US Treasury Secretary: Bond Market Volatility To Ease

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Secretary: Bond Market Volatility to Ease, Signaling Economic Stability

Recent volatility in the US Treasury bond market is expected to subside, according to Treasury Secretary Janet Yellen, offering a reassuring sign for the broader economy. Yellen's comments, delivered during a press conference on [Date of Press Conference], follow weeks of significant price swings in government bonds, sparking concerns about potential economic instability. Her optimistic outlook suggests a potential calming effect on investor anxieties and a stabilization of borrowing costs for businesses and consumers.

Understanding the Bond Market Volatility:

The recent turbulence in the bond market stemmed from several factors, including rising inflation, the Federal Reserve's monetary policy tightening, and concerns about the US debt ceiling. Higher inflation typically pushes bond yields up as investors demand higher returns to compensate for the erosion of purchasing power. The Fed's interest rate hikes also contribute to rising yields, making existing bonds less attractive compared to newly issued ones with higher interest rates. The debt ceiling debate further added to the uncertainty, increasing risk premiums and driving volatility. These factors combined created a perfect storm for increased market fluctuations.

Yellen's Reassuring Message:

Secretary Yellen expressed confidence that the current volatility is temporary. She highlighted the strength of the US economy, citing [mention specific economic indicators like job growth or consumer spending]. Her statements emphasized the administration's commitment to fiscal responsibility and managing the national debt effectively. She also pointed to the [mention specific actions taken by the Treasury or Fed, e.g., debt ceiling deal, policy adjustments] as contributing factors to the anticipated easing of market volatility. She further stressed the importance of maintaining a stable and predictable economic environment.

What This Means for Investors and the Economy:

Yellen's assessment offers a degree of reassurance to investors. Easing volatility in the bond market can lead to:

- Lower borrowing costs: Businesses and consumers may benefit from reduced borrowing costs as interest rates stabilize, boosting investment and spending.

- Reduced market uncertainty: A calmer bond market can improve investor confidence and encourage greater participation in the financial markets.

- Improved economic outlook: Stability in the bond market generally reflects a more positive outlook on the overall economic health of the nation.

However, it's crucial to remember that economic forecasts are inherently uncertain, and unforeseen events could still impact the bond market. While Yellen's prediction is encouraging, it's essential to monitor economic indicators closely to gauge the accuracy of her assessment.

Looking Ahead:

The coming weeks will be crucial in determining the accuracy of Yellen’s prediction. Analysts will be closely watching key economic data releases, including [mention relevant economic data points like inflation figures, employment reports]. The Federal Reserve's upcoming policy decisions will also play a significant role in shaping the trajectory of the bond market. This situation warrants continuous monitoring and informed decision-making for investors and economic policymakers alike. The stability of the bond market is inextricably linked to the overall health and stability of the US economy. Therefore, any shifts in this market are indicators worth tracking carefully.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Secretary: Bond Market Volatility To Ease. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

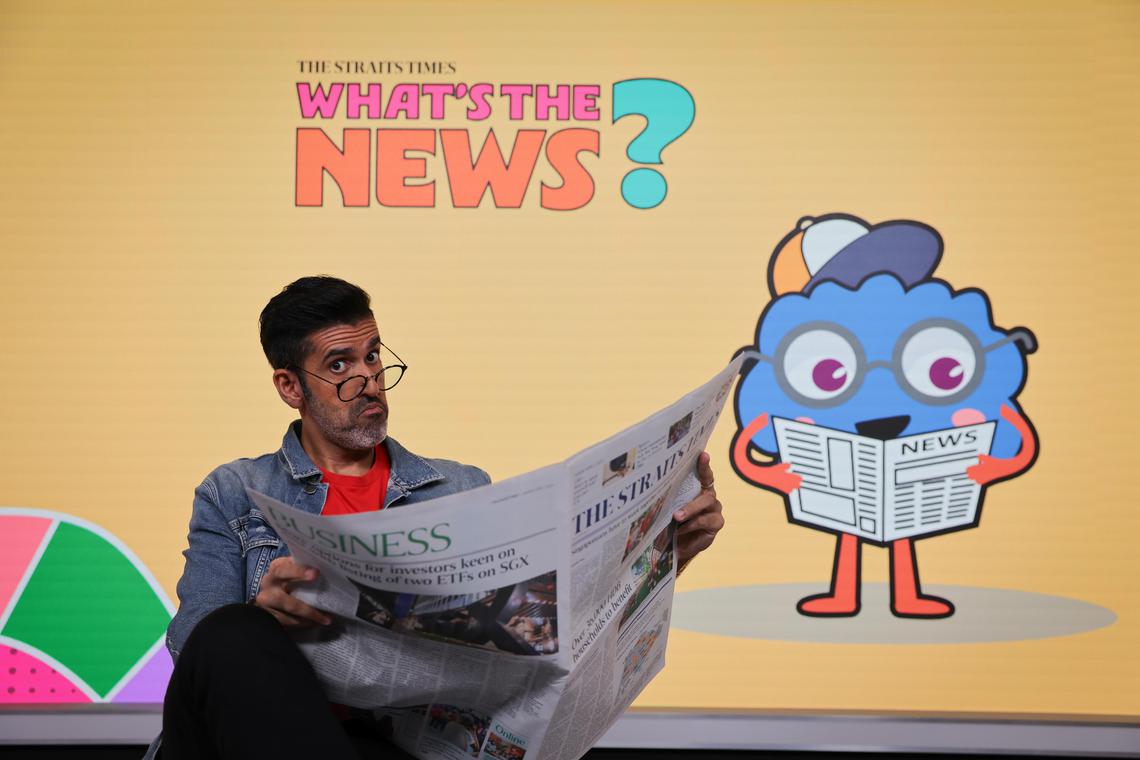

Whats The News Preliminary Round Attracts 6 000 Student Participants

Apr 10, 2025

Whats The News Preliminary Round Attracts 6 000 Student Participants

Apr 10, 2025 -

Bnpb Bantah Video Viral Erupsi Gunung Gede Hoaks

Apr 10, 2025

Bnpb Bantah Video Viral Erupsi Gunung Gede Hoaks

Apr 10, 2025 -

Black Mirrors Future Charlie Brooker Discusses The Shows Potential Longevity

Apr 10, 2025

Black Mirrors Future Charlie Brooker Discusses The Shows Potential Longevity

Apr 10, 2025 -

American Tourist Found Dead In Bahamas After Leaving Dinner

Apr 10, 2025

American Tourist Found Dead In Bahamas After Leaving Dinner

Apr 10, 2025 -

Australia On The Brink Why The Rbas May Meeting Is Crucial Amidst Trump Tariff Impacts

Apr 10, 2025

Australia On The Brink Why The Rbas May Meeting Is Crucial Amidst Trump Tariff Impacts

Apr 10, 2025