US Stock Market Crash: Dow Jones Total Market Index Down 6%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Stock Market Crash: Dow Jones Total Market Index Plunges 6% – What Went Wrong?

The US stock market experienced a significant downturn today, with the Dow Jones Total Market Index plummeting by a shocking 6%. This dramatic fall sent shockwaves through Wall Street, leaving investors reeling and prompting urgent questions about the underlying causes and potential future consequences. This unprecedented drop marks the market's worst single-day performance in several months and signals a potential shift in market sentiment.

What Triggered the Plunge?

While pinpointing a single cause for such a drastic market correction is difficult, several factors likely contributed to today's crash:

-

Rising Interest Rates: The Federal Reserve's persistent efforts to combat inflation through interest rate hikes continue to pressure the market. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate profitability. This uncertainty is a major factor driving investors to seek safer havens.

-

Inflationary Pressures: Stubbornly high inflation remains a significant concern. While recent data showed a slight easing, the fear of persistent inflation continues to erode investor confidence. The market is anxiously awaiting further economic indicators to gauge the effectiveness of the Fed's actions.

-

Geopolitical Instability: Ongoing geopolitical tensions, particularly the war in Ukraine and escalating trade disputes, contribute to market volatility. Uncertainty about global supply chains and energy prices adds to the overall risk aversion.

-

Tech Sector Weakness: The technology sector, a major driver of the market's recent performance, experienced a significant downturn. Concerns over valuations and slowing growth in the tech industry likely exacerbated the overall market decline.

Impact on Investors and the Economy:

The 6% drop in the Dow Jones Total Market Index represents a substantial loss for many investors. Retirement accounts, investment portfolios, and overall market wealth have been significantly impacted. This sharp decline could also have broader economic consequences, potentially dampening consumer confidence and impacting business investment.

What Happens Next?

The immediate aftermath of this market crash will be characterized by uncertainty and volatility. Analysts are divided on the market's future trajectory. Some predict a further correction, while others believe this represents a temporary setback before a potential rebound. However, one thing is certain: investors will be closely monitoring economic data, Federal Reserve announcements, and geopolitical developments for clues about the market's next move.

Navigating the Market Volatility:

For investors, this period underscores the importance of:

- Diversification: Spreading investments across different asset classes can help mitigate risk during market downturns.

- Long-Term Perspective: Maintaining a long-term investment strategy is crucial, avoiding panic selling in response to short-term market fluctuations.

- Professional Advice: Seeking guidance from a qualified financial advisor can provide valuable insights and help navigate challenging market conditions.

The 6% drop in the Dow Jones Total Market Index is a significant event with potential long-term implications. While the immediate future remains uncertain, understanding the contributing factors and adopting a well-informed investment strategy are crucial for navigating this turbulent period. Stay informed, stay vigilant, and consult with financial professionals for personalized guidance. The market's future remains to be seen, but proactive planning is essential in mitigating risk and weathering the storm.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Stock Market Crash: Dow Jones Total Market Index Down 6%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Ultimate Face Off Rey Mysterio Vs El Grande Americano

Apr 08, 2025

The Ultimate Face Off Rey Mysterio Vs El Grande Americano

Apr 08, 2025 -

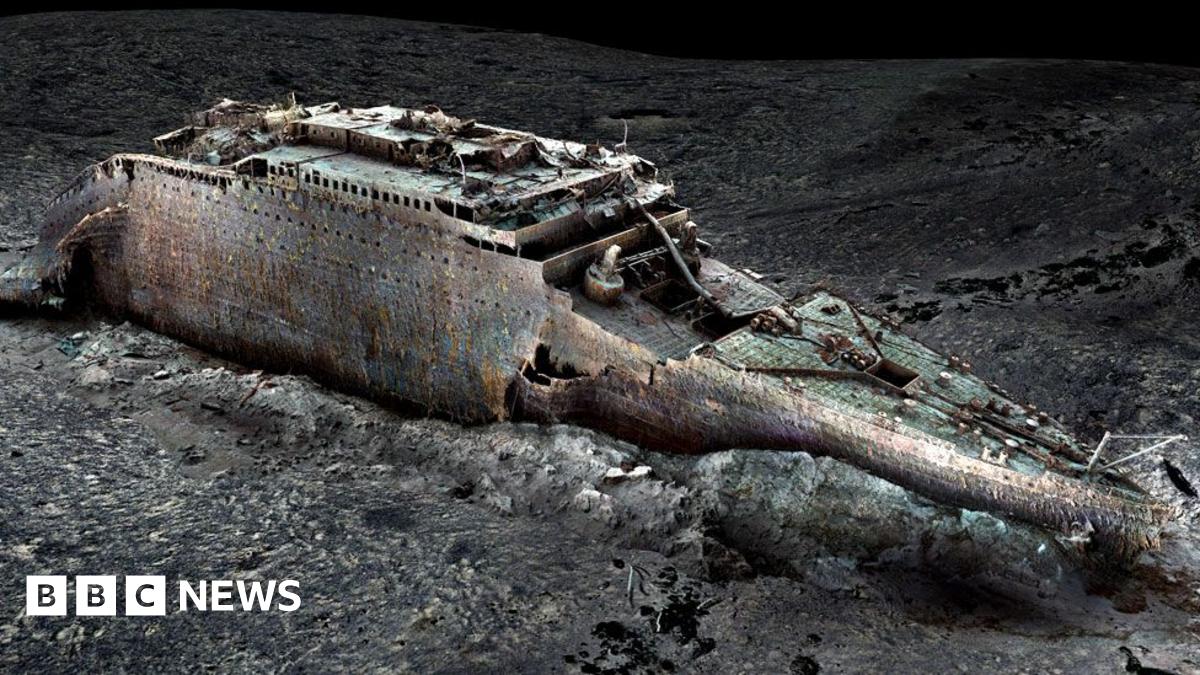

Sonar Scan Reveals Stunning Details Of Titanics Last Moments

Apr 08, 2025

Sonar Scan Reveals Stunning Details Of Titanics Last Moments

Apr 08, 2025 -

New Ge Force Rtx 5060 And 5060 Ti Pre Built Pcs Announced Starting Under 1200

Apr 08, 2025

New Ge Force Rtx 5060 And 5060 Ti Pre Built Pcs Announced Starting Under 1200

Apr 08, 2025 -

The Narrow Road To The Deep North Jacob Elordi Discusses His Role And Passion

Apr 08, 2025

The Narrow Road To The Deep North Jacob Elordi Discusses His Role And Passion

Apr 08, 2025 -

Gerdau Rs Sofre Com Chuvas E Empresa Suspende Atividades

Apr 08, 2025

Gerdau Rs Sofre Com Chuvas E Empresa Suspende Atividades

Apr 08, 2025