Veteran Investor Jim Chanos Bets Against Bitcoin Despite Personal Holdings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Veteran Investor Jim Chanos Bets Against Bitcoin Despite Personal Holdings: A Contrarian Stand

Veteran short-seller Jim Chanos, renowned for his prescient calls on Enron and other corporate giants, has taken a contrarian stance on Bitcoin, betting against the cryptocurrency despite personally holding some. This surprising move highlights the ongoing debate surrounding Bitcoin's long-term viability and underscores the inherent risks associated with the volatile digital asset. Chanos's actions have sent ripples through the crypto community, sparking renewed discussion about Bitcoin's future and the wisdom of investing in the digital currency market.

Chanos, founder of Kynikos Associates, a hedge fund known for its successful short-selling strategies, has long been a vocal critic of Bitcoin. He has previously expressed concerns about Bitcoin's regulatory uncertainty, its energy consumption, and its susceptibility to manipulation. However, the revelation that he holds a personal position in Bitcoin, while simultaneously betting against it, adds a layer of complexity to his view.

<h3>A Calculated Risk or a Contradictory Strategy?</h3>

The juxtaposition of Chanos’s personal holdings and his short position raises several questions. Is this a sophisticated hedging strategy? Is he attempting to profit from both sides of the market? Or does it simply reflect a belief that Bitcoin's price is likely to fluctuate significantly in the near future, presenting opportunities for profit through both long and short positions?

Analysts suggest several possible interpretations. Some believe Chanos's personal holdings are relatively small compared to his overall portfolio, thus minimizing the risk associated with a potential Bitcoin price collapse. Others theorize that his short position is a calculated bet against the broader speculative fervor surrounding Bitcoin, rather than a complete rejection of the cryptocurrency's underlying technology.

<h3>The Implications for Bitcoin Investors</h3>

Chanos's position, regardless of its complexity, underscores the inherent risks involved in Bitcoin investment. While Bitcoin has experienced periods of significant growth, its price volatility remains a major concern. The cryptocurrency market is notoriously susceptible to market manipulation and regulatory uncertainty, making it a high-risk investment for the average investor.

- Regulatory Uncertainty: Governments worldwide are still grappling with how to regulate cryptocurrencies, creating a constantly shifting landscape for investors.

- Price Volatility: Bitcoin's price is highly volatile, experiencing dramatic swings in a short period. This volatility poses significant risks for investors who lack the risk tolerance for substantial losses.

- Security Risks: Cryptocurrency exchanges and wallets are not immune to hacking and theft, posing a significant security risk for investors.

<h3>What's Next for Bitcoin?</h3>

While Chanos's bet against Bitcoin is significant, it doesn't necessarily signal the end of Bitcoin's reign. Many proponents of Bitcoin remain bullish, highlighting its decentralized nature, potential for disrupting traditional financial systems, and growing adoption among businesses and individuals. The future of Bitcoin will likely depend on several factors, including regulatory developments, technological advancements, and overall market sentiment.

Chanos's contrarian bet, however, serves as a stark reminder that the cryptocurrency market is characterized by high risk and uncertainty. Investors should carefully consider these risks before investing in Bitcoin or any other cryptocurrency. Conduct thorough research, diversify your investments, and only invest what you can afford to lose. The veteran investor's actions provide a cautionary tale in a market known for its unpredictable nature. The ongoing saga of Chanos's Bitcoin strategy will undoubtedly continue to fuel discussions within the investment community for months to come.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Veteran Investor Jim Chanos Bets Against Bitcoin Despite Personal Holdings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Jim Chanoss Bitcoin Investment A Calculated Risk Or A Contradiction

May 17, 2025

Is Jim Chanoss Bitcoin Investment A Calculated Risk Or A Contradiction

May 17, 2025 -

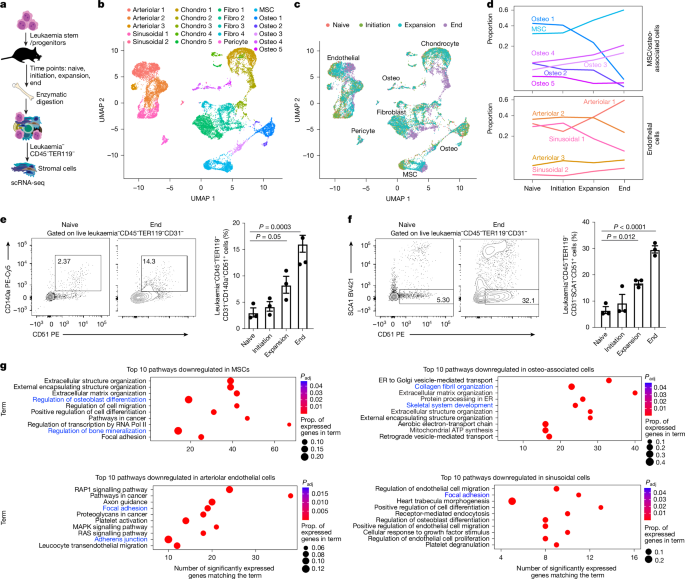

Tumor Niche Taurine And Glycolysis A New Mechanism In Leukemogenesis

May 17, 2025

Tumor Niche Taurine And Glycolysis A New Mechanism In Leukemogenesis

May 17, 2025 -

Internazionali Bnl D Italia Tennis Live Streaming Tv Channels And Match Times For May 16th

May 17, 2025

Internazionali Bnl D Italia Tennis Live Streaming Tv Channels And Match Times For May 16th

May 17, 2025 -

From Uk To Us The Growing Threat Of The Scattered Spider Cyberattacks

May 17, 2025

From Uk To Us The Growing Threat Of The Scattered Spider Cyberattacks

May 17, 2025 -

Murder During Livestream Investigation Into Death Of Influencer Valeria Marquez

May 17, 2025

Murder During Livestream Investigation Into Death Of Influencer Valeria Marquez

May 17, 2025