US Stock Market Meltdown: Dow Jones Total Market Index Down Nearly 6%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Stock Market Meltdown: Dow Jones Total Market Index Plunges Nearly 6% – What Happened?

The US stock market experienced a significant downturn on [Date of Market Crash], with the Dow Jones Total Market Index plummeting nearly 6%. This dramatic fall sent shockwaves through Wall Street and sparked widespread concern among investors. This unprecedented drop marks one of the worst single-day declines in recent memory, raising crucial questions about the future of the US economy.

What Triggered the Market Crash?

While pinpointing a single cause for such a dramatic market shift is complex, several contributing factors likely played a role:

-

Rising Interest Rates: The Federal Reserve's continued efforts to combat inflation through interest rate hikes have significantly increased borrowing costs for businesses and consumers. This dampens economic activity and reduces corporate profits, leading to decreased investor confidence.

-

Inflationary Pressures: Persistent inflation continues to erode purchasing power and fuel uncertainty about future economic growth. High inflation erodes corporate profit margins and makes future earnings projections less certain, impacting stock valuations.

-

Geopolitical Instability: Ongoing geopolitical tensions, particularly the war in Ukraine and escalating trade disputes, contribute to market volatility and investor anxiety. Global uncertainty often translates into a flight to safety, leading to capital outflows from riskier assets like stocks.

-

Tech Sector Weakness: The tech sector, a significant driver of the overall market, experienced a particularly sharp decline. Concerns about overvalued tech stocks and slowing growth in the sector exacerbated the broader market downturn.

Impact on Investors and the Economy:

The nearly 6% drop in the Dow Jones Total Market Index represents a substantial loss for many investors. Retirement accounts, investment portfolios, and even the overall wealth of many Americans have been significantly impacted. This market meltdown also signals potential broader economic consequences:

-

Reduced Consumer Spending: Decreased investor confidence can lead to reduced consumer spending as people become more cautious about their financial future. This can trigger a slowdown in economic growth.

-

Increased Unemployment: Companies may respond to economic uncertainty by cutting costs, potentially leading to job losses and increased unemployment.

-

Potential Recession: While not guaranteed, the severity of the market crash raises concerns about the possibility of a recession. The sustained downturn and negative sentiment could trigger a negative feedback loop, worsening economic conditions.

Looking Ahead: What to Expect?

The immediate future remains uncertain. Market analysts are closely monitoring economic indicators and government policy responses to assess the extent of the damage and predict future market trends. Several key factors will influence the market's recovery:

-

Federal Reserve Policy: The Federal Reserve's future actions regarding interest rates will significantly impact market sentiment. A shift towards a more dovish policy could help stabilize the market, while further rate hikes could exacerbate the downturn.

-

Corporate Earnings Reports: Upcoming corporate earnings reports will provide further insights into the financial health of companies and their ability to withstand economic headwinds.

-

Geopolitical Developments: Resolution or escalation of geopolitical tensions will also have a significant impact on market stability.

Expert Opinions and Advice:

Financial experts recommend maintaining a long-term investment strategy and avoiding panic selling. Diversification of investment portfolios is crucial to mitigate risk during market volatility. Investors should consult with financial advisors to assess their individual risk tolerance and adjust their investment strategies accordingly.

The recent stock market crash underscores the inherent risks associated with investing in the stock market. While market downturns are a normal part of the economic cycle, the magnitude of this decline highlights the need for careful planning, diversification, and a clear understanding of one's risk tolerance. Staying informed about market trends and seeking professional advice are essential steps for navigating market volatility and protecting one's financial future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Stock Market Meltdown: Dow Jones Total Market Index Down Nearly 6%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Indonesia Berduka Murdaya Poo Pemilik Pondok Indah Mall Wafat

Apr 08, 2025

Indonesia Berduka Murdaya Poo Pemilik Pondok Indah Mall Wafat

Apr 08, 2025 -

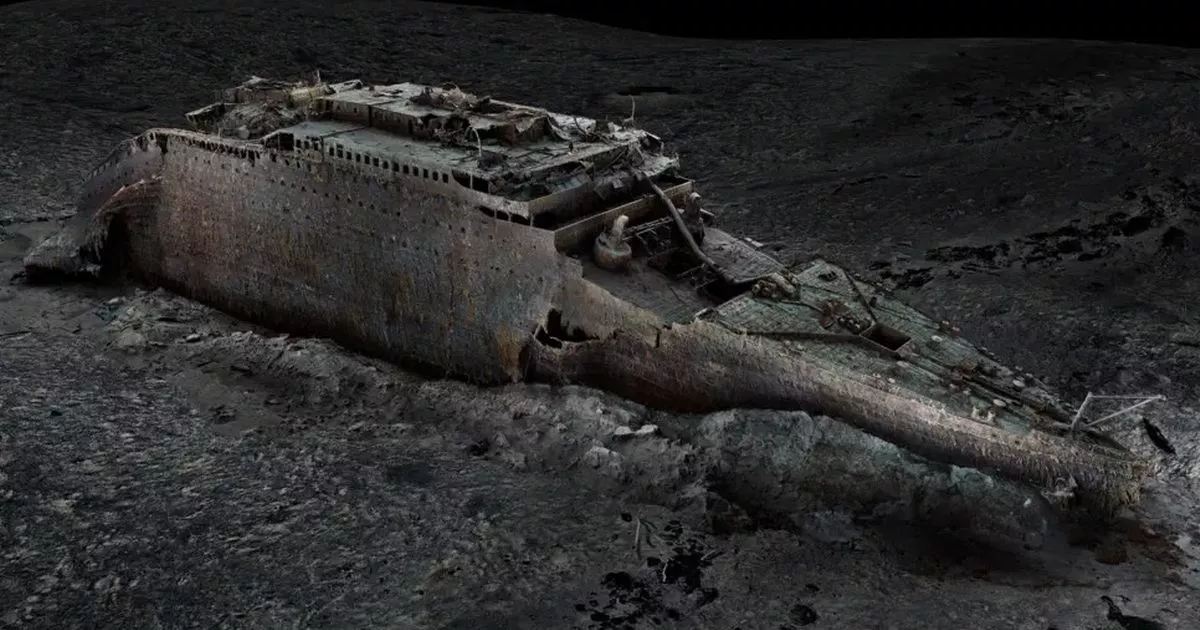

Revolutionary Titanic Wreckage Imagery Unveiling The Sinkings Untold Story

Apr 08, 2025

Revolutionary Titanic Wreckage Imagery Unveiling The Sinkings Untold Story

Apr 08, 2025 -

Will Crow Play Against The Cats Calf Injury Raises Concerns

Apr 08, 2025

Will Crow Play Against The Cats Calf Injury Raises Concerns

Apr 08, 2025 -

Death Of A Unicorn Film Review Witty Social Commentary And Stellar Acting

Apr 08, 2025

Death Of A Unicorn Film Review Witty Social Commentary And Stellar Acting

Apr 08, 2025 -

What To Stream On Hulu In April 2025 The Biggest Movie Releases

Apr 08, 2025

What To Stream On Hulu In April 2025 The Biggest Movie Releases

Apr 08, 2025