Village Roadshow's $1 Billion Bankruptcy: Implications For Australian Businesses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Village Roadshow's $1 Billion Bankruptcy: A Wake-Up Call for Australian Businesses

Village Roadshow, the Australian entertainment giant behind iconic theme parks like Movie World and Sea World, recently filed for bankruptcy, leaving a staggering $1 billion debt in its wake. This monumental collapse isn't just a blow to the entertainment industry; it serves as a stark warning to Australian businesses across the board about the perils of over-leveraging, pandemic vulnerability, and the changing landscape of entertainment consumption.

The Fall of an Entertainment Empire:

The bankruptcy filing, a culmination of years of mounting debt and the crippling impact of the COVID-19 pandemic, sent shockwaves through the Australian business community. Village Roadshow, once a powerhouse in film distribution, theme parks, and cinema exhibition, struggled to adapt to the rapid shift towards streaming services and the prolonged closure of its physical venues during lockdowns. This highlights the crucial need for businesses to embrace digital transformation and diversify revenue streams to withstand unforeseen crises.

Key Factors Contributing to the Bankruptcy:

- High Debt Levels: Years of aggressive expansion and acquisitions left Village Roadshow with a crippling debt burden, making it vulnerable to economic downturns. This underscores the importance of responsible financial management and a careful consideration of risk.

- Pandemic Impact: The COVID-19 pandemic dealt a devastating blow to the company's core businesses. The closure of theme parks and cinemas resulted in massive revenue losses, leaving the company struggling to meet its financial obligations. This emphasizes the importance of robust contingency planning and diversification strategies.

- Shifting Entertainment Landscape: The rise of streaming services like Netflix and Disney+ significantly impacted cinema attendance and the demand for traditional film distribution, further exacerbating Village Roadshow's financial woes. This highlights the necessity for adaptability and innovation in the face of disruptive technologies.

Implications for Australian Businesses:

The Village Roadshow bankruptcy serves as a cautionary tale for Australian businesses of all sizes. Several key lessons emerge:

- Prudent Financial Management: Maintaining a healthy balance sheet and avoiding excessive debt is crucial for long-term sustainability. Businesses need to carefully assess their risk tolerance and develop robust financial strategies.

- Adaptability and Innovation: The ability to adapt to changing market conditions and embrace innovation is vital for survival. Businesses must constantly evolve and diversify their offerings to remain competitive.

- Diversification of Revenue Streams: Relying on a single revenue source can be extremely risky. Diversification minimizes vulnerability to economic shocks and disruptions.

- Crisis Preparedness: Developing comprehensive contingency plans to mitigate the impact of unforeseen events, such as pandemics or economic downturns, is essential for business resilience.

Looking Ahead:

The future of Village Roadshow remains uncertain. While the bankruptcy process unfolds, the company's assets will be evaluated, and a restructuring plan will be developed. However, the legacy of this collapse will undoubtedly shape the strategies of Australian businesses for years to come. The case serves as a powerful reminder of the importance of proactive planning, financial responsibility, and adaptability in an increasingly volatile business environment. The Australian business community must learn from this significant event and implement strategies to avoid a similar fate. This necessitates a renewed focus on financial prudence, technological innovation, and a commitment to long-term sustainability. The lessons learned from Village Roadshow's downfall are invaluable for ensuring the future stability and success of Australian businesses.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Village Roadshow's $1 Billion Bankruptcy: Implications For Australian Businesses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

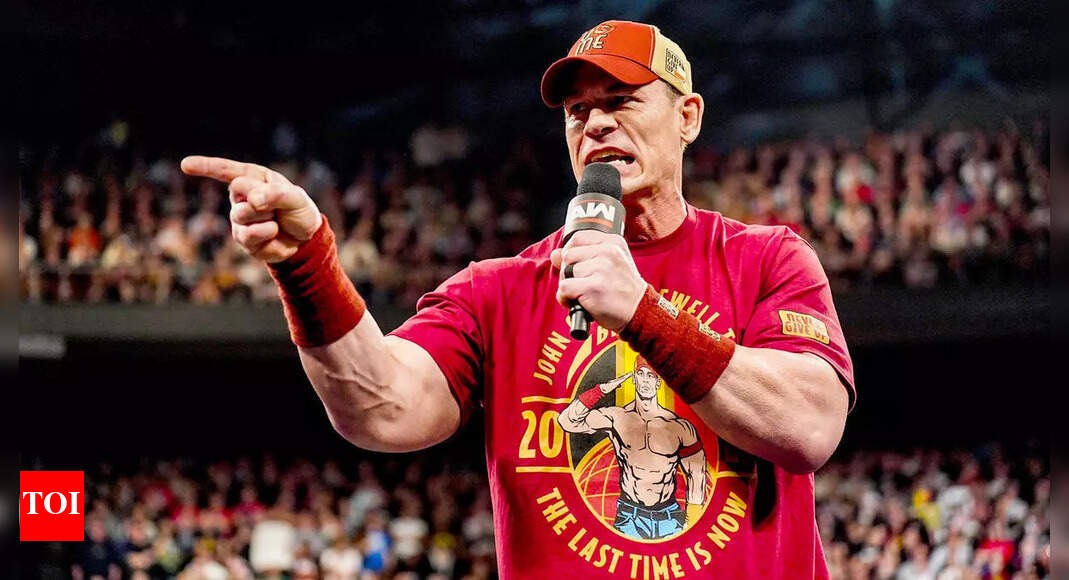

Wwe Raw John Cenas Shocking Return And Fallout March 17 2025

Mar 18, 2025

Wwe Raw John Cenas Shocking Return And Fallout March 17 2025

Mar 18, 2025 -

Complete Wwe Raw Results March 17 2025 Cenas Farewell

Mar 18, 2025

Complete Wwe Raw Results March 17 2025 Cenas Farewell

Mar 18, 2025 -

John Cena Addresses Fan Backlash After Invisible Man Joke

Mar 18, 2025

John Cena Addresses Fan Backlash After Invisible Man Joke

Mar 18, 2025 -

Are You Affected Understanding The Implications Of Welfare Cuts On Pip

Mar 18, 2025

Are You Affected Understanding The Implications Of Welfare Cuts On Pip

Mar 18, 2025 -

Lakers Reaves Jordan Goodwin Earns A Standard Nba Contract

Mar 18, 2025

Lakers Reaves Jordan Goodwin Earns A Standard Nba Contract

Mar 18, 2025

Latest Posts

-

Match Report Team A Vs Team B A Tactical Breakdown

Apr 30, 2025

Match Report Team A Vs Team B A Tactical Breakdown

Apr 30, 2025 -

Martinelli Faces Arsenal Transfer Test Will New Signing Impact Playing Time

Apr 30, 2025

Martinelli Faces Arsenal Transfer Test Will New Signing Impact Playing Time

Apr 30, 2025 -

Is Apples App Store Anti Competitive The Epic Games Store On Android Suggests Yes

Apr 30, 2025

Is Apples App Store Anti Competitive The Epic Games Store On Android Suggests Yes

Apr 30, 2025 -

Episode 3 Examining The Urgent Need For Science In War Torn Regions

Apr 30, 2025

Episode 3 Examining The Urgent Need For Science In War Torn Regions

Apr 30, 2025 -

Amazon Tariff Dispute Trumps Heated Exchange With Bezos

Apr 30, 2025

Amazon Tariff Dispute Trumps Heated Exchange With Bezos

Apr 30, 2025