US-China Trade War And Rising Bond Yields: Their Impact On Today's Stock Market (Dow, S&P 500, Nasdaq)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US-China Trade War and Rising Bond Yields: Shaking Up the Stock Market

The global economic landscape is currently experiencing significant turbulence, primarily fueled by the lingering effects of the US-China trade war and a recent surge in bond yields. These factors are creating a complex interplay that's sending shockwaves through major US stock market indices like the Dow Jones Industrial Average (Dow), the S&P 500, and the Nasdaq Composite. Understanding this dynamic is crucial for investors navigating today's volatile market.

The Lingering Shadow of the Trade War:

While a comprehensive trade deal between the US and China was reached in 2020, the aftershocks continue to resonate. Tariffs imposed during the height of the conflict haven't been fully removed, creating persistent uncertainty for businesses reliant on global supply chains. This uncertainty translates into decreased investor confidence, impacting stock valuations across various sectors. Companies heavily reliant on exports to China or utilizing Chinese-sourced materials remain particularly vulnerable. The threat of future trade escalations further exacerbates this risk, keeping investors on edge.

Rising Bond Yields: A Double-Edged Sword:

The recent rise in US Treasury bond yields adds another layer of complexity. Higher yields, generally reflecting stronger economic growth expectations or increased inflation fears, make bonds more attractive to investors. This shift in investor preference can lead to capital flowing out of the stock market and into the seemingly safer haven of bonds. This outflow of capital can put downward pressure on stock prices, especially for growth stocks that are more sensitive to interest rate changes.

Impact on Major Indices:

The combined effect of these factors is already being felt across major US stock market indices:

-

Dow Jones Industrial Average (Dow): The Dow, comprised of 30 large, established companies, is experiencing increased volatility. While its performance isn't solely dictated by trade and yield fluctuations, these factors significantly contribute to its daily swings. Sectors like industrials and materials are particularly sensitive to trade tensions.

-

S&P 500: This broader index, representing 500 large-cap US companies, showcases a similar pattern. However, its diversification offers some degree of resilience compared to the more concentrated Dow. Still, rising bond yields and lingering trade uncertainties impact its overall performance.

-

Nasdaq Composite: The tech-heavy Nasdaq is particularly vulnerable to rising interest rates. Growth stocks, often found in the tech sector, are heavily reliant on future earnings expectations. Higher interest rates increase the discount rate used to calculate present value, making these future earnings less attractive and depressing valuations.

What Lies Ahead?

Predicting the future of the stock market is always challenging, but understanding the interplay between US-China trade relations and bond yields is critical. Investors need to closely monitor:

- Trade policy developments: Any escalation or de-escalation in US-China trade tensions will significantly impact market sentiment.

- Inflation data: Inflationary pressures can further drive up bond yields, potentially exacerbating the outflow of capital from the stock market.

- Federal Reserve policy: The actions of the Federal Reserve regarding interest rates will have a substantial impact on both bond and stock markets.

Investor Strategies:

Given the current climate, investors might consider adopting strategies such as diversification across asset classes, focusing on value stocks rather than growth stocks (which are more vulnerable to rising interest rates), and maintaining a longer-term investment horizon to weather short-term market volatility. Professional financial advice is always recommended.

The current market conditions demand a cautious yet informed approach. Staying abreast of global economic developments and understanding their impact on various asset classes is crucial for navigating the complexities of today's stock market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US-China Trade War And Rising Bond Yields: Their Impact On Today's Stock Market (Dow, S&P 500, Nasdaq). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

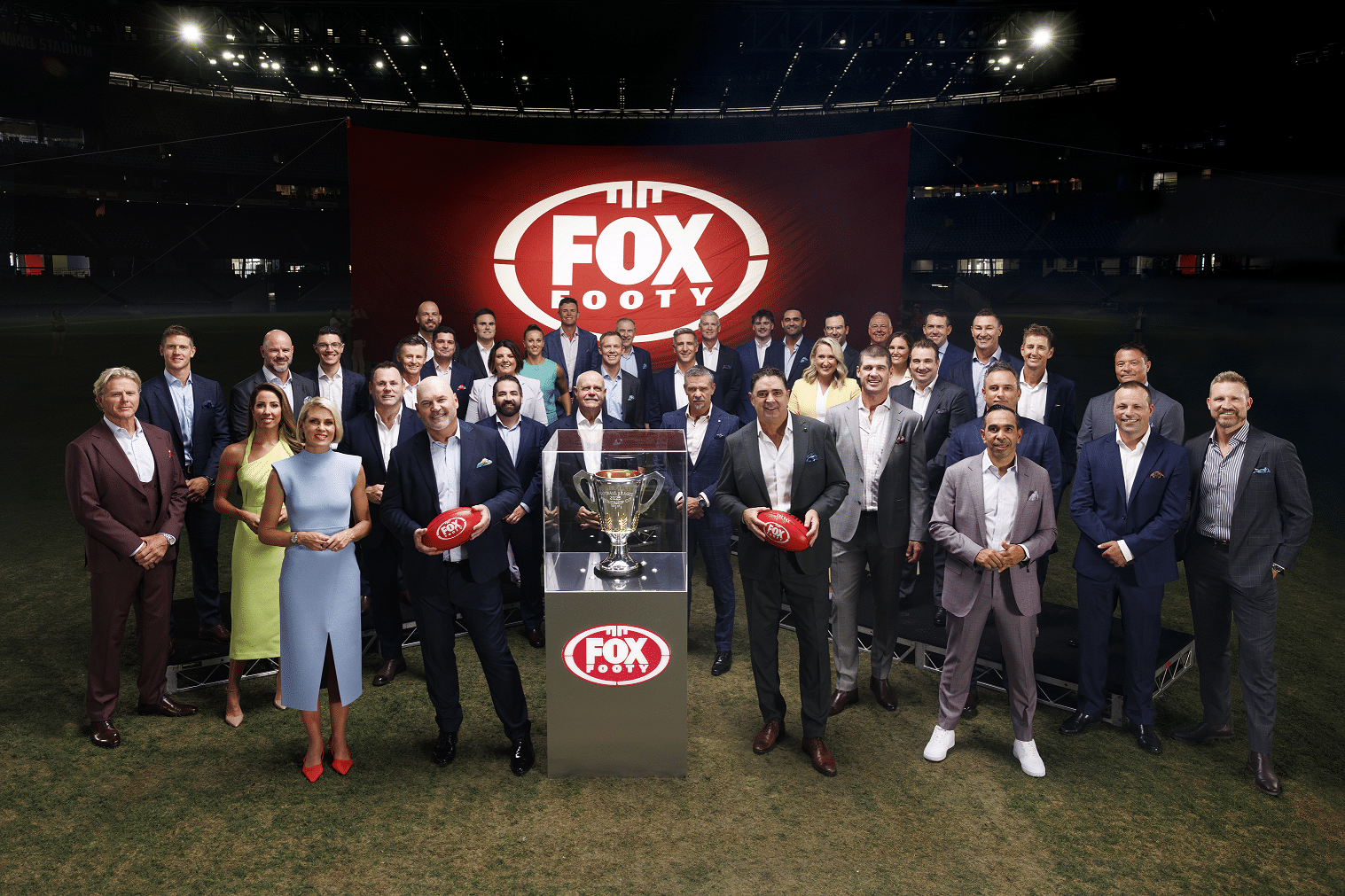

Analyzing Kayo Sports Approach To Streaming Market Leadership

Apr 12, 2025

Analyzing Kayo Sports Approach To Streaming Market Leadership

Apr 12, 2025 -

Jdwl W Ntayj Kaml Hfth 26 Lyg Brtr Fwtbal Ayran

Apr 12, 2025

Jdwl W Ntayj Kaml Hfth 26 Lyg Brtr Fwtbal Ayran

Apr 12, 2025 -

Mac De Marcos New Album Tour Dates And Release Hints

Apr 12, 2025

Mac De Marcos New Album Tour Dates And Release Hints

Apr 12, 2025 -

Masters 2024 Sungjae Ims Solid 71 Defies Augustas Challenge

Apr 12, 2025

Masters 2024 Sungjae Ims Solid 71 Defies Augustas Challenge

Apr 12, 2025 -

Where Is He Now An Update On Simon Helberg After The Big Bang Theory

Apr 12, 2025

Where Is He Now An Update On Simon Helberg After The Big Bang Theory

Apr 12, 2025