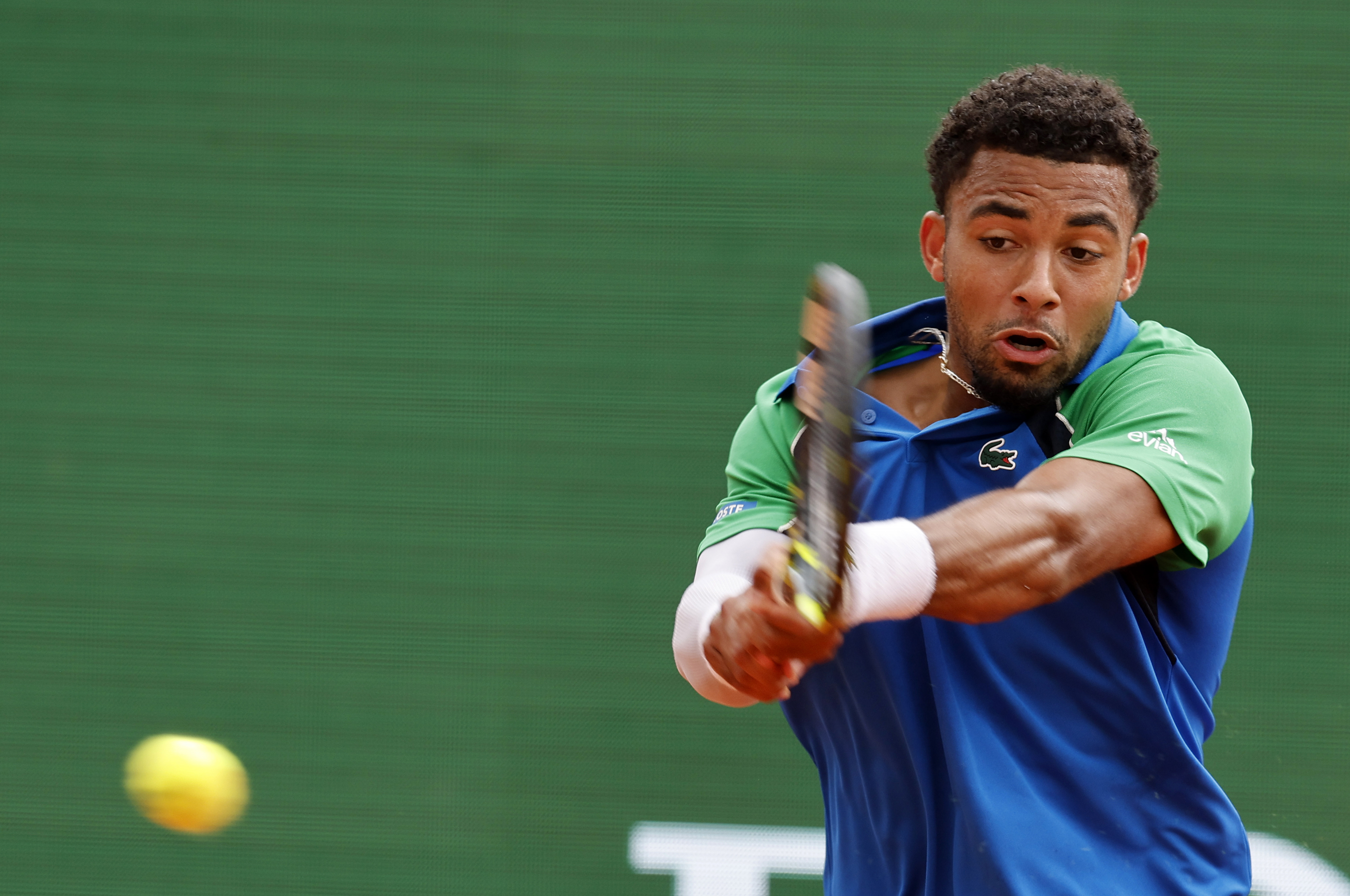

Montecarlo Alcaraz Derrota A Fils Y Garantiza Finalista Espanol En El Masters 1000

Apr 12, 2025

Montecarlo Alcaraz Derrota A Fils Y Garantiza Finalista Espanol En El Masters 1000

Apr 12, 2025 -

Kompanys Startelf Entscheidung Der Einfluss Von Thomas

Apr 12, 2025

Kompanys Startelf Entscheidung Der Einfluss Von Thomas

Apr 12, 2025 -

Alcaraz Un Luchador Victoria Agonica Ante Fils En Semifinales De Montecarlo

Apr 12, 2025

Alcaraz Un Luchador Victoria Agonica Ante Fils En Semifinales De Montecarlo

Apr 12, 2025