USD/ZAR: April 21st, 2024 Market Commentary & Chart Review

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

USD/ZAR: April 21st, 2024 Market Commentary & Chart Review – Rand Volatility Continues

The South African Rand (ZAR) continues to experience significant volatility against the US dollar (USD), mirroring global economic uncertainty and domestic political pressures. Today, April 21st, 2024, we delve into the current market dynamics influencing the USD/ZAR exchange rate, providing a comprehensive commentary and chart review to help investors navigate this turbulent landscape.

Key Factors Influencing USD/ZAR:

Several interconnected factors are driving the current USD/ZAR fluctuations:

-

Global Economic Slowdown: Concerns about a potential global recession are weighing heavily on emerging market currencies like the ZAR. The ongoing war in Ukraine, persistent inflation in developed economies, and rising interest rates are all contributing to this uncertainty. A weaker global economic outlook typically reduces demand for riskier assets, including the Rand.

-

US Interest Rate Expectations: The Federal Reserve's monetary policy continues to be a major influence on the USD. Expectations regarding future interest rate hikes in the US impact the relative attractiveness of the dollar compared to other currencies. Higher US interest rates tend to strengthen the USD, putting downward pressure on the ZAR.

-

Domestic Political Landscape: South Africa's political climate remains a significant factor influencing investor sentiment. Concerns about policy uncertainty and potential economic reforms impact the Rand's stability. Transparency and decisive leadership are crucial for attracting foreign investment and bolstering the ZAR.

-

Commodity Prices: As a significant commodity exporter, South Africa's economy is closely tied to global commodity prices. Fluctuations in the prices of gold, platinum, and other key exports directly impact the Rand's value. A surge in commodity prices generally strengthens the ZAR, while a decline weakens it.

USD/ZAR Chart Review (April 21st, 2024):

(Note: A real-time chart would be included here in a published article. This would show the USD/ZAR exchange rate for the day, highlighting key support and resistance levels, trends, and any significant price movements. The chart would be sourced from a reputable financial data provider.)

The chart reveals [Describe the chart's key features, e.g., a recent upward trend, consolidation period, break of support/resistance levels, etc.]. This suggests [Interpret the chart's implications, e.g., potential for further Rand weakening, possibility of a short-term reversal, etc.].

Trading Strategies and Outlook:

Given the current market dynamics, investors should exercise caution and adopt a well-informed approach. Strategies may include:

-

Hedging: Businesses with significant USD/ZAR exposure should consider hedging strategies to mitigate potential losses from currency fluctuations.

-

Diversification: Diversifying investment portfolios across various asset classes and currencies can help reduce overall risk.

-

Technical Analysis: Careful monitoring of technical indicators and chart patterns can provide valuable insights into potential price movements.

-

Fundamental Analysis: Staying abreast of economic and political developments in both the US and South Africa is crucial for making well-informed investment decisions.

Conclusion:

The USD/ZAR exchange rate remains highly sensitive to both global and domestic factors. While predicting future movements with certainty is impossible, understanding the key drivers and carefully analyzing market data is crucial for navigating the volatility and making informed investment decisions. Continuous monitoring of economic indicators, political developments, and chart patterns is essential for those involved in trading or investing in this currency pair. Consult with a financial advisor before making any significant investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on USD/ZAR: April 21st, 2024 Market Commentary & Chart Review. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Boeing 737 Max Back In The Air But China Remains A Key Market Challenge

Apr 26, 2025

Boeing 737 Max Back In The Air But China Remains A Key Market Challenge

Apr 26, 2025 -

Dundee United Vs Celtic A Crucial Match For The Premiership

Apr 26, 2025

Dundee United Vs Celtic A Crucial Match For The Premiership

Apr 26, 2025 -

Revolut Financial Report Exploding Growth 506 M In Crypto And Ipo Speculation

Apr 26, 2025

Revolut Financial Report Exploding Growth 506 M In Crypto And Ipo Speculation

Apr 26, 2025 -

The Pressure Of Wrexhams Promotion Ryan Reynolds Opens Up About His Health

Apr 26, 2025

The Pressure Of Wrexhams Promotion Ryan Reynolds Opens Up About His Health

Apr 26, 2025 -

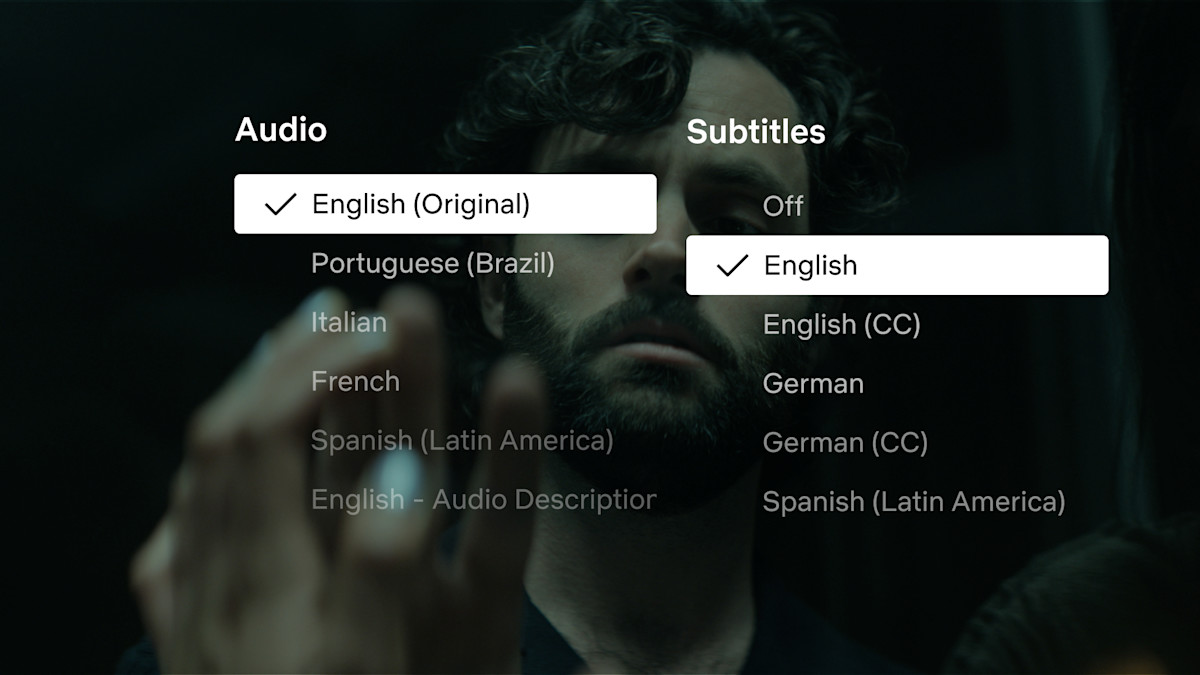

Netflix Improves Streaming Free Update Benefits You Season 5 Viewers

Apr 26, 2025

Netflix Improves Streaming Free Update Benefits You Season 5 Viewers

Apr 26, 2025