US Stock Market Freefall: Dow Futures Drop 1300 Points Amid Tariff Crisis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Stock Market Freefall: Dow Futures Plunge 1300 Points Amid Tariff Crisis

The US stock market is experiencing a dramatic freefall, with Dow futures plummeting over 1300 points in pre-market trading. This sharp decline, fueled by escalating trade tensions and a renewed tariff crisis, signals a potential deepening of the ongoing economic uncertainty. Investors are reacting with fear to the latest developments, raising concerns about a potential recession.

Tariff Crisis Intensifies: The Catalyst for the Market Crash

The immediate trigger for this market meltdown appears to be the escalating trade war between the US and [mention specific country, e.g., China]. The announcement of [mention specific tariff announcement, e.g., new tariffs on imported goods] sent shockwaves through the financial markets, igniting a wave of selling pressure. This action follows a period of relative calm, leading many analysts to believe that the market was already teetering on the edge. The renewed escalation underscores the fragility of the global economy and the significant impact of trade policy on investor sentiment.

Dow Futures Plummet: A Sign of Deeper Economic Worries?

The 1300-point drop in Dow futures is a stark indicator of the severity of the situation. This unprecedented pre-market plunge suggests that investors are anticipating a significant negative opening for the broader market. This level of volatility highlights the deep-seated anxieties surrounding the ongoing trade disputes and their potential ripple effects across various sectors of the economy. Beyond tariffs, concerns about [mention other contributing factors, e.g., slowing global growth, rising interest rates] are further contributing to the market's anxieties.

What This Means for Investors:

The current market turmoil presents a challenging landscape for investors. Several key considerations emerge from this dramatic downturn:

- Increased Volatility: Expect significantly increased market volatility in the coming days and weeks. Sharp swings are likely to become the norm as investors grapple with the uncertainty.

- Risk Assessment: A thorough review of individual investment portfolios is crucial. Diversification and risk management strategies need to be reassessed in light of this heightened uncertainty.

- Long-Term Perspective: While short-term market fluctuations are unsettling, maintaining a long-term investment perspective is vital. Panic selling is rarely a sound investment strategy.

- Seek Professional Advice: Consulting with a qualified financial advisor is highly recommended, particularly for those with significant investment holdings.

Beyond the Dow: Broader Market Impact

The impact extends far beyond the Dow Jones Industrial Average. Other major indices, including the S&P 500 and Nasdaq, are also experiencing significant declines, indicating a broad-based sell-off across the market. This widespread negative sentiment suggests that the current crisis is not isolated to a specific sector but reflects broader systemic concerns.

Looking Ahead: Uncertainty Remains

The future direction of the market remains uncertain. Much depends on the response of policymakers and the evolution of the trade situation. A de-escalation of tensions could potentially lead to a market rebound, but further escalation could trigger even more dramatic declines. For now, investors must brace themselves for continued volatility and remain vigilant in monitoring the evolving economic landscape. The current freefall serves as a stark reminder of the interconnectedness of global markets and the significant influence of geopolitical events on investor confidence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Stock Market Freefall: Dow Futures Drop 1300 Points Amid Tariff Crisis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

65 Price Point For Original Switch Games On Nintendo Switch 2 In The Uk

Apr 08, 2025

65 Price Point For Original Switch Games On Nintendo Switch 2 In The Uk

Apr 08, 2025 -

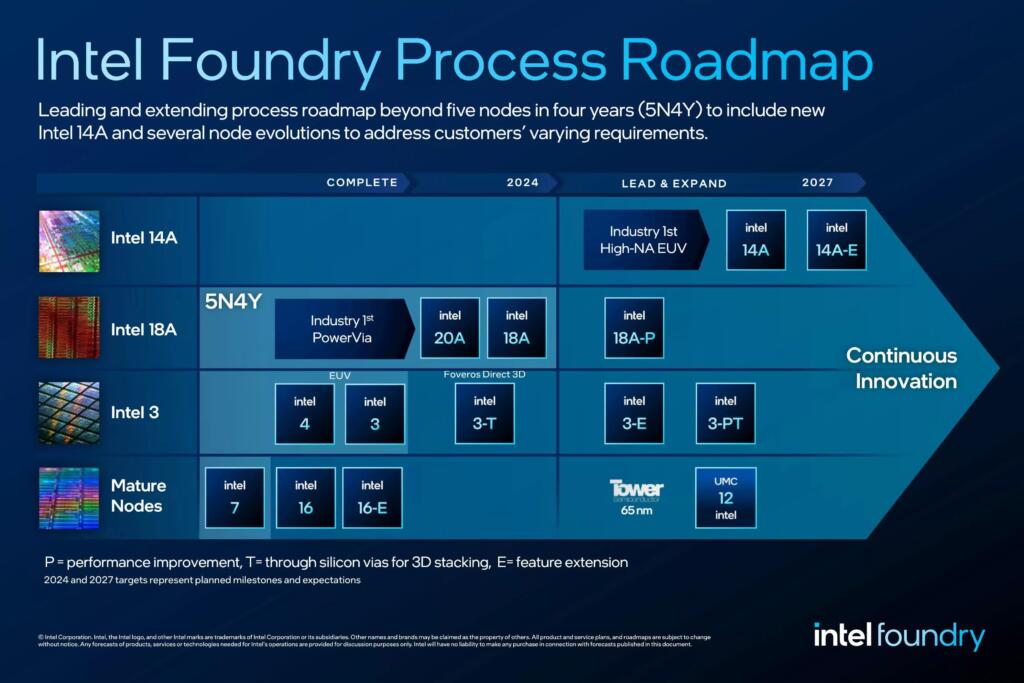

Intels 18 A Chips 2025 Production Ramp Up Signals A Resurgent Intel

Apr 08, 2025

Intels 18 A Chips 2025 Production Ramp Up Signals A Resurgent Intel

Apr 08, 2025 -

Tariff Chaos Deepens As Stock Market Plunges Trump Offers Dialogue

Apr 08, 2025

Tariff Chaos Deepens As Stock Market Plunges Trump Offers Dialogue

Apr 08, 2025 -

English Premier League Powerhouses Real Madrid And Psgs Quarterfinal Hurdles

Apr 08, 2025

English Premier League Powerhouses Real Madrid And Psgs Quarterfinal Hurdles

Apr 08, 2025 -

Quantum Mechanics A Potential Solution For Joystick Drift

Apr 08, 2025

Quantum Mechanics A Potential Solution For Joystick Drift

Apr 08, 2025