Wall Street And Oil Prices Fall: Nine-Day Bull Run Ends Abruptly

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street and Oil Prices Take a Tumble: Nine-Day Bull Run Ends Abruptly

Wall Street experienced a sharp reversal on Tuesday, ending a nine-day winning streak fueled by optimism surrounding artificial intelligence and surprisingly resilient economic data. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all suffered significant losses, mirroring a dramatic drop in oil prices. This sudden downturn raises questions about the sustainability of recent market gains and the outlook for both the stock market and the energy sector.

A Sudden Shift in Market Sentiment:

The recent rally, which saw the Dow gain over 600 points in just nine days, was largely attributed to investor enthusiasm for AI technology and better-than-expected economic indicators, suggesting a "soft landing" might be possible for the US economy, avoiding a recession. However, Tuesday's market reaction suggests a shift in investor sentiment. Concerns about persistent inflation, rising interest rates, and geopolitical uncertainty likely contributed to the sell-off.

Oil Prices Plummet, Impacting Energy Sector:

The energy sector took a particularly hard hit, with oil prices experiencing their most significant one-day decline in several weeks. West Texas Intermediate (WTI) crude, the US benchmark, fell sharply, dropping below the $70 per barrel mark. This decline is partly attributed to growing concerns about weakening global demand, particularly from China, the world's largest oil importer. Furthermore, rising interest rates increase borrowing costs for energy companies, potentially impacting future investments and production.

What Caused the Market Reversal?

Several factors likely contributed to the abrupt market reversal:

- Profit-taking: After a nine-day rally, many investors may have decided to lock in profits, leading to a wave of selling.

- Inflation Concerns: Persistent inflationary pressures continue to weigh on investor confidence, despite recent positive economic data. The Federal Reserve's ongoing interest rate hikes remain a major concern.

- Geopolitical Uncertainty: Ongoing geopolitical tensions, including the war in Ukraine and other international conflicts, create uncertainty and risk aversion in the market.

- China's Economic Slowdown: Concerns about a slower-than-expected economic recovery in China, a major consumer of oil and other commodities, impacted both oil and stock markets.

Looking Ahead: Uncertainty Remains:

The sudden reversal raises questions about the future direction of both the stock market and oil prices. While the recent rally was impressive, it's crucial to remember that markets are inherently volatile. Analysts are divided on the outlook, with some suggesting that this is merely a temporary correction, while others warn of further potential declines. The coming weeks will be critical in determining whether this is a short-term blip or the start of a more significant downturn. Investors should carefully consider their risk tolerance and diversification strategies in light of this market volatility.

Keywords: Wall Street, Oil Prices, Stock Market, Dow Jones, S&P 500, Nasdaq, Crude Oil, WTI, Market Crash, Recession, Inflation, Interest Rates, Geopolitical Uncertainty, China Economy, Energy Sector, Investment, Market Volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street And Oil Prices Fall: Nine-Day Bull Run Ends Abruptly. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cassians Emotional Journey Analyzing Maarvas Absence In Andor Season 2 Episode 9

May 07, 2025

Cassians Emotional Journey Analyzing Maarvas Absence In Andor Season 2 Episode 9

May 07, 2025 -

May 4 2025 Nba Game Warriors 103 89 Victory Against Rockets Full Recap

May 07, 2025

May 4 2025 Nba Game Warriors 103 89 Victory Against Rockets Full Recap

May 07, 2025 -

The Luis Enrique Era A Reshaped Paris Saint Germain

May 07, 2025

The Luis Enrique Era A Reshaped Paris Saint Germain

May 07, 2025 -

Giants Vs Cubs Key Matchups To Watch In The Upcoming Series

May 07, 2025

Giants Vs Cubs Key Matchups To Watch In The Upcoming Series

May 07, 2025 -

Oklahoma City Thunder Host Denver Nuggets Game 1 Matchup Breakdown

May 07, 2025

Oklahoma City Thunder Host Denver Nuggets Game 1 Matchup Breakdown

May 07, 2025

Latest Posts

-

Googles Search Chief Slams Doj Antitrust Proposal User Trust At Risk

May 08, 2025

Googles Search Chief Slams Doj Antitrust Proposal User Trust At Risk

May 08, 2025 -

Can Nasa Eliminate 7 Billion In Unnecessary Spending A Deep Dive

May 08, 2025

Can Nasa Eliminate 7 Billion In Unnecessary Spending A Deep Dive

May 08, 2025 -

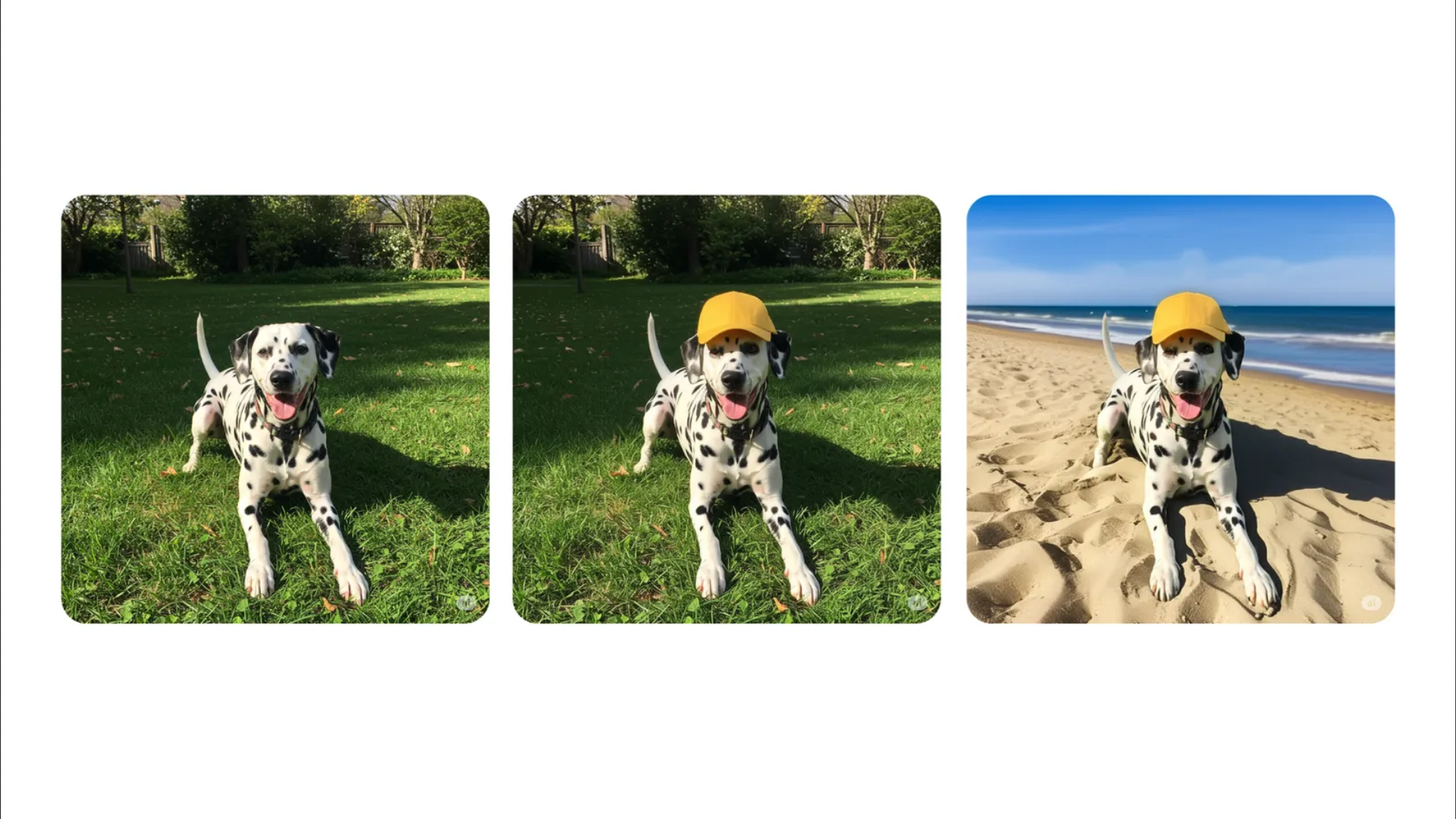

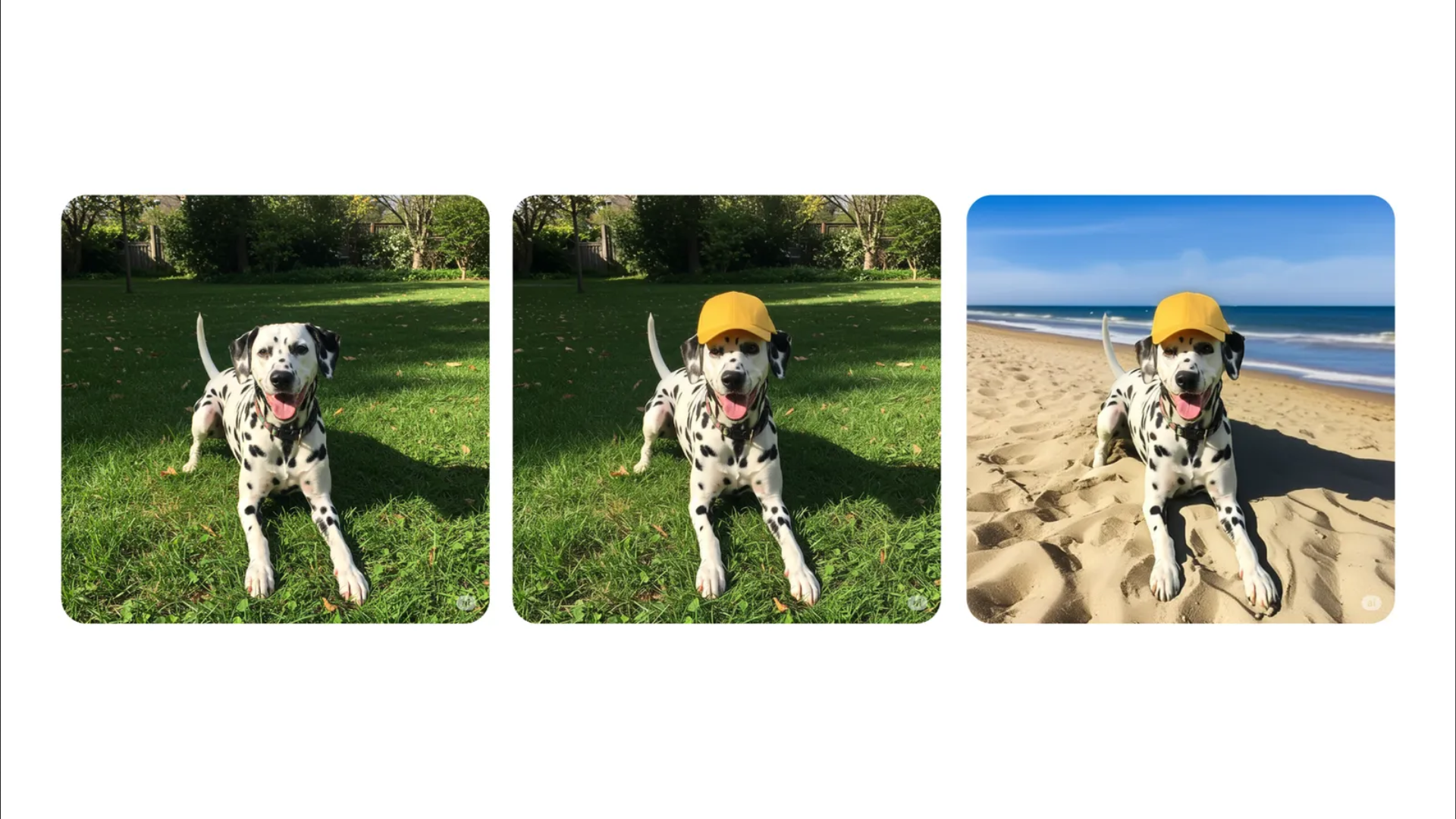

Streamline Your Workflow In App Image Editing In Gemini

May 08, 2025

Streamline Your Workflow In App Image Editing In Gemini

May 08, 2025 -

Dodgers Win Hyeseong Kims Memorable Moment With Ohtani

May 08, 2025

Dodgers Win Hyeseong Kims Memorable Moment With Ohtani

May 08, 2025 -

Gemini Update Introducing Integrated Image Editing Capabilities

May 08, 2025

Gemini Update Introducing Integrated Image Editing Capabilities

May 08, 2025