USD/ZAR Technical Analysis: April 21, 2024 - Implications Of Thin Forex Trading

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

USD/ZAR Technical Analysis: April 21, 2024 – Thin Forex Trading Impacts the Rand

The South African Rand (ZAR) continues its volatile dance against the US dollar (USD), and today, April 21st, 2024, presents a compelling case study in how thin forex trading conditions can significantly impact price action. The relatively low trading volume observed this week introduces significant uncertainty, making technical analysis even more crucial for navigating the market.

Thin Trading: A Double-Edged Sword for the USD/ZAR

Low liquidity, a characteristic of thin trading, amplifies price swings. Smaller trades can have a disproportionately large effect on the USD/ZAR exchange rate, leading to rapid and sometimes unpredictable movements. This makes precise forecasting challenging, as the usual market indicators may be less reliable. While experienced traders might exploit these volatile conditions, less experienced participants should exercise caution.

Technical Analysis: Key Levels to Watch

Our technical analysis of the USD/ZAR pair reveals several key levels to monitor closely:

-

Resistance: The immediate resistance level sits around 18.50. A sustained break above this level could signal further upward momentum for the USD and potentially lead to a move towards the next resistance at 19.00.

-

Support: Significant support is found near 18.00. A breakdown below this level could trigger further selling pressure, potentially pushing the pair towards the next support level at 17.75.

-

Moving Averages: The 50-day and 200-day moving averages are currently converging, indicating potential indecision in the market. The interaction between these averages will be a key indicator to watch in the coming days.

-

RSI (Relative Strength Index): The RSI is currently hovering near the overbought territory, suggesting potential for a short-term correction. However, the low trading volume makes this indicator's reliability questionable.

Implications of Thin Trading for Traders

The low trading volume significantly impacts trading strategies. Here's what traders should consider:

-

Wider Spreads: Expect wider spreads due to lower liquidity. This will directly impact profitability.

-

Increased Volatility: Be prepared for sudden and sharp price movements. Tight stop-loss orders are essential to manage risk.

-

Delayed Execution: Orders might take longer to execute due to a lack of immediate buyers or sellers.

-

Reduced Liquidity: This makes it harder to enter or exit positions quickly, potentially leading to slippage.

Looking Ahead: What to Expect

The coming days will be crucial in determining the direction of the USD/ZAR. Keep a close eye on economic news releases from both the US and South Africa, as these could trigger significant market reactions. Furthermore, monitor global market sentiment, as any broader shifts could impact the Rand's performance. Thin trading conditions are likely to persist for the near term, requiring traders to be exceptionally cautious and adaptable.

Disclaimer: This analysis is for informational purposes only and should not be considered investment advice. Trading foreign exchange involves significant risk of loss and may not be suitable for all investors. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on USD/ZAR Technical Analysis: April 21, 2024 - Implications Of Thin Forex Trading. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jennifer Anistons Last Of Us Appearance The Actress Reveals Her Reaction

Apr 25, 2025

Jennifer Anistons Last Of Us Appearance The Actress Reveals Her Reaction

Apr 25, 2025 -

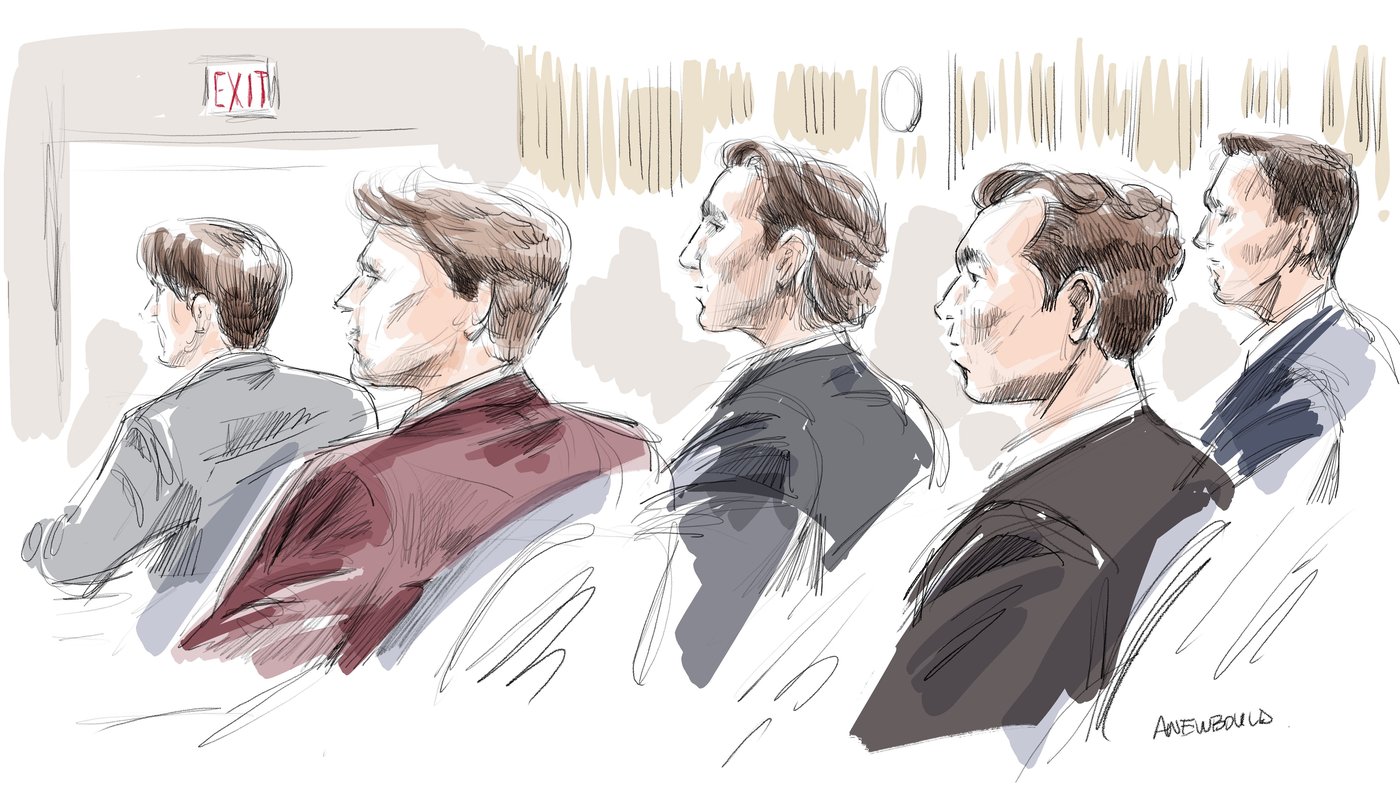

Legal Arguments Presented In Sex Assault Case Against Ex World Junior Hockey Players

Apr 25, 2025

Legal Arguments Presented In Sex Assault Case Against Ex World Junior Hockey Players

Apr 25, 2025 -

Ge 2025 Marine Parade Braddell Heights Residents Face Voting Exclusion

Apr 25, 2025

Ge 2025 Marine Parade Braddell Heights Residents Face Voting Exclusion

Apr 25, 2025 -

Lpga Chevron Championship Can Brooke Henderson Bounce Back

Apr 25, 2025

Lpga Chevron Championship Can Brooke Henderson Bounce Back

Apr 25, 2025 -

Nyt Wordle Answer For April 23 2024 Game 1404 Hints Included

Apr 25, 2025

Nyt Wordle Answer For April 23 2024 Game 1404 Hints Included

Apr 25, 2025

Latest Posts

-

Singapore Student Arrested Teacher Injured In Penknife Attack

Apr 29, 2025

Singapore Student Arrested Teacher Injured In Penknife Attack

Apr 29, 2025 -

Kvaratskhelias Journey How The Kvaradona Phenomenon Emerged

Apr 29, 2025

Kvaratskhelias Journey How The Kvaradona Phenomenon Emerged

Apr 29, 2025 -

Magnetic Mouse Review Folding Usb C Charging Cable Tested

Apr 29, 2025

Magnetic Mouse Review Folding Usb C Charging Cable Tested

Apr 29, 2025 -

Thunderbolts A Critical Look At Marvels Latest Featuring Florence Pugh

Apr 29, 2025

Thunderbolts A Critical Look At Marvels Latest Featuring Florence Pugh

Apr 29, 2025 -

A Test Of Nerves Higginss Close Call And Eventual Win

Apr 29, 2025

A Test Of Nerves Higginss Close Call And Eventual Win

Apr 29, 2025