US Economic Outlook: Americans' Optimism Hits Near-Record Low Point

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Economic Outlook: Americans' Optimism Hits Near-Record Low Point

A wave of pessimism washes over the nation as consumer confidence plummets, signaling potential trouble ahead for the US economy.

The American dream is looking a little less rosy these days. Recent data reveals a stark reality: consumer confidence has plummeted to near-record lows, painting a concerning picture of the US economic outlook. This widespread pessimism among American consumers could have significant implications for spending, investment, and overall economic growth.

The latest consumer confidence index, released [Insert Date and Source of Data Here – e.g., by the Conference Board], shows a dramatic decline, reaching its lowest point since [Insert Previous Low Point and Date]. This significant drop signals a growing unease amongst Americans regarding the current economic climate and future prospects. Several factors contribute to this alarming trend.

Inflation Remains a Major Culprit

Soaring inflation continues to erode purchasing power, leaving many Americans struggling to make ends meet. The rising cost of essential goods, including groceries, gasoline, and housing, is a major contributor to the decline in consumer confidence. This persistent inflation is forcing families to cut back on discretionary spending, impacting businesses across various sectors. Experts warn that this downward spiral could lead to a slowdown in economic activity.

- Grocery prices: Food costs have risen significantly, leaving many families struggling to afford nutritious meals.

- Gas prices: Fluctuating and often high gas prices impact commuting costs and overall household budgets.

- Housing costs: Rent and mortgage payments continue to climb, placing a substantial strain on household finances.

Interest Rate Hikes Exacerbate Concerns

The Federal Reserve's aggressive interest rate hikes, aimed at combating inflation, are also contributing to the gloomy outlook. While intended to cool the economy and curb price increases, these hikes increase borrowing costs for businesses and consumers, potentially stifling investment and consumer spending. The uncertainty surrounding the effectiveness of these policies further fuels public anxiety.

The Labor Market: A Glimmer of Hope?

While the overall picture appears bleak, the robust labor market offers a small measure of comfort. Unemployment remains relatively low, providing some support to consumer spending. However, even this positive aspect is tempered by concerns about wage growth not keeping pace with inflation, effectively leaving many feeling financially stagnant.

What Lies Ahead for the US Economy?

The near-record low in consumer confidence raises serious questions about the future trajectory of the US economy. Economists are divided on the potential consequences, with some predicting a mild recession while others remain cautiously optimistic. The coming months will be crucial in determining the severity of the situation and the effectiveness of government and Federal Reserve policies in mitigating the negative impacts.

Key takeaways:

- Consumer confidence is at near-record lows, reflecting significant economic anxieties.

- Inflation and interest rate hikes are the primary drivers of this pessimism.

- A strong labor market offers some counterbalance, but wage growth lags behind inflation.

- The future economic outlook remains uncertain, with potential risks including a mild recession.

Staying informed about economic developments is crucial for navigating these challenging times. Continue to monitor reputable news sources and financial publications for updates and expert analysis. Understanding the economic landscape empowers you to make informed financial decisions and plan for the future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Economic Outlook: Americans' Optimism Hits Near-Record Low Point. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Energy Drink Ingredient Linked To Increased Blood Cancer Risk

May 16, 2025

Energy Drink Ingredient Linked To Increased Blood Cancer Risk

May 16, 2025 -

Situacao Critica No Rs Chuvas Deixam Balanco De 75 Mortes E Falhas Em Abastecimento

May 16, 2025

Situacao Critica No Rs Chuvas Deixam Balanco De 75 Mortes E Falhas Em Abastecimento

May 16, 2025 -

Netflixs Highly Anticipated Game A New Update

May 16, 2025

Netflixs Highly Anticipated Game A New Update

May 16, 2025 -

Lucasfilms Ai Experiment A Two Minute Star Wars Film Gone Wrong

May 16, 2025

Lucasfilms Ai Experiment A Two Minute Star Wars Film Gone Wrong

May 16, 2025 -

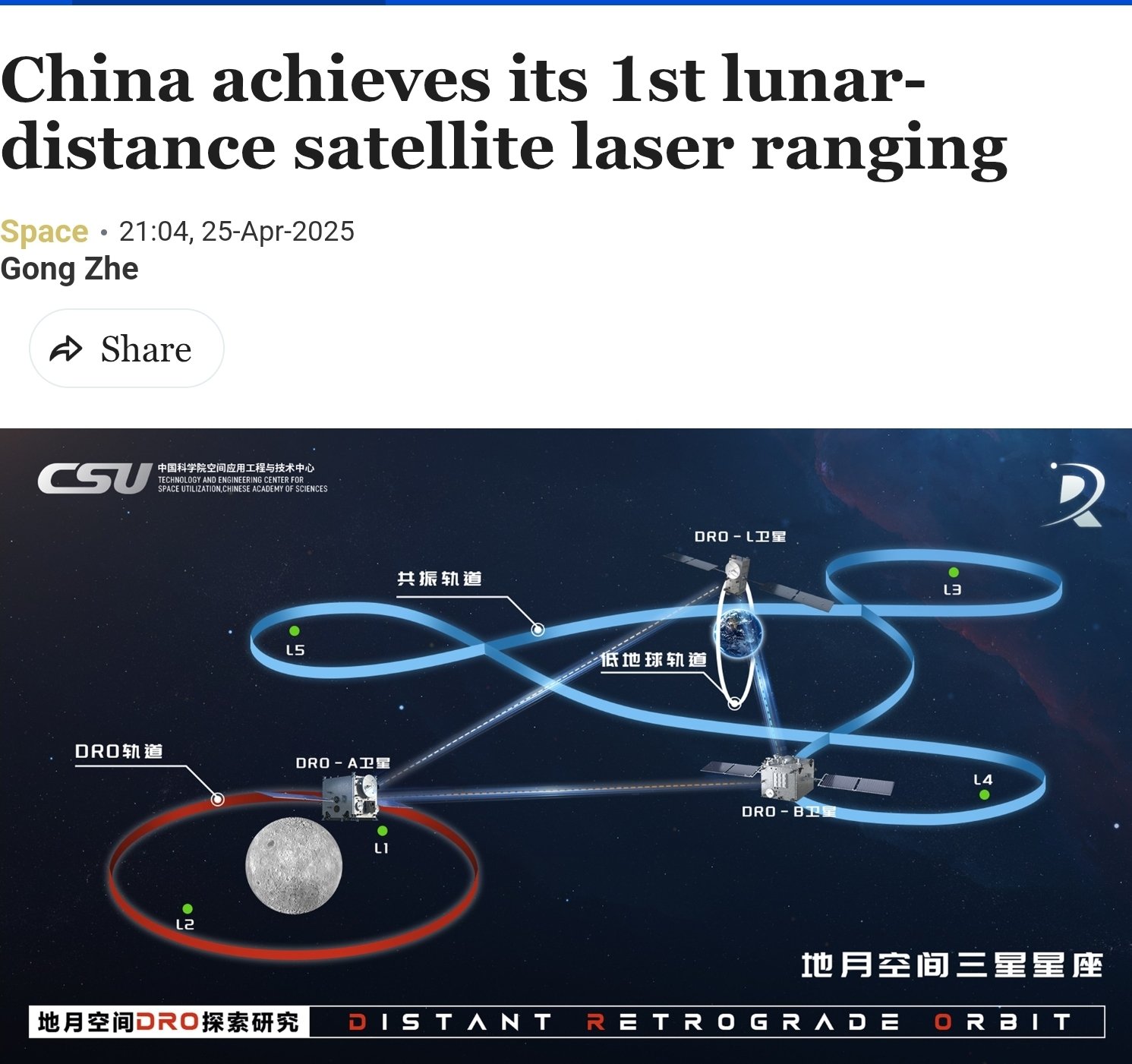

Lunar Laser Ranging A New Milestone Achieved By Chinese Satellite Technology

May 16, 2025

Lunar Laser Ranging A New Milestone Achieved By Chinese Satellite Technology

May 16, 2025