Wall Street Bets On Bitcoin: ETFs And Institutional Investment Fuel US Market Dominance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Bets on Bitcoin: ETFs and Institutional Investment Fuel US Market Dominance

Bitcoin's price has seen significant fluctuations, but one trend remains undeniable: Wall Street's increasing embrace of the cryptocurrency is solidifying US market dominance. This isn't just about individual investors anymore; institutional investment and the looming arrival of Bitcoin ETFs are reshaping the landscape.

The Rise of Institutional Investment:

For years, Bitcoin was largely the domain of individual investors and tech-savvy enthusiasts. However, the narrative shifted dramatically as major financial institutions began to see Bitcoin as a viable asset class. Companies like MicroStrategy, Tesla, and BlackRock have made significant Bitcoin purchases, signaling a shift in perception from speculative asset to potential portfolio diversifier. This institutional buying pressure has significantly contributed to Bitcoin's price stability and overall market capitalization.

- Reduced Volatility?: While Bitcoin remains volatile, institutional involvement brings a degree of stability often lacking in purely retail-driven markets. Large-scale buy-and-hold strategies by institutions help mitigate short-term price swings.

- Increased Legitimacy: The involvement of established financial institutions lends legitimacy to Bitcoin, attracting more conservative investors previously hesitant to participate. This influx of capital strengthens the overall ecosystem.

- Sophisticated Trading Strategies: Institutions bring sophisticated trading strategies and risk management techniques, potentially reducing market manipulation and improving price discovery.

Bitcoin ETFs: The Catalyst for Mainstream Adoption?

The potential approval of Bitcoin Exchange-Traded Funds (ETFs) in the US is arguably the biggest catalyst for further market growth. An ETF would allow everyday investors to easily access Bitcoin through their brokerage accounts, eliminating the complexities and security concerns associated with directly holding cryptocurrencies. This increased accessibility is expected to trigger a surge in demand, potentially driving Bitcoin's price significantly higher.

- Simplified Investment: ETFs offer a user-friendly gateway for millions of investors who are unfamiliar with cryptocurrency exchanges and wallets. This significantly lowers the barrier to entry.

- Regulatory Clarity: The approval of a Bitcoin ETF would represent a significant regulatory milestone, legitimizing Bitcoin in the eyes of many regulators and fostering increased confidence within the market.

- Increased Liquidity: ETFs generally boast higher liquidity than the underlying asset, making it easier for investors to buy and sell Bitcoin without significantly impacting the price.

US Market Dominance: A Global Shift?

The confluence of institutional investment and the anticipated arrival of Bitcoin ETFs is rapidly solidifying the US's position as the dominant force in the Bitcoin market. While other countries have their own cryptocurrency markets, the sheer scale of US financial institutions and regulatory developments gives the US a significant competitive advantage.

- Regulatory Landscape: The relatively clear (though still evolving) regulatory landscape in the US, compared to some other jurisdictions, makes it an attractive destination for both institutional and retail investors.

- Financial Infrastructure: The well-developed financial infrastructure of the US facilitates smoother trading and investment processes compared to many emerging markets.

- Innovation Hub: The US remains a global hub for financial technology and innovation, attracting talent and investment in the cryptocurrency space.

The Future of Bitcoin and Wall Street:

The relationship between Wall Street and Bitcoin is still in its early stages. While challenges remain, such as regulatory uncertainty and price volatility, the current trajectory points towards deeper integration. The ongoing influx of institutional capital and the potential approval of Bitcoin ETFs strongly suggest that the US will continue to lead the global Bitcoin market for the foreseeable future. This creates exciting opportunities for investors, but also underlines the importance of conducting thorough research and understanding the risks involved before investing in cryptocurrencies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Bets On Bitcoin: ETFs And Institutional Investment Fuel US Market Dominance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Janat Joins Prestigious Club 10th Afghan Cricketer In Indian Premier League

Apr 28, 2025

Janat Joins Prestigious Club 10th Afghan Cricketer In Indian Premier League

Apr 28, 2025 -

Singapore General Election 2025 A Pre Election Analysis

Apr 28, 2025

Singapore General Election 2025 A Pre Election Analysis

Apr 28, 2025 -

Altcoin Accumulation Alert 3 Cryptos Whales Are Buying In May

Apr 28, 2025

Altcoin Accumulation Alert 3 Cryptos Whales Are Buying In May

Apr 28, 2025 -

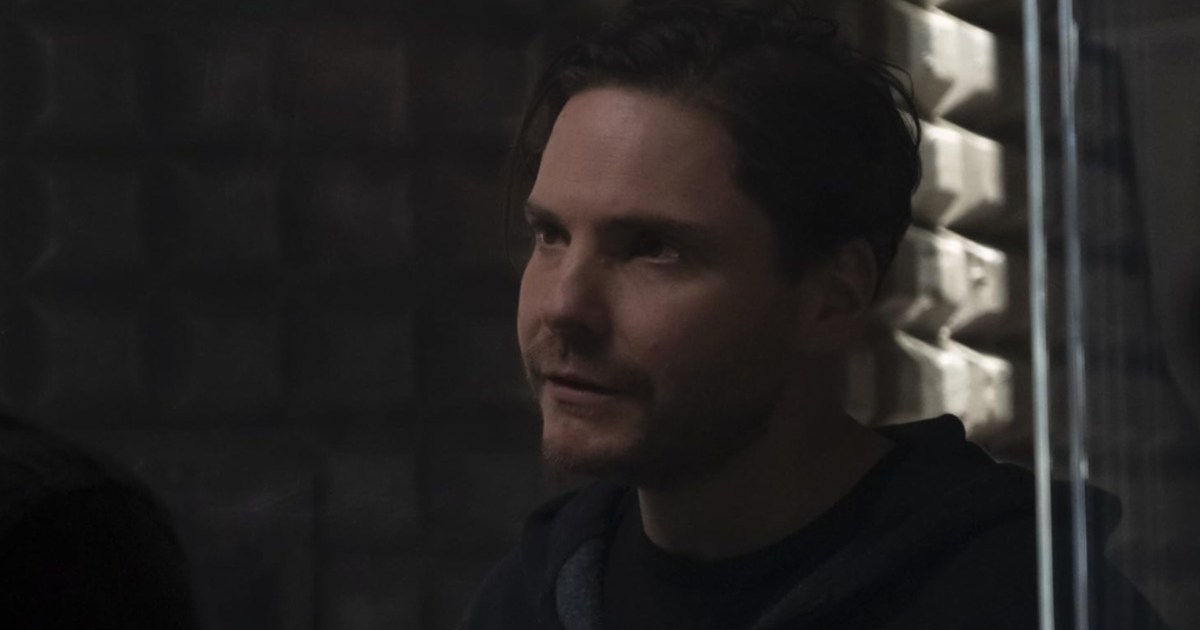

Baron Zemos Absence From Thunderbolts The Director Speaks Out

Apr 28, 2025

Baron Zemos Absence From Thunderbolts The Director Speaks Out

Apr 28, 2025 -

From Fossil Fuels To Cryptocurrency Oil And Gas Firms Embrace Bitcoin Mining

Apr 28, 2025

From Fossil Fuels To Cryptocurrency Oil And Gas Firms Embrace Bitcoin Mining

Apr 28, 2025

Latest Posts

-

Martinellis High Stakes Arsenals Crucial Champions League Battle Against Psg

Apr 30, 2025

Martinellis High Stakes Arsenals Crucial Champions League Battle Against Psg

Apr 30, 2025 -

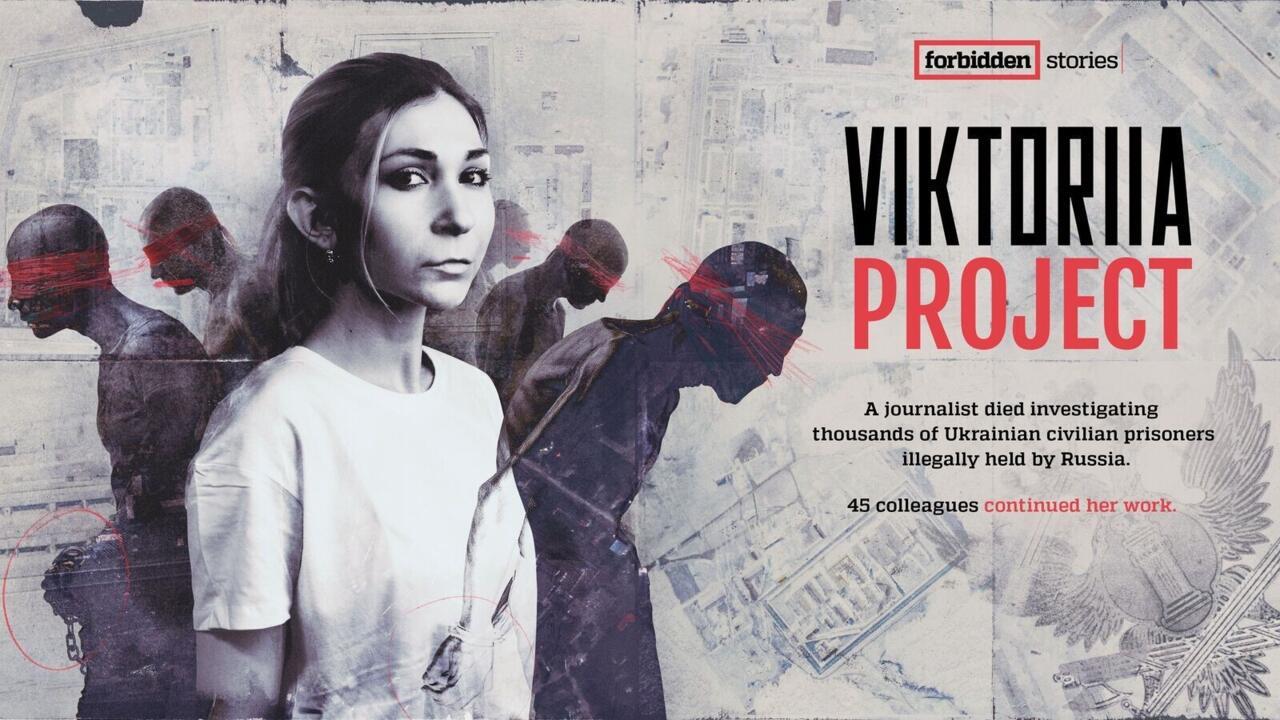

Forbidden Stories The Perilous Search For A Missing Journalist In Ukraine

Apr 30, 2025

Forbidden Stories The Perilous Search For A Missing Journalist In Ukraine

Apr 30, 2025 -

The Epic Games Store On Mobile A Retrospective And Future Outlook

Apr 30, 2025

The Epic Games Store On Mobile A Retrospective And Future Outlook

Apr 30, 2025 -

Are Ai Powered Web3 Projects Secure Exploring The Risks Of Key Access

Apr 30, 2025

Are Ai Powered Web3 Projects Secure Exploring The Risks Of Key Access

Apr 30, 2025 -

Cochise County Stronghold Fire 3 000 Acres Burned Investigation Begins

Apr 30, 2025

Cochise County Stronghold Fire 3 000 Acres Burned Investigation Begins

Apr 30, 2025