USD/ZAR Analysis April 21, 2024: Low Forex Liquidity Impacts Trading

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

USD/ZAR Analysis April 21, 2024: Low Forex Liquidity Impacts Trading

Low liquidity conditions in the forex market significantly impacted USD/ZAR trading on April 21, 2024. Traders experienced wider spreads and reduced trading volumes, making it a challenging day for those seeking to capitalize on potential price movements. This analysis delves into the factors contributing to this low liquidity environment and explores its implications for the USD/ZAR pair.

Understanding Forex Liquidity

Before analyzing the specific impact on USD/ZAR, it's crucial to understand what forex liquidity represents. Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. A liquid market, like the USD/ZAR pair during normal conditions, offers tight spreads (the difference between the bid and ask price) and allows for large trades without substantial price fluctuations. Low liquidity, conversely, leads to wider spreads, slower order execution, and increased slippage (the difference between the expected price and the actual execution price).

Factors Contributing to Low Liquidity on April 21, 2024

Several factors likely contributed to the low liquidity observed in the USD/ZAR market on April 21, 2024. These include:

- Weekend Proximity: Trading volume often decreases as the weekend approaches. Many market participants reduce their exposure, leading to thinner order books and consequently lower liquidity.

- Public Holidays: The presence of public holidays in either South Africa or the United States (or both) could significantly reduce the number of active traders, further contributing to low liquidity. Check for any regional holidays that might have coincided with April 21st.

- Geopolitical Uncertainty: Global political events or economic news releases can sometimes create uncertainty, causing some investors to adopt a "wait-and-see" approach, resulting in lower trading activity. Any significant news events around this date should be considered.

- Thin Market Conditions: Specific periods, even outside of the factors listed above, can simply experience naturally thin market conditions, leading to lower liquidity.

Impact on USD/ZAR Trading

The low liquidity environment directly impacted USD/ZAR trading in several ways:

- Wider Spreads: Traders faced significantly wider spreads, increasing their transaction costs. This makes it more difficult to profit from small price movements.

- Reduced Trading Volume: The lower liquidity meant that fewer trades were executed compared to more liquid days.

- Increased Slippage: The possibility of slippage increased, meaning traders may have executed trades at less favorable prices than anticipated.

- Difficulty in Executing Large Orders: Large orders were likely more challenging to execute without significantly impacting the price, potentially leading to partial fills or delayed executions.

Looking Ahead: Strategies for Low Liquidity Environments

Navigating low liquidity conditions requires adjustments to trading strategies. Traders should consider:

- Reducing Trade Size: Smaller trades are less likely to significantly impact the market price.

- Increasing Stop-Loss Orders: Wider spreads increase the risk of losses, so wider stop-loss orders can help manage this risk.

- Avoiding Scalping: Scalping strategies, which rely on small, frequent trades, are less effective in low liquidity environments.

- Focusing on Longer-Term Trades: Longer-term strategies are often less sensitive to short-term liquidity fluctuations.

Conclusion

The low forex liquidity on April 21, 2024, presented significant challenges for USD/ZAR traders. Understanding the factors contributing to low liquidity and adapting trading strategies accordingly is crucial for navigating these conditions and mitigating potential risks. Further analysis would require examining specific price charts and news from that date to gain a more granular understanding of the market dynamics. Always consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on USD/ZAR Analysis April 21, 2024: Low Forex Liquidity Impacts Trading. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Legal Action Mounts Against Qualified Immunity In Ohio Following Numerous First Responder Accidents

Apr 26, 2025

Legal Action Mounts Against Qualified Immunity In Ohio Following Numerous First Responder Accidents

Apr 26, 2025 -

Could Bryce Dallas Howard Resurrect Mace Windu For A Star Wars Disney Show

Apr 26, 2025

Could Bryce Dallas Howard Resurrect Mace Windu For A Star Wars Disney Show

Apr 26, 2025 -

Li Dar Technology Costs And The Rise Of Byd And Other Chinese Ev Companies

Apr 26, 2025

Li Dar Technology Costs And The Rise Of Byd And Other Chinese Ev Companies

Apr 26, 2025 -

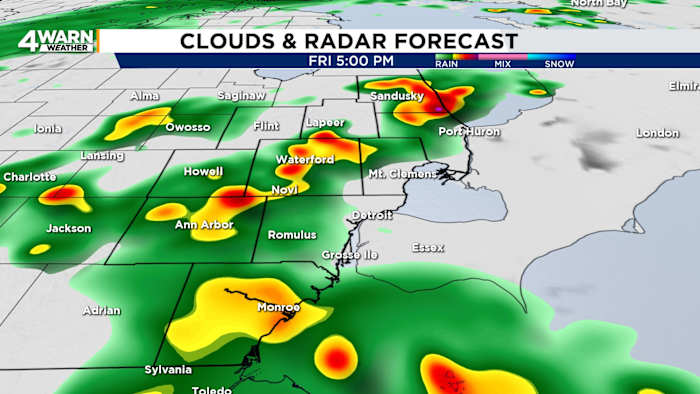

Se Michigan Weather Rollercoaster Weekend Ahead With Summerlike Conditions

Apr 26, 2025

Se Michigan Weather Rollercoaster Weekend Ahead With Summerlike Conditions

Apr 26, 2025 -

Gws Giants Vs Western Bulldogs Afl 2025 Live Match Updates And Scotts Outburst

Apr 26, 2025

Gws Giants Vs Western Bulldogs Afl 2025 Live Match Updates And Scotts Outburst

Apr 26, 2025