Wall Street And ETFs Drive US Bitcoin Dominance To Record High

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street and ETFs Drive US Bitcoin Dominance to Record High

Bitcoin's dominance in the global cryptocurrency market has surged to a record high, fueled by the growing influence of Wall Street and the launch of Bitcoin exchange-traded funds (ETFs). This unprecedented surge marks a significant shift in the crypto landscape, with the US emerging as a key player in shaping Bitcoin's future. The implications for the broader cryptocurrency market and traditional finance are profound.

The meteoric rise in Bitcoin's dominance, currently exceeding 55%, is largely attributed to two converging factors: the increasing institutional adoption of Bitcoin and the recent approval of Bitcoin ETFs. These developments have injected a massive influx of capital into the Bitcoin market, dwarfing the gains seen in altcoins.

The Wall Street Effect: Institutional Investment Fuels Bitcoin's Ascent

For years, Bitcoin's narrative was largely driven by individual investors and retail traders. However, the past few years have witnessed a dramatic shift with major financial institutions, hedge funds, and asset managers increasingly allocating assets to Bitcoin. This institutional interest is driven by several factors, including:

- Portfolio Diversification: Bitcoin is seen as a hedge against inflation and a potential safe haven asset, diversifying portfolios beyond traditional equities and bonds.

- Technological Innovation: The underlying blockchain technology behind Bitcoin continues to attract attention and investment from tech-savvy institutions.

- Regulatory Clarity (in the US): While global regulation remains a challenge, the increasing clarity in the US regulatory landscape, particularly concerning Bitcoin ETFs, has boosted investor confidence.

Bitcoin ETFs: A Catalyst for Mainstream Adoption

The approval of Bitcoin ETFs by the US Securities and Exchange Commission (SEC) has been a game-changer. These ETFs provide a regulated and accessible investment vehicle for institutional and retail investors alike, significantly lowering the barrier to entry for Bitcoin investment. This ease of access has led to a substantial influx of capital, driving up Bitcoin's price and market dominance.

This surge in Bitcoin investment through ETFs is not only impacting Bitcoin's price but also reshaping the overall cryptocurrency market. Altcoins, which previously experienced periods of rapid growth, are now struggling to keep pace with Bitcoin's ascent. This highlights the growing preference for Bitcoin as the leading and most established cryptocurrency.

The Implications: A New Era for Crypto and Finance?

The combined impact of Wall Street's involvement and the availability of Bitcoin ETFs represents a significant milestone for the cryptocurrency market. It signifies a potential shift towards greater institutional legitimacy and mainstream adoption of Bitcoin. However, this increased dominance also raises questions:

- Market Concentration: The growing dominance of Bitcoin could stifle innovation and competition within the broader cryptocurrency ecosystem.

- Regulatory Scrutiny: Increased institutional investment will likely attract greater regulatory scrutiny, potentially impacting the future development of the cryptocurrency market.

- Volatility Concerns: Despite the increased institutional involvement, Bitcoin remains a volatile asset, posing risks for investors.

The future of the cryptocurrency market remains uncertain, but the current trend clearly indicates a significant shift in power towards Bitcoin, driven primarily by the strategic investments of Wall Street and the accessibility offered by Bitcoin ETFs. This development will continue to shape the landscape of both the cryptocurrency world and traditional finance for years to come. The ongoing narrative will be defined by how regulators adapt, how investors react to volatility, and the continued innovation within the crypto space.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street And ETFs Drive US Bitcoin Dominance To Record High. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

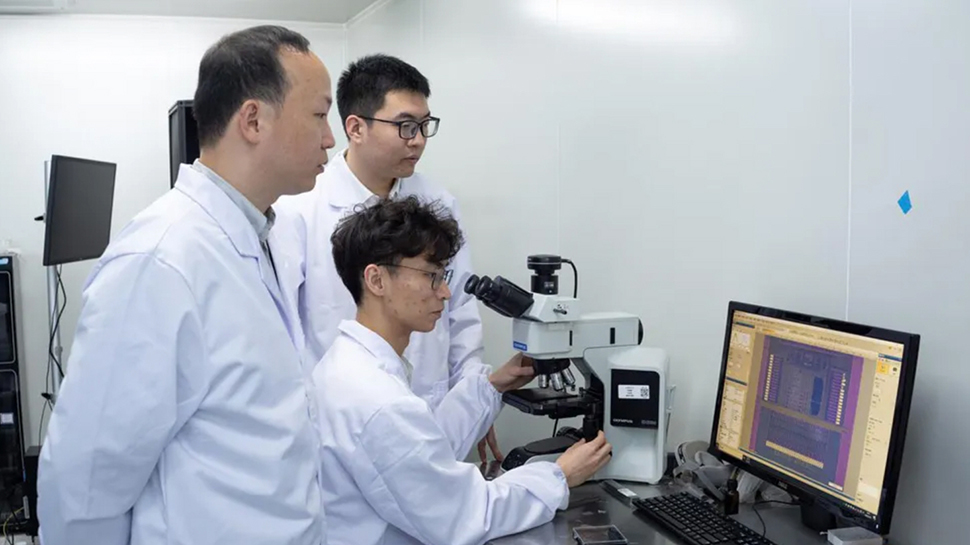

Faster Than Sram A New Era Of Flash Memory From China

Apr 29, 2025

Faster Than Sram A New Era Of Flash Memory From China

Apr 29, 2025 -

Chat Gpt Offline Effective Solutions To Get Back Online

Apr 29, 2025

Chat Gpt Offline Effective Solutions To Get Back Online

Apr 29, 2025 -

Silnye Dozhdi V Riu Grandi Du Sul Vynuzhdayut Gerdau Priostanovit Rabotu

Apr 29, 2025

Silnye Dozhdi V Riu Grandi Du Sul Vynuzhdayut Gerdau Priostanovit Rabotu

Apr 29, 2025 -

Chat Gpt Down Troubleshooting Guide Common Fixes And Solutions

Apr 29, 2025

Chat Gpt Down Troubleshooting Guide Common Fixes And Solutions

Apr 29, 2025 -

Ipl History Complete List Of Afghan Players And Karim Janats Gujarat Titans Debut

Apr 29, 2025

Ipl History Complete List Of Afghan Players And Karim Janats Gujarat Titans Debut

Apr 29, 2025

Latest Posts

-

Deceptive Trust Examining The Security Gaps Behind Web3 Verification

Apr 29, 2025

Deceptive Trust Examining The Security Gaps Behind Web3 Verification

Apr 29, 2025 -

Christie Brinkley The Exact Moment She Knew Her Marriage To Billy Joel Was Over

Apr 29, 2025

Christie Brinkley The Exact Moment She Knew Her Marriage To Billy Joel Was Over

Apr 29, 2025 -

Wordle Solutions A Complete List Of Past Answers

Apr 29, 2025

Wordle Solutions A Complete List Of Past Answers

Apr 29, 2025 -

Ge 2025 Election Campaign Day 6 Recap Rallies And Walkabouts

Apr 29, 2025

Ge 2025 Election Campaign Day 6 Recap Rallies And Walkabouts

Apr 29, 2025 -

Criminal Ip Showcases Advanced Threat Intelligence At Rsac 2025

Apr 29, 2025

Criminal Ip Showcases Advanced Threat Intelligence At Rsac 2025

Apr 29, 2025