US Debt And Deficit: Realistic Solutions For Economic Recovery And Tax Reform

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Debt and Deficit: Realistic Solutions for Economic Recovery and Tax Reform

The US national debt continues its relentless climb, sparking anxieties about economic stability and future prosperity. This isn't just a headline; it's a complex issue impacting every American. Understanding the problem requires examining both the staggering debt and the persistent annual deficit, and then exploring realistic, politically viable solutions involving economic recovery and comprehensive tax reform.

The Looming Debt Crisis: Understanding the Numbers

The US national debt currently exceeds $31 trillion, a figure that dwarfs the size of most national economies. This massive debt isn't just a number on a spreadsheet; it represents a significant financial burden, impacting interest payments, government spending priorities, and ultimately, the economic well-being of citizens. The annual deficit, the difference between government spending and revenue, consistently adds to this already substantial debt. This unsustainable trajectory necessitates immediate and decisive action.

Contributing Factors: A Multifaceted Problem

Several factors contribute to this fiscal predicament. These include:

- Increased Government Spending: Entitlement programs like Social Security and Medicare, coupled with rising defense spending and other government initiatives, contribute significantly to the deficit.

- Tax Cuts and Revenue Shortfalls: Recent tax cuts, while stimulating economic growth in the short term, have also reduced government revenue, exacerbating the deficit.

- Economic Slowdowns and Recessions: Economic downturns decrease tax revenue while simultaneously increasing the demand for government safety nets, further widening the deficit.

- Lack of Fiscal Discipline: The consistent failure to prioritize long-term fiscal responsibility has allowed the debt to balloon unchecked.

Realistic Solutions: A Path Towards Fiscal Sustainability

Addressing this crisis requires a multi-pronged approach that tackles both spending and revenue:

1. Spending Reforms:

- Entitlement Program Reform: Addressing the long-term solvency of Social Security and Medicare is crucial. This may involve gradually raising the retirement age, adjusting benefit formulas, or increasing contribution rates.

- Targeted Spending Cuts: Identifying areas of government spending that are inefficient or redundant is essential. This requires careful analysis and prioritization of essential services.

- Improved Efficiency and Transparency: Streamlining government operations and increasing transparency in spending can help reduce waste and improve accountability.

2. Tax Reform:

- Broadening the Tax Base: Closing tax loopholes and ensuring that all individuals and corporations pay their fair share is paramount. This could involve simplifying the tax code and eliminating deductions that disproportionately benefit high-income earners.

- Reforming Corporate Taxation: Implementing a more competitive and efficient corporate tax system can encourage investment and economic growth. This could include lowering the corporate tax rate while simultaneously broadening the tax base.

- Addressing Tax Avoidance: Strengthening enforcement mechanisms to combat tax evasion and avoidance is crucial for increasing government revenue.

3. Economic Growth Strategies:

- Investment in Infrastructure: Investing in infrastructure projects can boost economic growth, create jobs, and improve productivity.

- Education and Skills Development: Investing in education and skills development can increase the productivity of the workforce and improve long-term economic prospects.

- Promoting Innovation and Technological Advancement: Encouraging innovation and technological advancement can lead to increased economic growth and higher tax revenue.

Conclusion: A Collaborative Effort

Solving the US debt and deficit crisis requires a bipartisan effort. No single solution will suffice; instead, a comprehensive strategy that combines spending reforms, tax reform, and economic growth strategies is necessary. Addressing this challenge proactively will ensure a more stable and prosperous future for generations to come. Ignoring the problem will only lead to more severe consequences down the line. The time for decisive action is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Debt And Deficit: Realistic Solutions For Economic Recovery And Tax Reform. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Third Term Ambitions Exploring The Feasibility And Implications

Mar 30, 2025

Trumps Third Term Ambitions Exploring The Feasibility And Implications

Mar 30, 2025 -

Mlb Tv Announces 2025 Lineup Local Team Streaming Now Included

Mar 30, 2025

Mlb Tv Announces 2025 Lineup Local Team Streaming Now Included

Mar 30, 2025 -

Bayerns Rueckstand Leverkusens Letzte Hoffnung Im Titelkampf

Mar 30, 2025

Bayerns Rueckstand Leverkusens Letzte Hoffnung Im Titelkampf

Mar 30, 2025 -

Ian Hamiltons Health Update Return Planned For Early April

Mar 30, 2025

Ian Hamiltons Health Update Return Planned For Early April

Mar 30, 2025 -

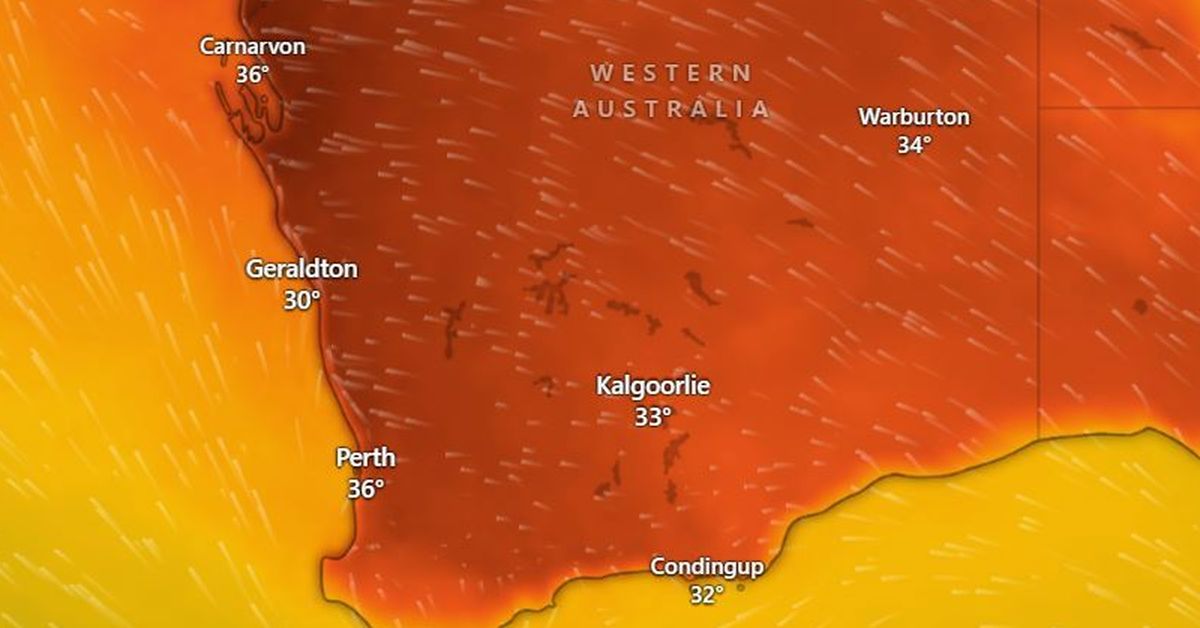

Autumn Heatwave Western Australia Battles Near Record Breaking Temperatures

Mar 30, 2025

Autumn Heatwave Western Australia Battles Near Record Breaking Temperatures

Mar 30, 2025