US Crypto Drive Threatens Europe's Financial Independence: EU Official Sounds Alarm

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Crypto Drive Threatens Europe's Financial Independence: EU Official Sounds Alarm

Europe's financial sovereignty is under threat from the United States' growing dominance in the cryptocurrency sector, a senior EU official warned today. The escalating concerns highlight a deepening transatlantic rift over regulatory power and the future of global finance. This isn't just about technological innovation; it's about geopolitical control.

The stark warning comes amidst a flurry of activity in the US crypto market, with significant investment flowing into American-based exchanges and infrastructure. This, coupled with the US's increasingly assertive approach to regulating digital assets, is causing alarm bells to ring in Brussels.

H2: The Growing US Influence in Crypto

The US currently holds a significant lead in the global cryptocurrency landscape. This advantage stems from:

- Early adoption and investment: The US has been a hotbed for cryptocurrency innovation and investment since Bitcoin's inception.

- Regulatory frameworks (however imperfect): While still evolving, the US is actively developing regulatory frameworks for crypto, attracting both businesses and investors seeking legal clarity.

- Technological infrastructure: Major crypto exchanges and blockchain technology companies are largely headquartered in the US.

This dominance, according to the unnamed EU official who spoke on condition of anonymity, poses a direct threat to the EU's ambition to build a robust and independent digital financial ecosystem.

H2: EU Concerns: Beyond Simple Competition

The EU's concern transcends simple economic competition. The official emphasized that the US's growing influence in crypto carries significant geopolitical implications:

- Data sovereignty: The concentration of crypto data and transactions in the US raises concerns about data privacy and the potential for surveillance.

- Financial control: A US-dominated crypto market could grant the US significant leverage over the EU's financial system. This includes the ability to influence transactions, potentially freezing assets or even imposing sanctions.

- Regulatory disparities: Differences in regulatory approaches between the US and EU could create fragmentation in the global crypto market, hindering innovation and potentially harming European businesses.

H3: The EU's Response: A Race Against Time

The EU is actively working to counter this growing influence. The Markets in Crypto-Assets (MiCA) regulation, expected to come into force next year, aims to create a comprehensive regulatory framework for crypto within the EU. However, the official acknowledged that the EU faces a significant challenge in catching up with the US's head start. "We need to act decisively and swiftly," the official stated, "or risk falling behind irrevocably."

H2: The Future of Transatlantic Cooperation on Crypto

The situation highlights a growing divergence between the US and EU on regulatory approaches to crypto. While collaboration is crucial for the stable development of the global crypto market, the current situation suggests a potential for conflict. The EU's pursuit of financial independence in the crypto space necessitates a proactive and strategic response. The coming years will be crucial in determining whether the EU can successfully navigate this challenge and maintain its financial autonomy in the age of digital assets. The success or failure of MiCA will be a key indicator of the EU's ability to assert its position in the global crypto landscape and mitigate the potential threat to its financial independence posed by the US.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Crypto Drive Threatens Europe's Financial Independence: EU Official Sounds Alarm. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

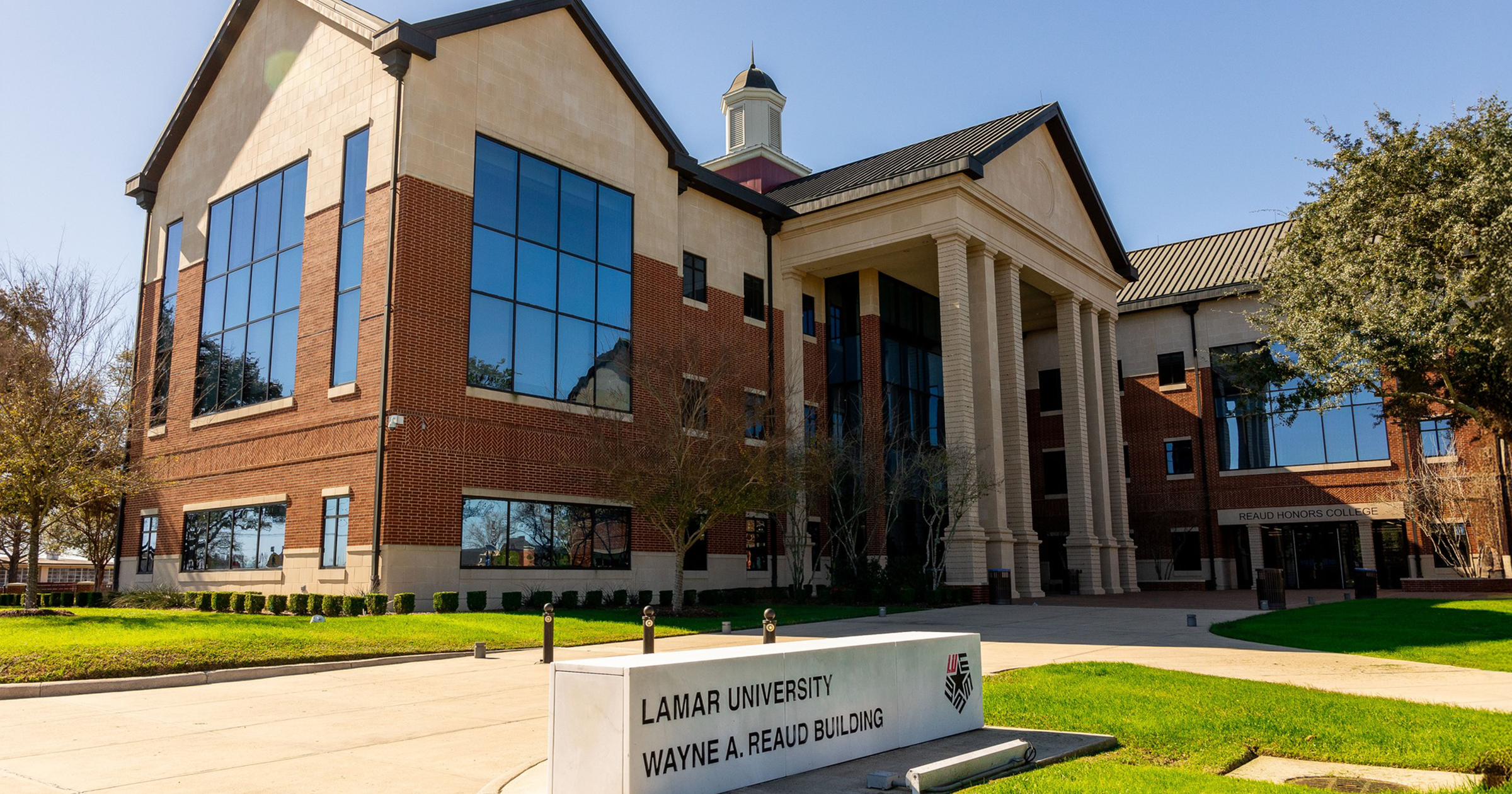

Official Historic Designation Confers New Protections On Lamar

Mar 13, 2025

Official Historic Designation Confers New Protections On Lamar

Mar 13, 2025 -

Apple Mac Book Air M4 Review A Balanced Look At Power And Portability

Mar 13, 2025

Apple Mac Book Air M4 Review A Balanced Look At Power And Portability

Mar 13, 2025 -

Terzics Plan Dortmund Aims To Hone Attack Ahead Of Lille Clash

Mar 13, 2025

Terzics Plan Dortmund Aims To Hone Attack Ahead Of Lille Clash

Mar 13, 2025 -

Sergen Yalcin In Arda Gueler Hakkindaki Aciklamasi Detaylar Ve Tepkiler

Mar 13, 2025

Sergen Yalcin In Arda Gueler Hakkindaki Aciklamasi Detaylar Ve Tepkiler

Mar 13, 2025 -

Krakens Uk Expansion E Money License Paves Way For Improved Fiat And Crypto Access

Mar 13, 2025

Krakens Uk Expansion E Money License Paves Way For Improved Fiat And Crypto Access

Mar 13, 2025