Wall Street And Crude Oil Take A Tumble: End Of A Nine-Day Bull Run

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street and Crude Oil Take a Tumble: End of a Nine-Day Bull Run

Wall Street experienced a significant downturn, and crude oil prices plummeted, marking a dramatic end to a nine-day rally that had investors feeling bullish. The simultaneous drop across both markets has sent shockwaves through the financial world, leaving analysts scrambling to understand the underlying causes and predict the future trajectory of these crucial commodities.

A Sudden Shift in Market Sentiment:

The nine-day bull run, fueled by a combination of positive economic data and easing inflation concerns, came to an abrupt halt. Investors, who had been enjoying a period of relative stability and growth, were met with a wave of selling pressure, resulting in sharp declines across major indices and a considerable drop in crude oil futures. This unexpected reversal suggests a potential shift in market sentiment, raising questions about the sustainability of recent economic optimism.

What Triggered the Market Drop?

While pinpointing a single cause is challenging, several factors likely contributed to the simultaneous slump in Wall Street and crude oil markets:

-

Profit-Taking: After a sustained period of gains, many investors likely decided to secure their profits, leading to a wave of selling that amplified the downward momentum. This is a common occurrence after extended bull runs.

-

Inflation Concerns Resurface: Despite recent positive inflation data, lingering concerns about persistent inflationary pressures may have prompted investors to reassess their risk tolerance. The fear of further interest rate hikes by central banks likely contributed to the sell-off.

-

Geopolitical Uncertainties: Ongoing geopolitical tensions, particularly in Eastern Europe, continue to cast a shadow over global markets. Any escalation of these conflicts could easily trigger further volatility.

-

Crude Oil Supply Concerns: While initially boosted by supply concerns, the crude oil market experienced a correction as some of these worries began to ease. Increased production from certain OPEC+ nations might have also played a role in the price drop.

Impact on Investors and the Broader Economy:

The sudden market downturn will undoubtedly have a significant impact on investors, particularly those who were heavily invested in the recent rally. The broader economy could also feel the ripple effects, with potential consequences for consumer spending and business investment. The volatility highlights the inherent risks associated with market fluctuations and the importance of diversification in investment strategies.

Looking Ahead: What's Next for Wall Street and Crude Oil?

Predicting the future is always challenging, but analysts are closely monitoring several key indicators to gauge the markets' next move. These include inflation data, central bank policy decisions, geopolitical developments, and overall investor sentiment. The coming weeks will be critical in determining whether this represents a temporary correction or the start of a more significant downturn.

Key Takeaways:

- The recent market downturn serves as a stark reminder of the volatility inherent in financial markets.

- A combination of factors, including profit-taking, resurfacing inflation concerns, geopolitical uncertainties, and shifting crude oil supply dynamics, likely contributed to the drop.

- Investors should carefully monitor market developments and consider adjusting their portfolios accordingly.

- The long-term outlook for both Wall Street and crude oil remains uncertain, but analysts are closely tracking key indicators for clues.

This unexpected market shift emphasizes the need for investors to remain vigilant and adapt to changing market conditions. The interplay between global economics, geopolitical events, and investor psychology continues to shape the landscape of Wall Street and the commodities market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street And Crude Oil Take A Tumble: End Of A Nine-Day Bull Run. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Live Game 1 Coverage Golden State Warriors Vs Minnesota Timberwolves

May 07, 2025

Live Game 1 Coverage Golden State Warriors Vs Minnesota Timberwolves

May 07, 2025 -

Planned Gatwick Strikes Could Cause Widespread Half Term Travel Disruption

May 07, 2025

Planned Gatwick Strikes Could Cause Widespread Half Term Travel Disruption

May 07, 2025 -

Randles Injury A Turning Point For The Timberwolves Surge

May 07, 2025

Randles Injury A Turning Point For The Timberwolves Surge

May 07, 2025 -

Pacers Vs Cavaliers May 6 2025 Game Recap And Box Score

May 07, 2025

Pacers Vs Cavaliers May 6 2025 Game Recap And Box Score

May 07, 2025 -

San Francisco Giants Call Up Reliever Dfa Trivino

May 07, 2025

San Francisco Giants Call Up Reliever Dfa Trivino

May 07, 2025

Latest Posts

-

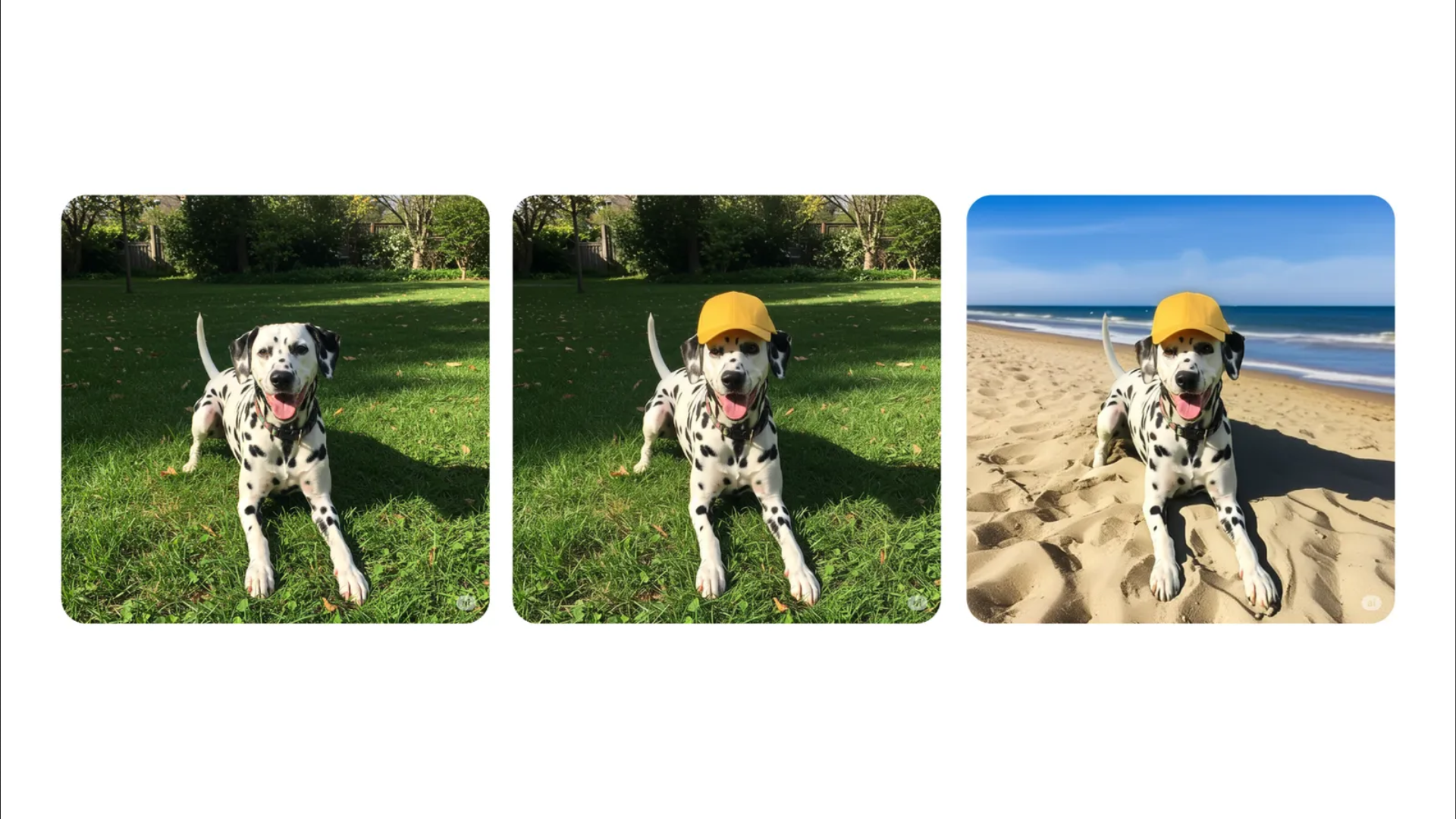

Enhanced Productivity Edit Images Directly Within The Gemini Platform

May 08, 2025

Enhanced Productivity Edit Images Directly Within The Gemini Platform

May 08, 2025 -

Us Pc Vendor Hints At Amd Epyc 4005 Mini Pc Deployment In Massive 42 U Racks

May 08, 2025

Us Pc Vendor Hints At Amd Epyc 4005 Mini Pc Deployment In Massive 42 U Racks

May 08, 2025 -

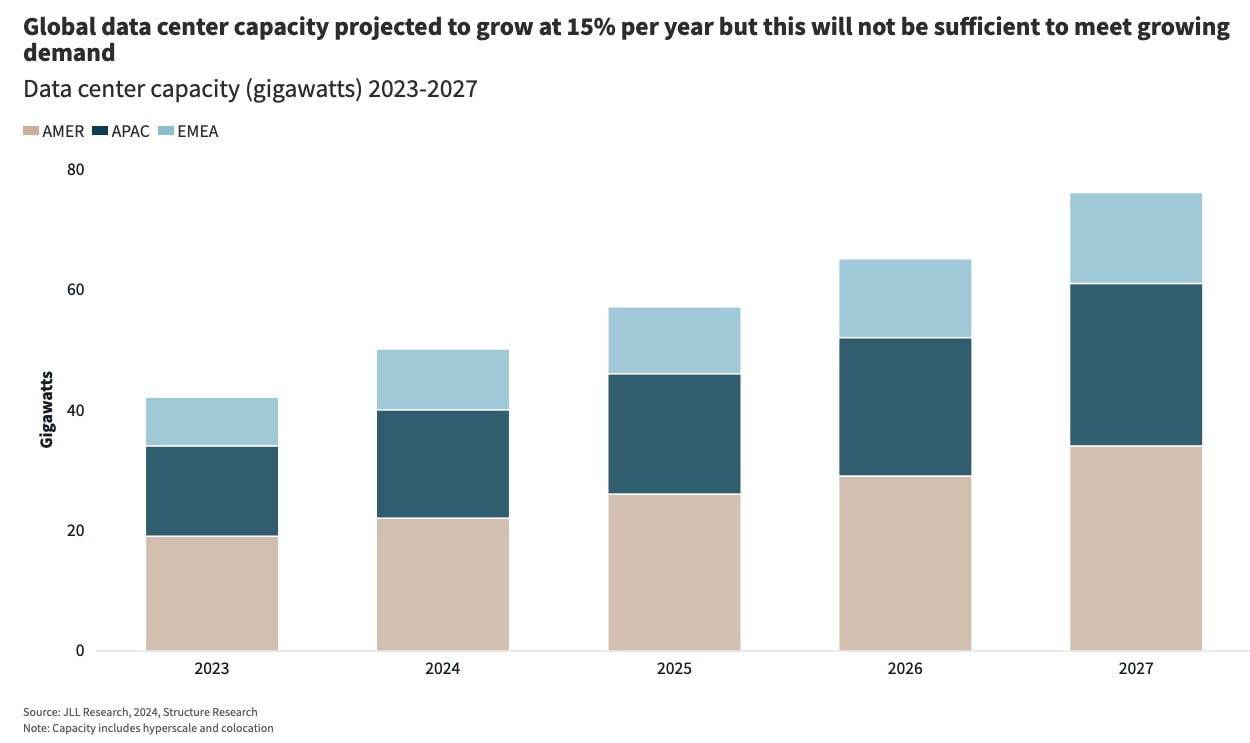

New Data Global Ai Data Center Market Shows Resilience Outpacing Amazon And Microsoft Adjustments

May 08, 2025

New Data Global Ai Data Center Market Shows Resilience Outpacing Amazon And Microsoft Adjustments

May 08, 2025 -

Thunder Fans Honor Russell Westbrook A Classy Tribute Years In The Making

May 08, 2025

Thunder Fans Honor Russell Westbrook A Classy Tribute Years In The Making

May 08, 2025 -

Xdc Network Xdc Holds Steady Despite 10 Pullback Long Term Analysis

May 08, 2025

Xdc Network Xdc Holds Steady Despite 10 Pullback Long Term Analysis

May 08, 2025