USD/ZAR: April 21st, 2024 Market Report - Low Liquidity Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

USD/ZAR: April 21st, 2024 Market Report - Navigating the Low Liquidity Landscape

The USD/ZAR exchange rate experienced a period of unusually low liquidity on April 21st, 2024, leading to increased volatility and presenting unique challenges for traders. This report analyzes the market conditions of that day, examining the factors contributing to low liquidity and their impact on trading strategies. Understanding these dynamics is crucial for navigating future periods of reduced market activity.

Low Liquidity: A Defining Characteristic of April 21st

Low liquidity, characterized by thin trading volumes and wide bid-ask spreads, was the dominant feature of the USD/ZAR market on April 21st, 2024. This meant that significant price movements could occur with relatively small trades, creating an environment ripe for both opportunity and risk. Several factors contributed to this subdued market activity:

- Public Holidays: A confluence of public holidays in key South African and international markets likely suppressed trading volumes. Reduced participation from major players naturally led to thinner order books.

- Global Economic Uncertainty: Ongoing global economic anxieties, perhaps related to [insert specific relevant geopolitical event or economic indicator from around April 21st, 2024], might have encouraged investors to adopt a wait-and-see approach, reducing their activity in emerging market currencies like the ZAR.

- Technical Factors: Potential technical glitches in trading platforms or disruptions to electronic communication networks could have temporarily hampered trading activity, further exacerbating low liquidity.

Impact on Trading Strategies

The low liquidity on April 21st significantly impacted trading strategies. Traders faced several challenges:

- Wider Spreads: Increased bid-ask spreads meant that the cost of executing trades was higher, potentially eating into profits.

- Increased Volatility: Smaller trading volumes amplified the impact of individual trades, resulting in sharp and unexpected price swings. This heightened the risk of significant losses for those unprepared.

- Slippage: The difficulty in finding counterparties at desired prices led to slippage – the difference between the expected execution price and the actual execution price.

Strategies for Navigating Low Liquidity Environments

Traders can employ several strategies to mitigate risks during periods of low liquidity:

- Reduced Position Sizing: Lowering position sizes reduces potential losses in case of unexpected price movements.

- Wider Stop-Loss Orders: Setting wider stop-loss orders provides a buffer against sudden price fluctuations.

- Increased Monitoring: Closely monitoring market conditions and news affecting the USD/ZAR pair is crucial for making informed decisions.

- Alternative Instruments: Considering alternative instruments with higher liquidity, such as major currency pairs, could be a prudent strategy.

- Limit Orders: Using limit orders, which only execute at a specified price or better, can help avoid slippage.

Conclusion: Learning from Low Liquidity Periods

The low liquidity experienced in the USD/ZAR market on April 21st, 2024, served as a valuable reminder of the importance of understanding market conditions and adapting trading strategies accordingly. By acknowledging the factors that contribute to low liquidity and implementing appropriate risk management techniques, traders can navigate these challenging environments more effectively and potentially capitalize on the unique opportunities they present. Future analysis should investigate the correlation between global events, specific holiday schedules, and the resulting impact on the liquidity of the USD/ZAR pair. This will aid in developing more robust and adaptable trading strategies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on USD/ZAR: April 21st, 2024 Market Report - Low Liquidity Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Paddy Mc Guinnesss Heartfelt Message To Freddie Flintoff After Recent Struggles

Apr 25, 2025

Paddy Mc Guinnesss Heartfelt Message To Freddie Flintoff After Recent Struggles

Apr 25, 2025 -

Sorpresa En Madrid Comesana Elimina A Fils Y Se Cita Con Compatriota

Apr 25, 2025

Sorpresa En Madrid Comesana Elimina A Fils Y Se Cita Con Compatriota

Apr 25, 2025 -

Jury Deliberations To Conclude Friday In High Profile Sexual Assault Case

Apr 25, 2025

Jury Deliberations To Conclude Friday In High Profile Sexual Assault Case

Apr 25, 2025 -

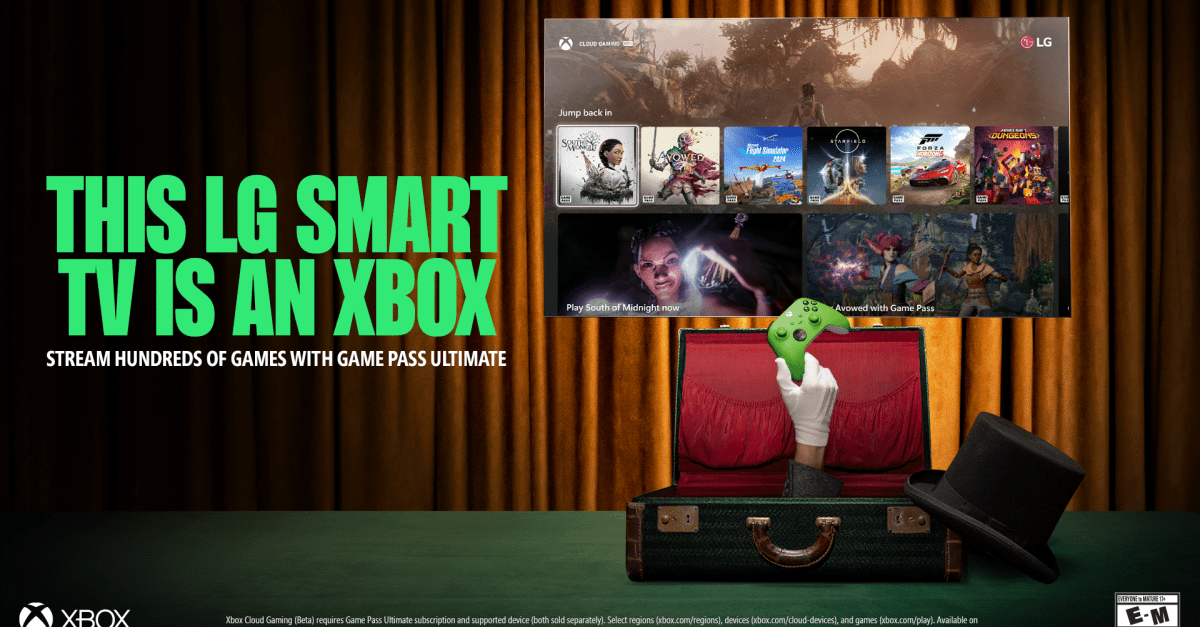

Game On Lg Smart Tvs Get The Official Microsoft Xbox App

Apr 25, 2025

Game On Lg Smart Tvs Get The Official Microsoft Xbox App

Apr 25, 2025 -

Stanley Cup Playoffs Early Data Shows Impact Of Home Ice

Apr 25, 2025

Stanley Cup Playoffs Early Data Shows Impact Of Home Ice

Apr 25, 2025

Latest Posts

-

Ucl Semi Finals Arsenal Vs Psg And Barcelona Vs Inter Milan Key Battles

Apr 30, 2025

Ucl Semi Finals Arsenal Vs Psg And Barcelona Vs Inter Milan Key Battles

Apr 30, 2025 -

Rapid Growth Of Stronghold Fire 3 000 Acres Consumed In Cochise County Investigation Ordered

Apr 30, 2025

Rapid Growth Of Stronghold Fire 3 000 Acres Consumed In Cochise County Investigation Ordered

Apr 30, 2025 -

Sabalenkas Ninth Straight Win A Three Set Triumph Against Mertens

Apr 30, 2025

Sabalenkas Ninth Straight Win A Three Set Triumph Against Mertens

Apr 30, 2025 -

Ligue Des Champions Arsenal Vs Psg Compos Officiels Avec Doue Et Dembele Titulaires

Apr 30, 2025

Ligue Des Champions Arsenal Vs Psg Compos Officiels Avec Doue Et Dembele Titulaires

Apr 30, 2025 -

Analyzing Kvaratskhelias Impact Why Psgs Kvaradona Is A Game Changer

Apr 30, 2025

Analyzing Kvaratskhelias Impact Why Psgs Kvaradona Is A Game Changer

Apr 30, 2025