US Stocks Tumble Amidst Calls For Fed Chair Removal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Stocks Tumble Amidst Growing Calls for Fed Chair Powell's Removal

Wall Street plunges as pressure mounts on Jerome Powell. The US stock market experienced a significant downturn today, fueled by intensifying calls for the removal of Federal Reserve Chair Jerome Powell. Concerns over the Fed's aggressive interest rate hikes and their impact on the economy are driving the volatility, leaving investors increasingly anxious about the future.

The Dow Jones Industrial Average plummeted [insert percentage] points, closing at [insert closing value], while the S&P 500 and Nasdaq Composite also suffered substantial losses. This sharp decline marks a significant setback after a period of relative market stability, leaving many questioning the Fed's current monetary policy approach.

Mounting Criticism of the Fed's Actions

The recent market turmoil comes amidst a chorus of criticism targeting Jerome Powell and the Federal Reserve. Many economists and political figures are openly questioning the effectiveness of the Fed's strategy in combating inflation. They argue that the aggressive interest rate increases are unnecessarily stifling economic growth and risk triggering a recession.

Key criticisms include:

- Overly aggressive rate hikes: Critics argue the Fed is raising rates too quickly, risking a sharper economic slowdown than necessary.

- Ignoring alternative solutions: Some believe the Fed is neglecting other potential tools to manage inflation, focusing too heavily on interest rate adjustments.

- Lack of transparency: Concerns exist regarding the Fed's communication strategy, with some accusing it of a lack of transparency regarding its decision-making process.

These criticisms have gained traction among both Republican and Democratic lawmakers, adding to the political pressure on Powell. Several prominent figures have publicly called for his resignation or removal, further exacerbating market uncertainty.

Economic Uncertainty Fuels Market Volatility

The uncertainty surrounding the Fed's future direction and the potential for further aggressive rate hikes are the primary drivers behind today's market downturn. Investors are grappling with concerns about:

- A potential recession: The rapid increase in interest rates significantly increases the risk of a recession, impacting corporate earnings and investor confidence.

- Inflationary pressures: Despite the rate hikes, inflation remains stubbornly high, raising concerns about the Fed's ability to effectively control it.

- Impact on the labor market: Rising interest rates can lead to job losses and slow wage growth, further impacting consumer spending and economic growth.

The current economic climate is characterized by a delicate balance between controlling inflation and avoiding a significant economic contraction. The Fed's actions – or inaction – in the coming weeks and months will be crucial in determining the trajectory of the US economy and the stock market.

What to Watch For

The coming weeks will be critical in gauging the market's reaction to the current situation. Investors will be closely monitoring:

- Upcoming Fed announcements: Any further announcements on interest rate hikes or changes in monetary policy will significantly impact market sentiment.

- Economic data releases: Key economic indicators, such as inflation data and employment figures, will provide crucial insights into the health of the US economy.

- Political developments: The ongoing debate surrounding Powell's leadership and the potential for changes at the Fed will continue to influence market sentiment.

The future of the US economy and the stock market remains uncertain. The intense pressure on Jerome Powell and the ongoing debate surrounding the Fed's policies are likely to continue shaping the market's trajectory in the near term. Investors should brace themselves for continued volatility as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Stocks Tumble Amidst Calls For Fed Chair Removal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nee Soon Grc Election 2024 Focus On The Pap Team And Their Campaign

Apr 22, 2025

Nee Soon Grc Election 2024 Focus On The Pap Team And Their Campaign

Apr 22, 2025 -

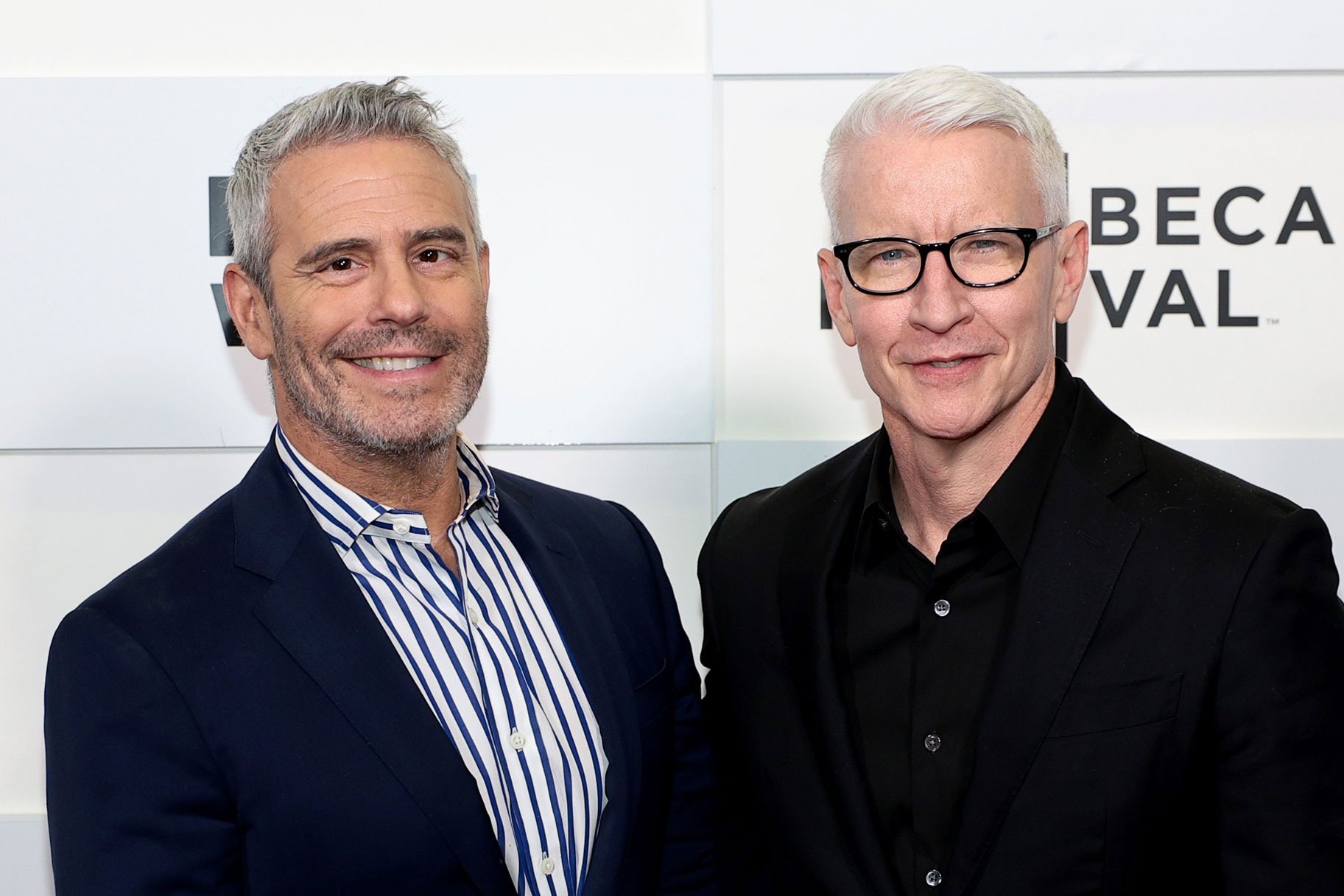

See The Adorable Photos Andy Cohen Shares Daughter Lucys Vacation With Anderson Cooper

Apr 22, 2025

See The Adorable Photos Andy Cohen Shares Daughter Lucys Vacation With Anderson Cooper

Apr 22, 2025 -

The Engineering Marvel Of Universals How To Train Your Dragon Robotics And Animatronics Deep Dive

Apr 22, 2025

The Engineering Marvel Of Universals How To Train Your Dragon Robotics And Animatronics Deep Dive

Apr 22, 2025 -

Nee Soon Grc Pap Team Meet The Candidates And Their Plans

Apr 22, 2025

Nee Soon Grc Pap Team Meet The Candidates And Their Plans

Apr 22, 2025 -

Andy Cohen And Anderson Coopers Spring Break Photos And Highlights From Their Family Trip

Apr 22, 2025

Andy Cohen And Anderson Coopers Spring Break Photos And Highlights From Their Family Trip

Apr 22, 2025