US Stock Market Freefall: Pressure Mounts On Federal Reserve Chair

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Stock Market Freefall: Pressure Mounts on Federal Reserve Chair Jerome Powell

The US stock market experienced a dramatic freefall this week, sending shockwaves through Wall Street and intensifying pressure on Federal Reserve Chair Jerome Powell. The Dow Jones Industrial Average plummeted [insert percentage and points], its worst single-day drop in [time period], while the S&P 500 and Nasdaq Composite also suffered significant losses. This sharp downturn has fueled intense scrutiny of the Fed's monetary policy and its role in the current economic turmoil.

This unprecedented market volatility comes amidst growing concerns about [mention specific economic concerns, e.g., inflation, rising interest rates, recessionary fears]. The rapid increase in interest rates by the Federal Reserve, aimed at curbing inflation, is now being blamed by many analysts for exacerbating the market downturn. The question on everyone's mind is: has the Fed gone too far, and what will be the next move?

<h3>The Fed's Tightrope Walk: Inflation vs. Recession</h3>

The Federal Reserve finds itself in a precarious position. Its primary mandate is to maintain price stability and maximum employment. However, tackling stubbornly high inflation with aggressive interest rate hikes risks triggering a recession. The current market freefall suggests that the balance between these two crucial goals is becoming increasingly difficult to achieve.

Several key factors are contributing to the market's anxiety:

- Persistent Inflation: Despite recent attempts to cool inflation, prices remain stubbornly high, eroding consumer purchasing power and impacting corporate profits.

- Aggressive Rate Hikes: The Fed's rapid increase in interest rates, while intended to curb inflation, is also slowing economic growth and increasing borrowing costs for businesses and consumers.

- Geopolitical Uncertainty: Global events, such as the war in Ukraine and ongoing tensions between the US and China, further add to economic instability and market uncertainty.

- Investor Sentiment: Negative investor sentiment is feeding on itself, creating a vicious cycle of selling and further price declines.

<h3>Powell Under the Microscope: What's Next for Monetary Policy?</h3>

Jerome Powell's leadership is now facing intense scrutiny. Critics argue that the Fed's aggressive rate hikes are unnecessarily harsh and are driving the economy towards a recession. Others maintain that the Fed needs to remain resolute in its fight against inflation, even if it means accepting some short-term economic pain.

The coming weeks will be crucial. Analysts are closely watching for any signs of a shift in the Fed's monetary policy. Will Powell and the Federal Open Market Committee (FOMC) continue their aggressive approach, or will they opt for a more cautious, data-driven strategy? The answer will have significant implications for the US economy and global markets. Any hint of a pivot towards a less hawkish stance could potentially soothe market jitters, while a continuation of the current trajectory might further exacerbate the freefall.

<h3>Looking Ahead: Navigating Market Uncertainty</h3>

The current situation underscores the inherent risks associated with volatile markets. Investors are grappling with significant uncertainty, and navigating this turbulent environment requires careful planning and a well-diversified portfolio. Seeking advice from qualified financial advisors is crucial during times of such economic instability.

The US stock market freefall and the pressure on Jerome Powell represent a critical juncture in the US economy. The coming weeks and months will be pivotal in determining the trajectory of the market and the effectiveness of the Fed's response to the challenges at hand. The situation is fluid, and continuous monitoring of economic indicators and Fed pronouncements is necessary for informed decision-making. This dynamic situation requires constant vigilance and adaptation from both policymakers and investors alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Stock Market Freefall: Pressure Mounts On Federal Reserve Chair. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Razer Blade 16 2025 Can Ultra Thin Design Deliver Ultra Settings Gaming

Apr 22, 2025

Razer Blade 16 2025 Can Ultra Thin Design Deliver Ultra Settings Gaming

Apr 22, 2025 -

Who Is Christy Lee Getting To Know Post Malones Partner

Apr 22, 2025

Who Is Christy Lee Getting To Know Post Malones Partner

Apr 22, 2025 -

Shenyang Auto Expo Highlights Flaws In Huaweis Advanced Driving Capabilities

Apr 22, 2025

Shenyang Auto Expo Highlights Flaws In Huaweis Advanced Driving Capabilities

Apr 22, 2025 -

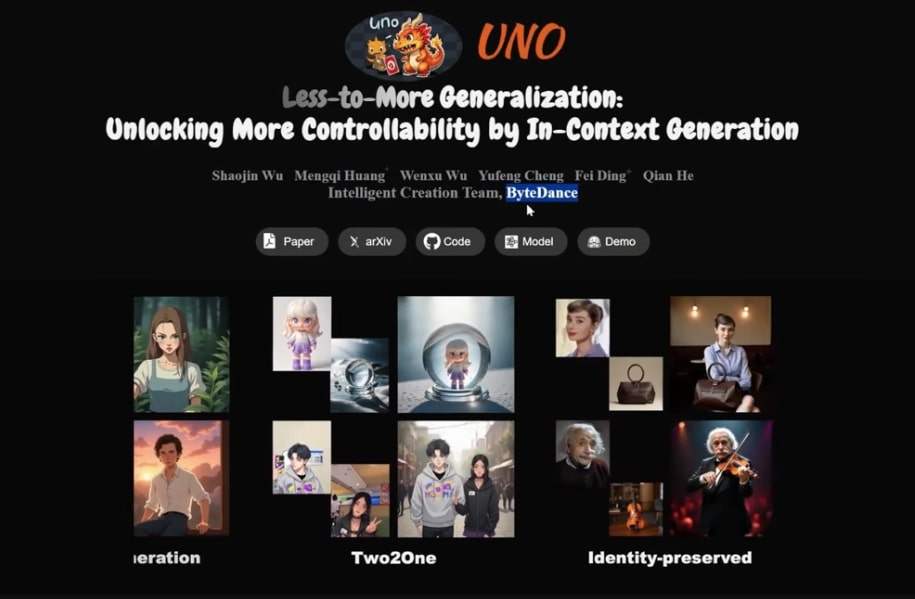

Revolutionizing Image Editing Ai For Photo Composition And Combination

Apr 22, 2025

Revolutionizing Image Editing Ai For Photo Composition And Combination

Apr 22, 2025 -

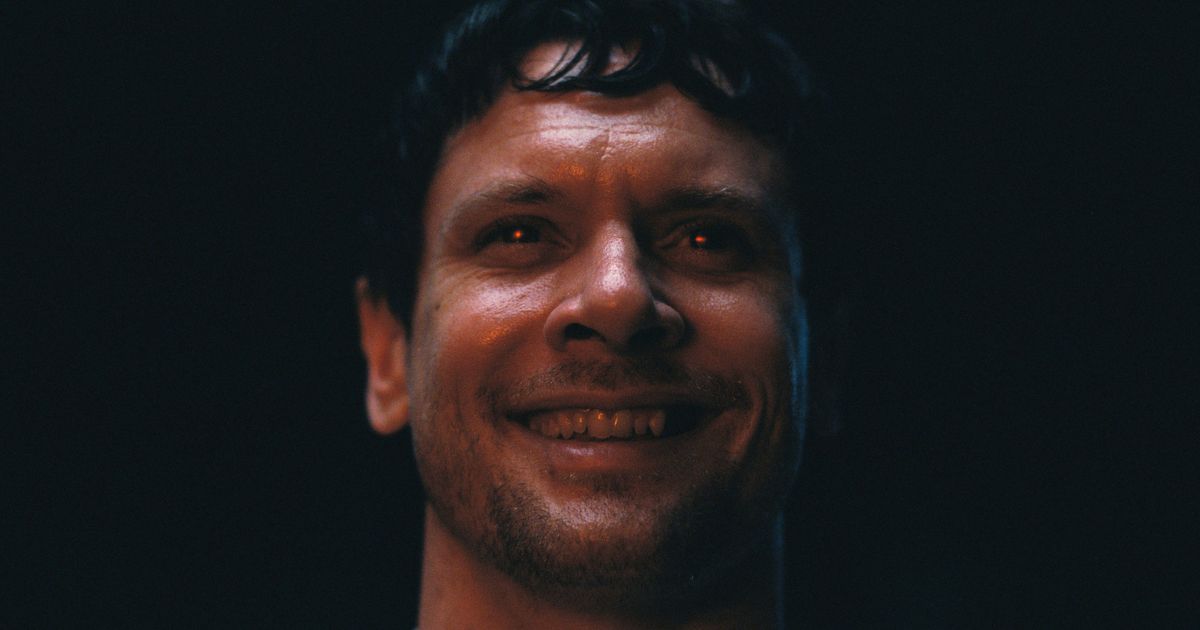

The Unexpected Horror Of Irish Dance In Sinners

Apr 22, 2025

The Unexpected Horror Of Irish Dance In Sinners

Apr 22, 2025