USD/ZAR Analysis: April 21st, 2024 - Thin Trading Conditions & Chart Overview

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

USD/ZAR Analysis: April 21st, 2024 - Thin Trading Conditions & Chart Overview

The USD/ZAR exchange rate displayed muted movement on April 21st, 2024, characterized by thin trading conditions and a lack of significant market-moving catalysts. This relatively quiet day followed recent volatility, leaving traders cautiously assessing the landscape for potential future directional shifts. Understanding the current market sentiment and technical chart analysis is crucial for navigating this period of uncertainty.

Thin Trading Conditions and Market Sentiment:

Lower-than-average trading volumes on April 21st indicated a period of consolidation. This often occurs before significant price movements, making it a crucial time for traders to carefully monitor economic indicators and geopolitical events. The relatively subdued activity suggests a market hesitant to make large bets, awaiting clearer signals regarding the future direction of the Rand and the US Dollar. This cautious approach reflects a general uncertainty surrounding global economic growth prospects and potential interest rate hikes.

Key Factors Affecting USD/ZAR:

Several factors continue to subtly influence the USD/ZAR pair:

- US Interest Rates: The Federal Reserve's monetary policy remains a key driver for the US Dollar. Any hints of further rate hikes or a prolonged period of high rates will likely strengthen the USD, potentially putting downward pressure on the ZAR. Conversely, signals of a pause or rate cuts could weaken the dollar.

- South African Economic Data: Upcoming economic releases from South Africa, such as inflation figures and GDP growth data, will be closely scrutinized. Stronger-than-expected data could bolster the Rand, while weaker-than-expected figures could contribute to further weakness.

- Global Risk Appetite: Geopolitical events and global market sentiment continue to play a significant role. Increased risk aversion often leads investors to seek the safety of the US Dollar, strengthening the USD/ZAR pair.

- Commodity Prices: South Africa is a significant commodity exporter. Fluctuations in commodity prices, particularly platinum and gold, have a notable impact on the Rand's value. Rising commodity prices generally support the Rand.

USD/ZAR Chart Overview (April 21st, 2024):

(Note: A detailed chart would typically be included here, showing the USD/ZAR exchange rate for April 21st, 2024. This would visually represent the day's trading range, support and resistance levels, and any significant price action. For illustrative purposes, imagine a chart showing relatively flat movement within a narrow range.)

The chart on April 21st likely showed a relatively flat trading range, indicating the thin trading conditions and lack of strong directional momentum. Traders should look for potential breakouts from this range as an indication of future price movements. Key levels of support and resistance should be identified on the chart to guide trading strategies. The absence of significant candlestick patterns suggests the prevailing uncertainty in the market.

Trading Strategies and Outlook:

Given the thin trading conditions and lack of clear directional signals, a cautious approach is advised. Traders may find it beneficial to:

- Monitor economic indicators: Keep a close eye on upcoming economic data releases from both the US and South Africa.

- Observe chart patterns: Look for potential breakouts from the established trading range to identify potential entry points.

- Use risk management techniques: Implement appropriate stop-loss orders to limit potential losses.

- Consider technical analysis: Employ tools such as moving averages and oscillators to identify potential support and resistance levels and momentum shifts.

The USD/ZAR exchange rate remains sensitive to a range of economic and geopolitical factors. While April 21st, 2024, demonstrated relatively quiet trading, the potential for future volatility remains. Careful monitoring of market developments and the implementation of sound risk management strategies are paramount for navigating this dynamic market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on USD/ZAR Analysis: April 21st, 2024 - Thin Trading Conditions & Chart Overview. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Understanding The Pap Teams Plans For Marine Parade Braddell Heights Grc

Apr 25, 2025

Understanding The Pap Teams Plans For Marine Parade Braddell Heights Grc

Apr 25, 2025 -

Nsp Chief Calls For Balance Between Opposition Unity And Party Priorities In Ge 2025

Apr 25, 2025

Nsp Chief Calls For Balance Between Opposition Unity And Party Priorities In Ge 2025

Apr 25, 2025 -

B And O Unveils Limited Edition David Bowie Speaker Sound And Style Unite

Apr 25, 2025

B And O Unveils Limited Edition David Bowie Speaker Sound And Style Unite

Apr 25, 2025 -

Driving Global Growth Hong Kongs Showcase Of Technological Advancement

Apr 25, 2025

Driving Global Growth Hong Kongs Showcase Of Technological Advancement

Apr 25, 2025 -

Americas Drive For Stablecoin Regulation A Catalyst For Cbdc Development

Apr 25, 2025

Americas Drive For Stablecoin Regulation A Catalyst For Cbdc Development

Apr 25, 2025

Latest Posts

-

Ligue Des Champions Arsenal Vs Psg Composition Des Equipes Avec Doue Et Dembele

Apr 29, 2025

Ligue Des Champions Arsenal Vs Psg Composition Des Equipes Avec Doue Et Dembele

Apr 29, 2025 -

Brampton Centre Votes Key Takeaways From The 2025 Canadian Election

Apr 29, 2025

Brampton Centre Votes Key Takeaways From The 2025 Canadian Election

Apr 29, 2025 -

National Theatre Broadens Casting To Reach International Audiences

Apr 29, 2025

National Theatre Broadens Casting To Reach International Audiences

Apr 29, 2025 -

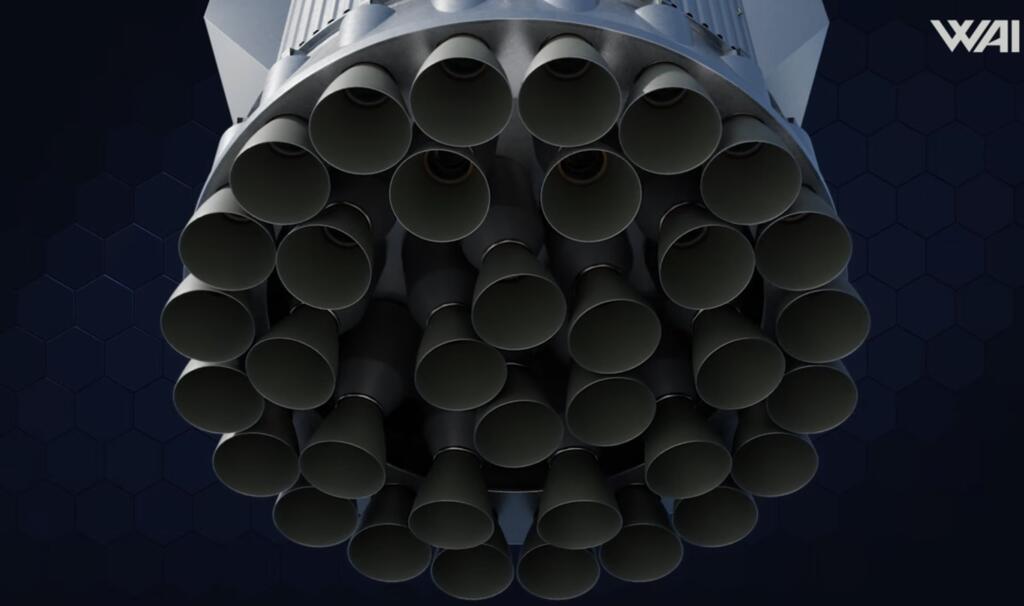

Enhanced Power Space X Starship Booster Equipped With 35 Raptor 3 Engines

Apr 29, 2025

Enhanced Power Space X Starship Booster Equipped With 35 Raptor 3 Engines

Apr 29, 2025 -

Pritam Singh On Ge 2025 Workers Party Rejects Negative Campaigning Tactics

Apr 29, 2025

Pritam Singh On Ge 2025 Workers Party Rejects Negative Campaigning Tactics

Apr 29, 2025